Starting a business at home certainly isn’t a new concept, but the rise of remote work and the flexibility it offers have fueled a boom in home businesses. In this guide, we’ll equip you with the knowledge and resources to turn your home business dream into reality, helping you achieve your professional and financial goals.

12-step guide on how to start a small business at home (with free template)

1. Nail down your business idea

Starting a business at home starts with a clear vision. Before diving into legalities and logistics, identify the problem you want to solve or the product/service you want to offer. This is where honing in on your niche becomes crucial.

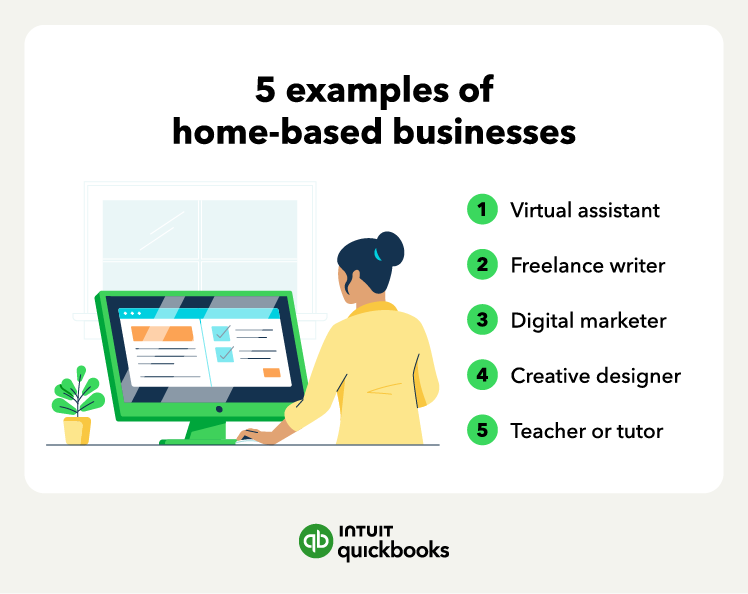

- Find your niche: Reflect on your skills, passions, and experiences. What are you uniquely qualified to offer? Are you a whiz at social media management? Do you have a talent for crafting handmade jewelry? Perhaps you have a knack for dog training or data analysis. Identifying your niche allows you to target a specific customer base and establish yourself as an expert within that community.

- Assess the competition: No matter what you’re selling, you’ll likely have some competition. Identifying and analyzing your competitors gives you valuable industry insight and helps you build better business strategies. You should know what they’re selling, how they’re selling it, and who they’re selling it to.

Social media is a strong place to start your competitor analysis. Check out what your competitors are posting and how their customer base reacts to it. Conducting this research early on will help you build your business plan, which we’ll cover in the next step.

By following these initial steps, you'll lay the groundwork for a strong and focused business idea, increasing your chances of success in the home business arena.

2. Create a business plan

So you’ve taken a look at your passions, your hobbies, and your unique skill set, and you said, “I can sell this.” You’re off to a great start. But when it comes to starting a successful business, you need more than just an idea. Here are some things to consider:

- Nearly 70% of seasoned business owners recommend writing a business plan before you start a business—and home-based businesses are no exception.

- A business plan clearly communicates what you’re going to do and how you’re going to do it.

- It answers the question, “Can this business realistically be conducted from home?”

For example, selling digital art online can easily be done from a home office, but a catering business can quickly outgrow your home kitchen. A business plan serves as your road map for growth. If you’re not sure where to start, a business plan template can take you through it step by step.

3. Pick the right business name

Choosing a business name is an exciting step! It's the name that will represent your brand and become recognizable to your customers. Take care to choose a name that's catchy, easy to remember, and reflects the essence of your business. Before getting too attached, ensure the name is available for use. This involves a multi-step process:

- State and federal checks: First, visit your state's Secretary of State website or business bureau website. These resources typically offer business entity search functions to determine if the name is already registered within the state.

- Trademark check: Next, head to the US Patent and Trademark Office (USPTO) website for a trademark search. This ensures another business hasn’t already trademarked the name .

- Domain name availability: Finally, conduct a quick Google search to see if the desired domain name (.com, .net, etc.) is available. While not mandatory, securing a domain name matching your business name creates a cohesive online presence.

By taking these steps, you'll ensure your chosen name is not only impactful but also legally available to use.

4. Choose a business structure

The structure you choose for your home business will impact taxes, liability, and even how you raise capital. Here's a breakdown of the most common structures:

- Sole proprietorship: The simplest structure, a sole proprietorship, means you are the sole owner. Profits and losses pass through to your personal tax return, and no separate tax filing is required. However, you have unlimited personal liability, meaning your personal assets are on the hook for business debts.

- Limited liability company (LLC): An LLC offers a balance between simplicity and protection. LLCs create a separate legal entity from the owner(s), shielding personal assets from business liabilities. Similar to a sole proprietorship, LLC taxes are typically passed through to the owner's personal return, unless you choose corporate tax treatment (which is rare for home businesses).

- C corporation: The most complex structure, C-Corporations are typically used for larger businesses. Corporations create a separate legal entity with its own tax filing requirements. This offers the most liability protection but also involves more paperwork and regulations.

- General partnership: A general partnership is similar to a sole proprietorship but with two or more owners who share profits, losses, and management responsibilities. Personal liability is also shared among partners. This structure is less common for home businesses due to the shared liability aspect.

5. Register your business

If you’re planning to operate as self-employed, you’re not required to register your business. But you run the risk of missing out on tax benefits and personal liability protection if you don’t. If you decide to register as self-employed (or as a sole proprietorship), you’ll report your business income on your personal Form 1040.

Sole proprietors enjoy some of the lowest tax rates, but because you and your business are the same entity, you can be held personally liable for business debts. As with most things, there are pros and cons for every business registration. Choosing how to register your business can be tricky, but your local SBA can help you choose the right business structure and register correctly.

6. Get a business license

Outside of registering your business, you might also need to apply for a business license. A business license gives you permission to conduct business in your city or state.

Some cities and counties require a home occupation permit to operate a business from your home. Others require a sign permit if you choose to display a sign in your yard or in your house. If you plan on renovating your home to accommodate your business, you might need a building permit.

Here's a breakdown of some common licenses you might encounter:

- General business license: Issued by your city or county, this authorizes you to operate a business within their jurisdiction.

- Home occupation permit: Specific to home-based businesses, this permit allows you to conduct business activities out of your residence.

- Industry-specific licenses: Certain professions or trades may require additional licenses. For example, hairstylists need a cosmetology license, and electricians require an electrician's license.

- Sales tax permit: If you sell taxable goods or services, you'll need a sales tax permit to collect and remit sales tax to the state.

- Homeowner’s Association (HOA) approval: If you live in a neighborhood with a homeowners association, you’ll want to make sure they don’t impose restrictions on home businesses. And if you’re renting, you’ll want to read your lease agreement—your landlord might not support your pet-sitting business.

Finally, you’ll want to apply for an Employer Identification Number (EIN). The IRS assigns this number to identify your business. Applying for an EIN is fast and free, and it protects your personal Social Security number. If you choose not to register your business, applying for an EIN is still a worthwhile step.

7. Get a business bank account

Good financial recordkeeping is key to starting a successful business. Opening a business bank account is an easy way to track and record business expenses. Keeping expenses separate from personal finances protects your assets.

It can also help you take full advantage of tax deductions and credits available to small business owners. Keep in mind that if you decide to register your business as an LLC or corporation, you’re required to have a separate bank account for your business.

8. Put financial systems in place

More than 60% of experienced business owners say the first thing you should get help with when starting a new business is setting up your financial systems correctly. Now is the time to invest in financial bookkeeping or accounting software for your business or recruit the help of an expert (like a bookkeeper or accountant).

9. Invest in business insurance

It’s a good idea for any small business to think about general liability insurance. This type of business insurance policy protects you if someone claims your business for injury or property damage. It also protects you if you accidentally damage someone else’s property. For example, if you start a housecleaning business and accidentally break something, you’re covered.

You might need to reassess your homeowner’s insurance as well. Your policy might not cover the costs related to operating a home-based business. If something happens to your home, you’ll want to make sure you can recover the losses from your business as well.

10. Think about funding

It’s possible to start a business with no money, but almost every new business begins with some amount of startup expenses for things like:

- Registering your new business

- Applying for business permits

- Purchasing equipment

- Purchasing software

These all come at a cost. It’s a good idea to calculate your startup costs before you start and consider how you might fund them. If your costs are low, you might be able to pay out of pocket.

If you need additional funding to get your business up and running, there are a few options to think about:

- Crowdfunding

- Appealing to angel investors

- Applying for small business loans

These are all common ways to secure business funding. If you’re not ready to take the financial leap, working part-time or focusing on your new business during evenings and weekends can bring in some income while you get on your feet. Our survey also found that more than 1 in 3 (36%) of future business owners identified secure funding as a priority.

11. Secure a marketing plan

Marketing is the pathway of getting paying customers to your product or service. It’s not only a good idea but required for any business to be successful. It also comes in many shapes and sizes, with different companies using various tactics to market to their target audience, including:

- Social media marketing: Utilizing social media platforms to drive customers to your product

- Print marketing: Utilizing print advertising in magazines or newspapers to drive business

- Online ad placement: Utilizing online outlets such as email or website ads to drive traffic back to your product or service offering.

Be sure to consider what you’re hoping to achieve with your marketing efforts. Do you want to increase brand awareness, drive website traffic, or generate leads? Setting specific and measurable goals will help you track your progress and adjust your strategies as needed. With a clear picture of your target audience and goals, you can select the marketing channels that will best reach them.

12. Dedicate space for work

Your kitchen table works as a desk for a short time, but if you’re serious about your business and want to maximize productivity (and save your lower back), you’ll need a more permanent space to work. Plus, separating your workspace from your living space can keep the line between work and life clearer.

For some, that might mean your home office ends up in the garage or the basement. If that’s the case, you’re in good company. Remember, Jeff Bezos and Bill Gates both started their multibillion-dollar businesses in garages.

Start your business with confidence

Launching and managing a home business requires dedication, but you don't have to go it alone. One way to get support is to consider working with an accountant, which offers several benefits:

- Tax expertise: Navigating tax regulations and deductions can be complex. An accountant can ensure you're maximizing your deductions and complying with all tax filing requirements, saving you time and money in the long run.

- Financial planning and analysis: An accountant can analyze your financial data, identify areas for improvement, and help you establish financial goals and strategies for long-term growth.

- Peace of mind: Knowing your finances are in good hands allows you to focus on what you do best—running your home business.

Also, accounting software built for self-employed individuals like QuickBooks Solopreneur helps you track your income and expenses and file taxes with ease.

There may come a time when it makes sense for you and your business to expand into a physical brick-and-mortar location or commercial workspace. But for now, starting a business at home is a smart way to test the waters, maximize your productivity, and chase your passion.