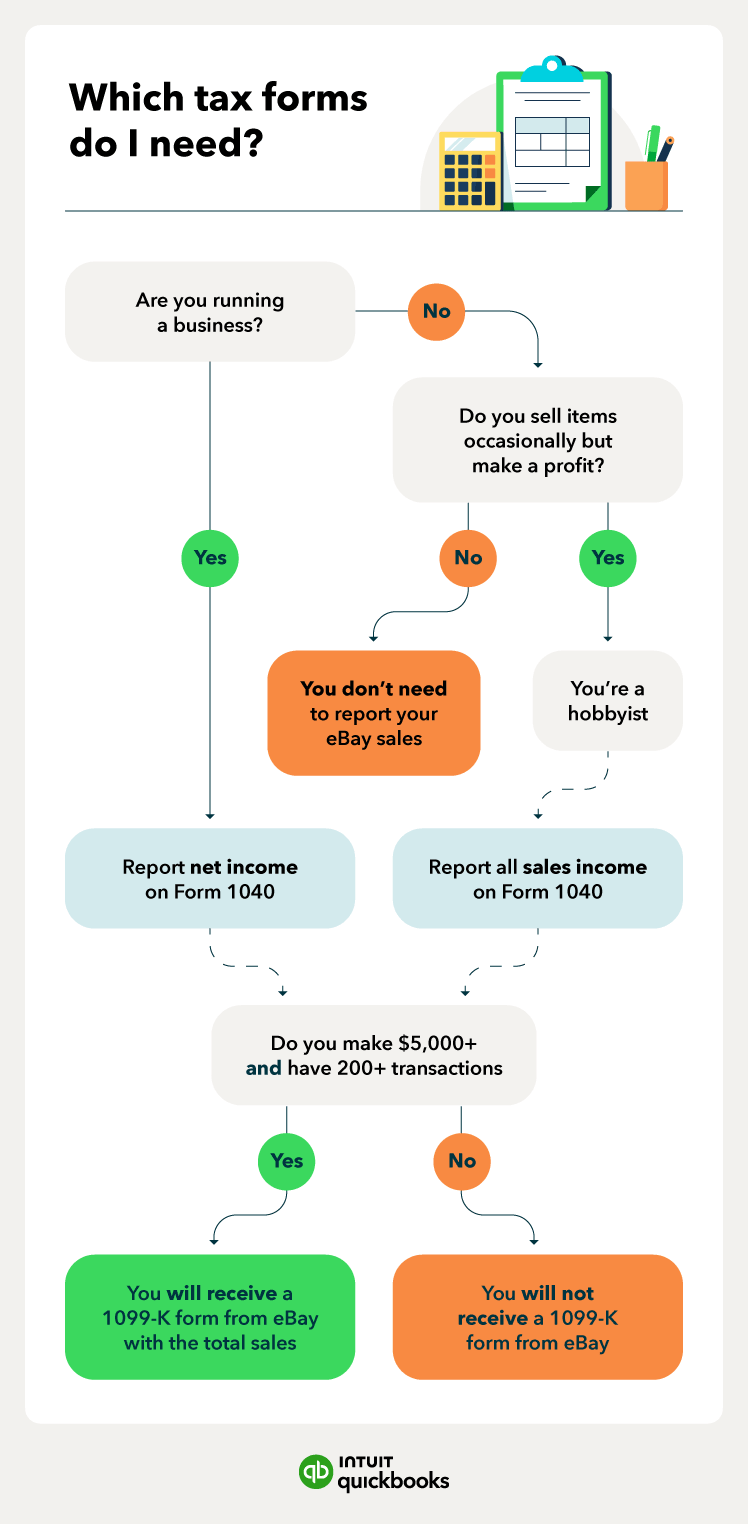

Do you need to report eBay and TikTok sales on taxes? Yes, in most cases. Whether you sell on eBay, TikTok Shop, or any other marketplace as a hobby or a business, you need to report that income on your Form 1040 when you file your taxes for 2025.

Selling online through platforms like eBay and the rapidly growing TikTok Shop can be a fun side gig or a serious business. Everyone (from casual sellers to professional e-commerce owners) needs to know exactly how to report their income.

In this post, you’ll find essential information on tax forms, calculating income, and maximizing deductions to make tax season easier, no matter where you sell.

Understanding online marketplace taxes

What’s the difference between a hobby and a business?

How to calculate your online sales

Which sales are subject to income tax?

Tax deductions for online sellers

Understanding Form 1099-K (the latest threshold update)

For the 2025 tax year, the federal Form 1099-K reporting threshold has been restored to the original high level: $20,000 in gross payments and 200 transactions. This applies to platforms like eBay, TikTok Shop, and payment processors like PayPal. Always check for your state's specific threshold, as some maintain a lower reporting requirement.

For the 2025 tax year, the federal Form 1099-K reporting threshold has been restored to the original high level: $20,000 in gross payments and 200 transactions. This applies to platforms like eBay, TikTok Shop, and payment processors like PayPal. Always check for your state's specific threshold, as some maintain a lower reporting requirement.