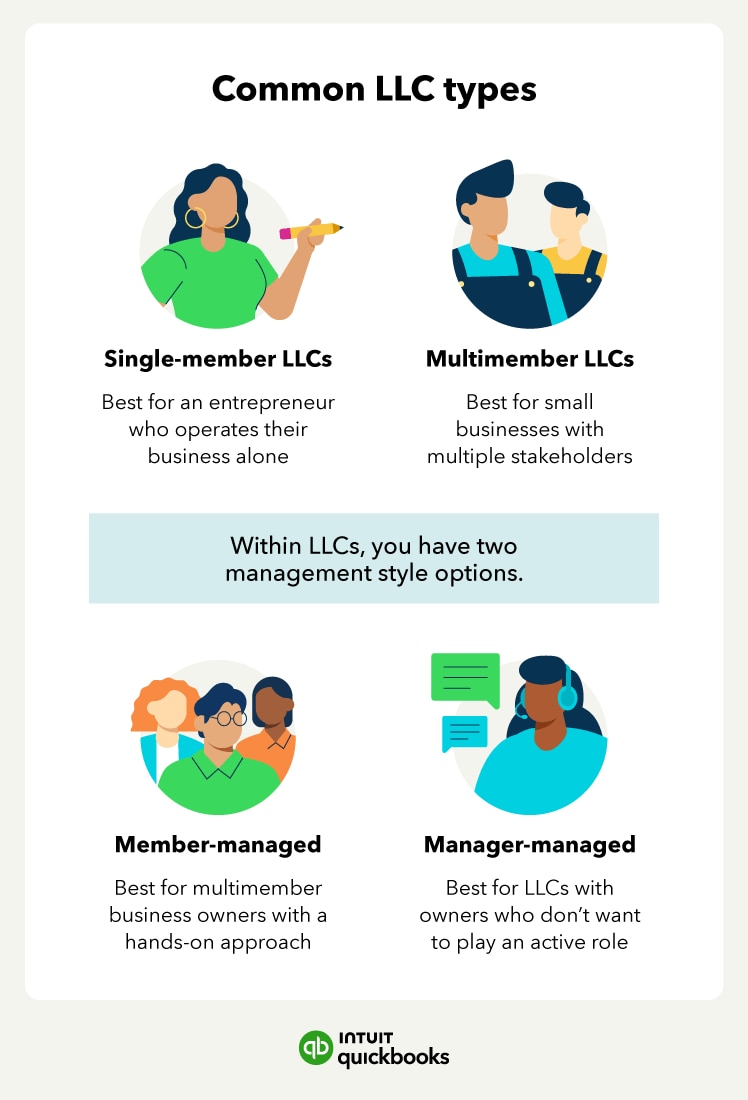

Single-member LLCs

Best for an entrepreneur who operates their business alone

Example: A freelance book illustrator

A single-member LLC exists when there is only one person associated with the company. Filing as a single-member LLC is advantageous because of the liability protection the owner receives. If an individual were to form a sole proprietorship instead of a single-member LLC, they would be responsible for the business’s debts and liabilities.

Multimember LLCs

Best for small businesses with multiple stakeholders

Example: A restaurant owned by two chefs

A multimember LLC is an LLC consisting of more than one member. For this business structure to operate within legal bounds, all members must sign the company's operating agreement. Apart from this requirement, the process of establishing a multiple-member LLC closely resembles its single-member counterpart.

Member-managed LLCs

Best for business owners who want a hands-on approach

Example: An e-commerce startup founded by tech professionals

In a member-managed LLC, the owner– or owners – make up the membership of the company. Each member has a vote when it comes to making business decisions. Everyone’s vote counts equally and must be considered when changing company management or operations. This type of LLC is great for entities with one or multiple members who all want to have a say in the day-to-day operations of their business.

Manager-managed LLCs

Best for LLCs with owners who don’t want to play an active role

Example: A real estate investing LLC for potentially passive income

In a manager-managed LLC, the members are not in control of the day-to-day business operations. Instead, LLC owners elect managers to run the company. The owners are in charge of filling management positions. Those in management positions are then responsible for handling business activities. LLC owners take a much more hands-off role.