Key IRS rules to know

A few IRS rules are especially important if you want to avoid penalties. These guidelines set the thresholds for who must pay estimated taxes and how much is required. Knowing them can help you plan ahead and stay in compliance without surprises at tax time.

What is the 110% rule for higher earners?

If you're married, filing jointly, and your adjusted gross income (AGI) was more than $150,000 last year ($75,000 for married filing separately), the IRS requires you to pay 110% of your prior year’s tax liability. This rule ensures that high-income taxpayers don’t underpay, even if their income is steady year over year.

For example, if you owed $20,000 in taxes last year, you’d need to pay at least $22,000 in estimated taxes this year to avoid penalties. Planning for this upfront can help you set aside enough cash and avoid scrambling when deadlines arrive.

What’s the minimum thresholds for estimated taxes?

The IRS sets minimum thresholds to determine who needs to make quarterly payments. Individuals who expect to owe more than $1,000 must file Form 1040-ES and pay estimated taxes, while corporations have a lower threshold of just $500.

These amounts may seem small, but they are the dividing line between needing to make quarterly payments or not. Keeping track of your projected tax liability throughout the year can help you determine whether you’ll cross these thresholds and need to plan for installments.

Can I use paycheck withholdings to cover taxes?

Not everyone has to deal with sending separate estimated tax payments. If you earn W-2 income, you can increase the withholdings on your paycheck by filing a new Form W-4 with your employer.

By doing this, you’re essentially prepaying your taxes through payroll deductions instead of quarterly estimates. This approach can simplify tax planning, especially if you have both wage income and side business income, since the extra withholding can offset what you owe from self-employment.

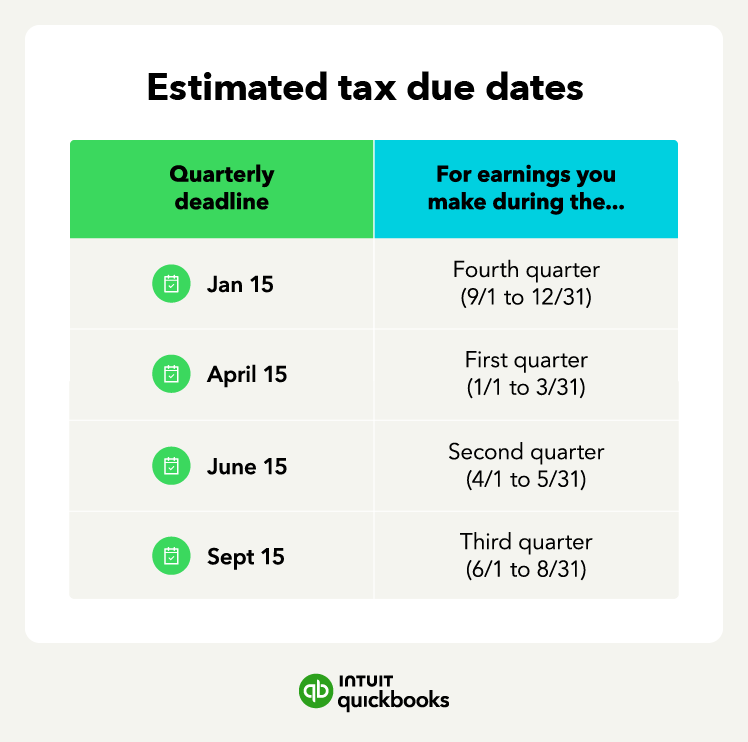

If any of these dates fall on a weekend or a legal holiday, the deadline is shifted to the next business day.

If any of these dates fall on a weekend or a legal holiday, the deadline is shifted to the next business day.