One of the first things you should do when running or starting a business is to ensure your accounting system operates as smoothly as possible. Following certain accounting practices will ensure that this happens.

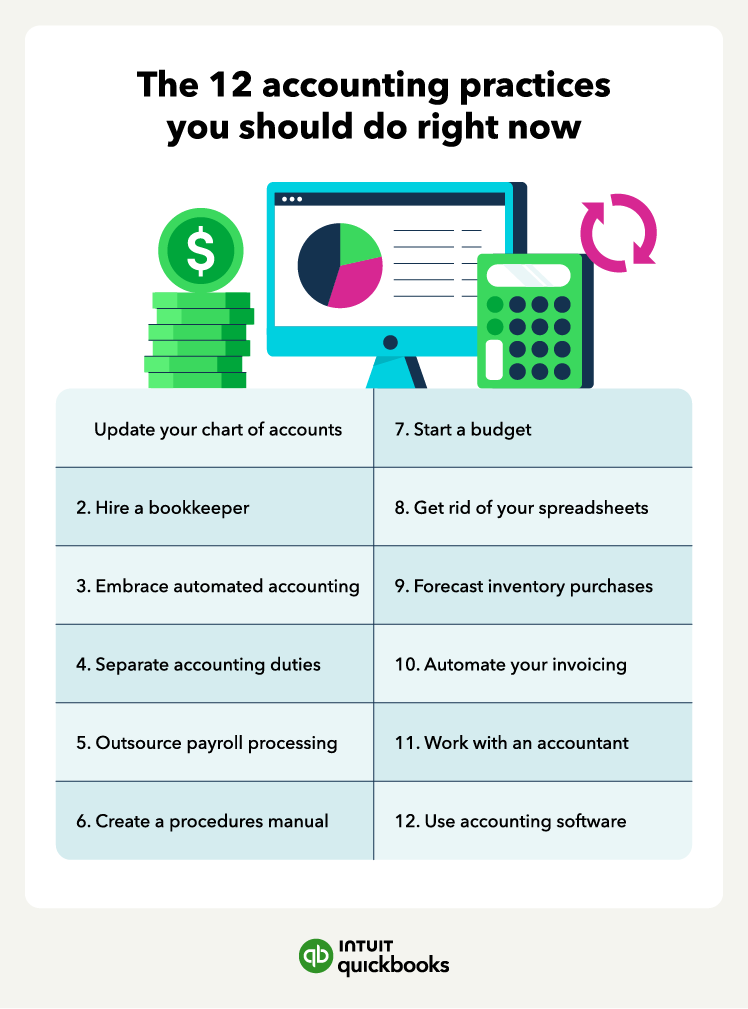

However, many business owners overlook this vital step. Let’s explore the 12 accounting practices you should start using as soon as possible, including tips on implementing them.

1. Update your chart of accounts

3. Embrace automated accounting

5. Outsource payroll processing

8. Get rid of your spreadsheets