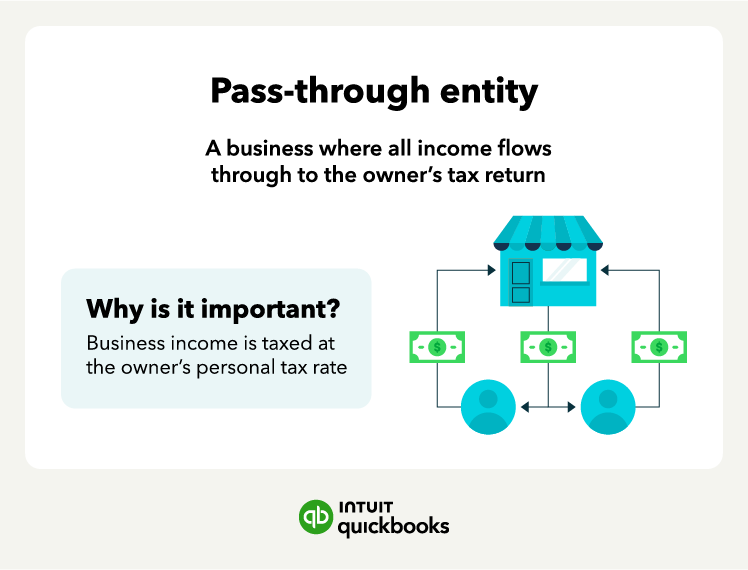

Feeling lost in the tax maze? Pass-through entities are business structures designed to simplify how your business income gets taxed.

From our Entrepreneurship Survey, 54% of all respondents say they’re thinking about starting a new business. The right structure can save you money, reduce paperwork, and shape how your business grows. To make the best decision, it’s important to understand how business structures affect your taxes, liability, and long-term goals.

Pass-through entities are sometimes called “flow-through entities”—both terms mean the same thing: business income and losses flow directly to your personal tax return.

Jump to:

Key tax updates for pass-through entities for 2025 and beyond

How do pass-through entities work?

Types of pass-through entities

Self-employment taxes for pass-through entities

What is a qualified business deduction?

What are the benefits of pass-through entities?

What are the pitfalls of pass-through entities?

Many pass-through entities don’t need an

Many pass-through entities don’t need an