Business taxes due dates

For corporations with a calendar year-end, the deadline to send your 1120 form to the IRS is April 15, 2026. However, many corporations have a fiscal year-end, which means that the year-end is any day other than December 31.

For fiscal year-end corporations, Form 1120 is due on the 15th day of the fourth month after the end of the corporation's tax year. A special rule applies for corporations with a June 30 year-end: Form 1120 is due on September 15, which is the 15th day of the third month following the June 30 year-end. For S-corps, multimember LLCs, and partnerships, the business tax filing deadline is March 15, 2026.

Here are the key business tax dates you need to know:

- February 2, 2026: W-2 form distribution deadline: Send W-2s to employees before the end of January for the previous tax year.

- February 2, 2026: 1099 form distribution deadline: Date to send the 1099 forms, like 1099-MISC and 1099-NEC, to recipients. This is also the deadline to file 1099-NEC forms with the IRS.

- March 16, 2026: Forms 1065 or 1120-S filing deadline: Tax filing deadline for partnerships, multi-member LLCs, and S corporations.

- March 31, 2026: 1099 form filing deadline: Date to file 1099 forms (except Form 1099-NEC) electronically with the IRS.

- April 15, 2026: Tax day: Single-member LLCs, sole proprietors, and C-corporations must file their income tax returns by this day to avoid penalties.

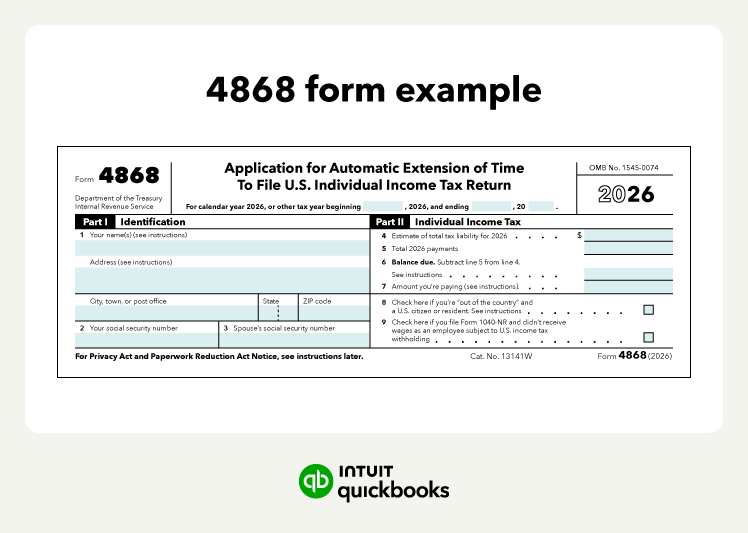

- April 15, 2026: Extension request deadline: File Form 4868 before the tax day if you need more time to file your tax return.

- September 15, 2026: Extended tax deadline for S-corporations and partnerships: If you applied for a tax filing extension before tax day, you must submit your return by this date. This day is also the extension filing deadline for C-corporations with a June 30 fiscal year-end.

- October 15, 2026: Extended filing deadline for calendar year C-corporations: If you apply for a tax filing extension before tax day, you must submit your return by this date.

C corporations can request a filing extension to October 15, 2026. Remember, you must file the extension request by April 15, 2026, to qualify. The extension gives extra time to file, not extra time to pay any taxes owed.