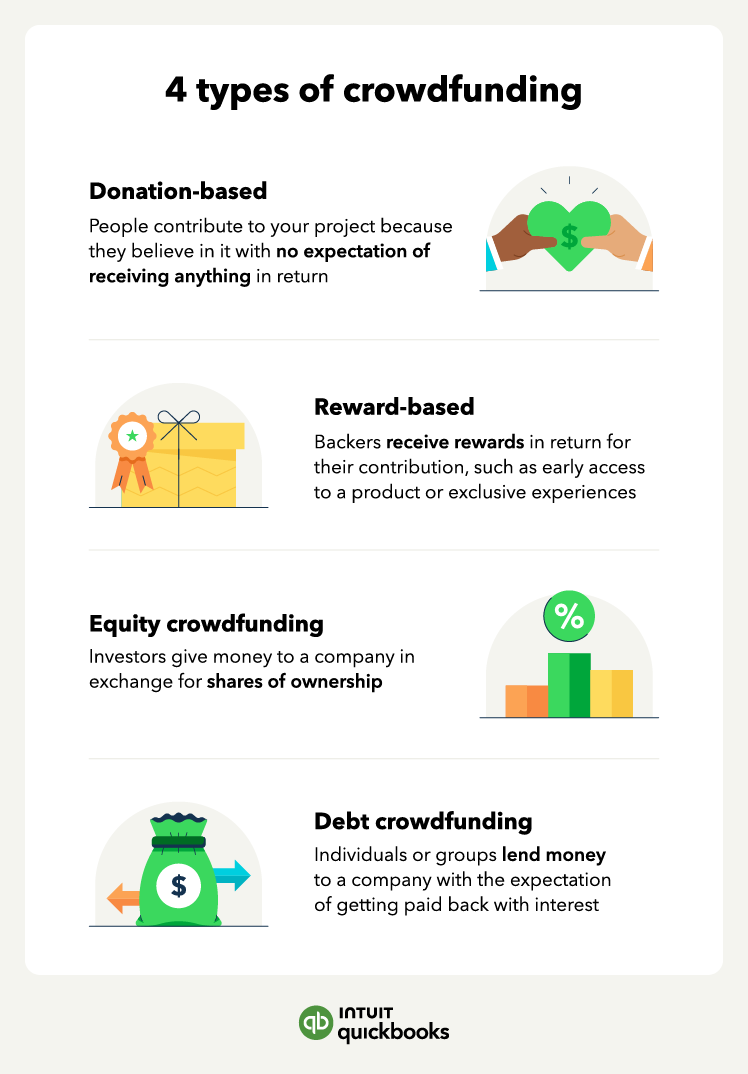

What are your funding options?

Starting a business without money might sound impossible, but it’s not. The key is to know where to look for funding. While the initial steps, like developing a concept and creating a business plan, are free, you will need capital for things like marketing, production, and office space.

QuickBooks can help with financing through options like a QuickBooks Line of Credit for ongoing flexible access to funds. You can also explore other avenues, including friends and family, government agencies, and other private lenders.

Once you’ve gone to market, of course, your priority will shift from startup costs to business expenses. And QuickBooks accounting software is there to help you manage everything in one place.

Disclaimers:

AI-focused content: This content is for information purposes only and the information provided should not be considered legal, accounting, or tax advice or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable for dealing with a customer’s particular situation. Intuit Inc. does it have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. cannot warrant that the material contained herein will continue to be accurate, nor that it is completely free of errors when published. Readers should verify statements before relying on them.

Intuit Assist: Intuit Assist and certain other AI features and functionalities are currently available at no additional cost to certain QuickBooks users. Pricing, terms, conditions, special features, and service options are subject to change without notice. Intuit reserves the right to discontinue the feature at any time for any reason in its sole and absolute discretion.