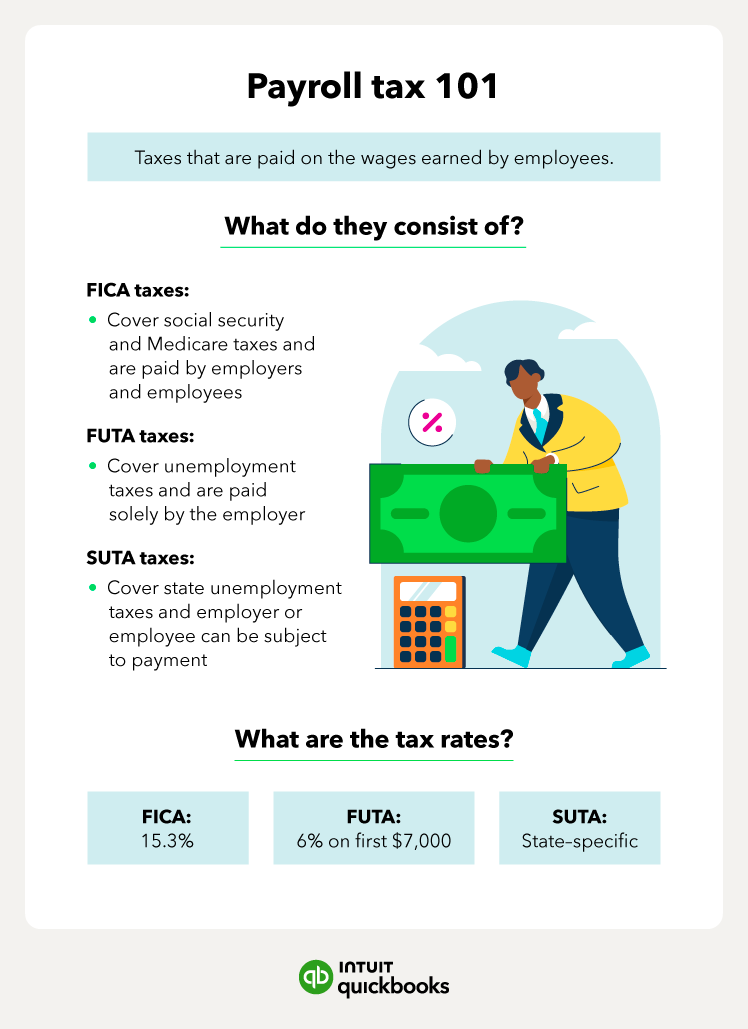

With over half of Americans considering starting a business in 2025, according to QuickBooks' Entrepreneurship in 2025 report, understanding business finances is crucial. Beyond employee payroll, entrepreneurs must navigate various tax obligations, including SUTA and FUTA taxes.

SUTA is the State Unemployment Tax Act, which requires employers to pay unemployment taxes into their respective state’s unemployment program. FUTA is for the Federal Unemployment Tax Act that requires payments into the federal uninsurance program.

In most states, SUTA and FUTA do not show up on your employee’s pay stub because you (the employer) pay the full amount. Let’s look at exactly how SUTA taxes work, how to figure out your rate, and how to calculate them:

How SUTA tax works

SUTA is a payroll tax employers pay to the state. Money from SUTA taxes goes into a state unemployment fund on behalf of that state’s employees. The fund pays unemployment insurance to employees who become unemployed through no fault of their own, such as through company layoffs.

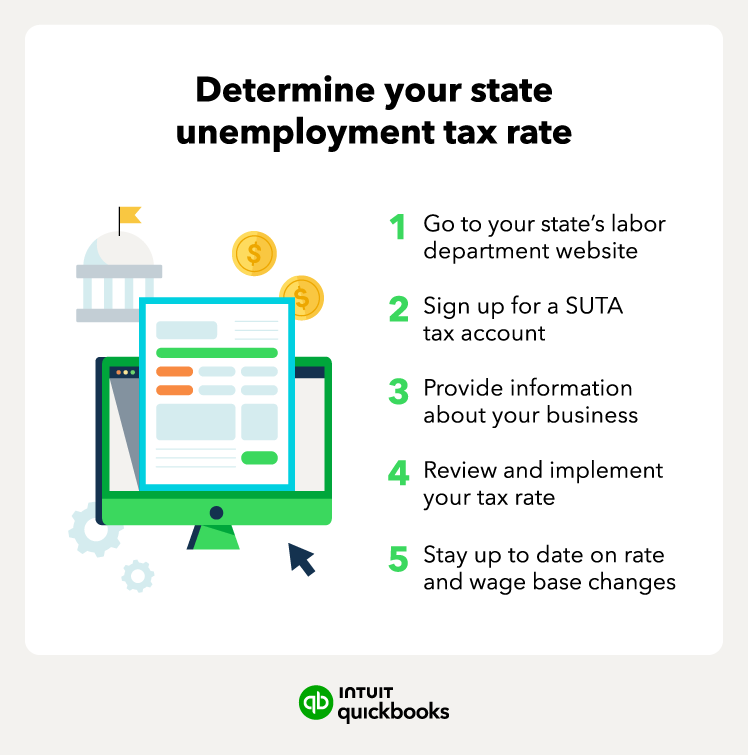

When you hear of someone collecting unemployment, they are likely drawing from SUTA funds. The SUTA tax rate companies pay varies depending on the state in which they do business. Your state’s labor department will provide guidelines for paying SUTA taxes.

Who pays SUTA tax?

In most states, the employer is solely responsible for paying SUTA tax. This means the tax is not deducted from employee wages. However, there are three states where employees also contribute to the state unemployment fund:

- Alaska

- New Jersey

- Pennsylvania

Check your specific state's laws to understand who is responsible for paying SUTA tax. You can usually find this information on your state's labor department website.

Check your specific state's laws to understand who is responsible for paying SUTA tax. You can usually find this information on your state's labor department website.

Conduct regular performance reviews and offer competitive benefits to help retain employees and minimize turnover. This can help keep your SUTA tax rate low.

Conduct regular performance reviews and offer competitive benefits to help retain employees and minimize turnover. This can help keep your SUTA tax rate low.