Calculate profit by figuring out how much it costs to produce your goods, and then subtract that from your total sales revenue. This is your gross profit, but you’ll also need to know how to calculate profit margin, operating profit, and more to make informed decisions about your business’s future and performance.

Get 70% off QuickBooks for 3 months.

Ends July 29th.

How to calculate 4 types of profit (+ examples)

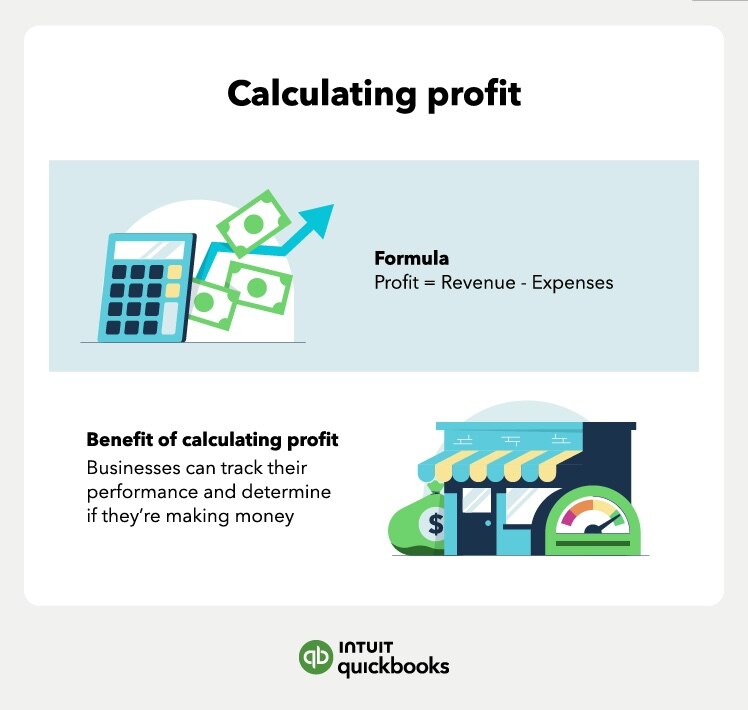

Profit is a key measure of success that provides insight into your company's financial health. Knowing how to calculate profit can help you determine if your business is viable, sustainable, and worth the investment. To determine how much your business is profiting, just subtract your total expenses from your total revenue. Sounds easy enough, but there’s a bit more to calculating profit than you might think.

In this article, we will explore the different types of profit and how to calculate them. We’ll also walk you through the profit formula and give examples for each type, as well as some additional FAQs. Let’s jump into each type of profit calculation:

Profit calculation example and overview

Profit calculation is a process of determining the total amount of profit a company has earned during a specified period. To determine the profit, subtract the total cost of goods and services from the total revenue generated.

To see this calculation in action, here’s an example:

- Assume a cosmetic company produces 100 units of lipstick at $2 per unit.

- You’ll find the total cost of producing the 100 units of a product by multiplying 100 x $2 = $200.

- If the selling price is $18 per unit, the total revenue from selling 100 units of the lipstick is 100 x $18 = $1,800.

Calculate the profit by subtracting the total cost from the total revenue, which yields a profit of $1,800 - $200 = $1,600.

Why calculate profit?

Knowing how to calculate profit allows owners to identify areas for potential improvement, understand the financial implications of their decisions, and make more informed decisions. It also empowers companies to reinvest back into the business, expand operations, pay down debt, and distribute dividends to shareholders.

This awareness will help track performance over time and identify any changes that you can make to improve and grow. According to the US Chamber of Commerce, failing in this “leads to financing mistakes that force a small business to close practically overnight.” (USCoC)

It’s a great first to have financial health on your mind, but you will need a more detailed understanding of where your business is—or isn’t—profiting.

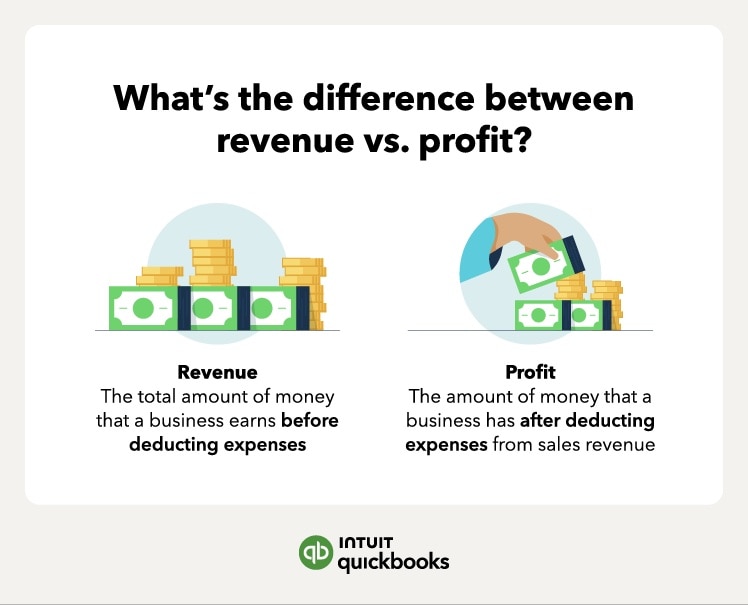

Profit vs. revenue—there’s a difference

Profit and revenue both describe the financial performance of a business. However, it’s important to remember that these words aren’t interchangeable, and they don’t mean the same thing. If you want to learn how to calculate profit properly, you need to know the difference.

- Revenue is the total amount of money that a business earns from sales, services, or other sources within a given time. It doesn't account for any costs associated with producing the income.

- Profit is the amount of money that a business earns after tracking expenses and subtracting them from the revenue. It represents a business's bottom line and ultimately determines if a business has made or lost money.

Also, keep in mind that profit is different from cash flow, which only measures the inflow and outflow of cash during a specific period and doesn’t consider non-cash items.

Now that you know the difference between profit and revenue, you’re ready to learn how to calculate profit.

How to calculate profit by type

There are different types of profit calculations for different circumstances, including gross profit, operating profit, net profit, and profit margin. Below we’ll outline each profit type and how to calculate them.

Gross profit

With so many types of profit at play, it’s normal to wonder how to calculate gross profit and what it is. In short, gross profit is pure profit from sales — a blunt measure of how a company is performing. It’s great for indicating overall financial health, and you’ll need it to determine net profit.

Formula

The gross profit formula subtracts the total cost of goods sold (COGS) from the total revenue:

Gross profit = Net Revenue - COGS

Calculation example

Let’s say a retail business has $1 million in net sales, and the COGS was $500,000. The profit equation would be gross profit = $1 million - $500,000. After doing the calculations, this company has a gross profit of $500,000.

Benefits and uses

Knowing how to calculate gross profit for your business can help you:

- Assess whether a company is making enough money to cover its operating costs and has enough remaining profit for other expenses.

- Identify areas for improvement.

- Track financial performance.

- Make informed decisions about investments.

For example, it can help you determine how much you are making on each sale and influence how you price your goods.

Operating profit

Operating profit measures how profitable a company is after subtracting operating expenses—or expenses that a company incurs when running its business operations. Many people call this “overhead,” and it includes costs such as wages, rent, utilities, advertising, liability insurance, and office supplies.

Formula

To calculate operating profit, just subtract operating expenses from revenue:

Operating Profit = Revenue - Operating expenses

Calculation example

Let's say a media company reports revenue of $100,000 and operating expenses of $70,000. The operating profit equation here would be to subtract $70,000 from $100,000, resulting in $30,000. This means that the company's operating profit was $30,000 for that period.

Benefit and uses

- Gives insights into how well your business manages its operations

- Helps predict future performance

- Aids in strategic decision-making surrounding systems, employees, and equipment

- Determines whether or not your business efforts are profitable

Once you have an idea of where your business stands after taking care of overhead, you can finally figure out your true bottom line, or “net profit.”

Net profit

For a more realistic look at your business’s income, you’ll want to calculate net profit, or “the bottom line,”. It represents the amount of money you have left over after paying all expenses and applying small business taxes to your revenue.

Formula

The net profit formula consists of applying taxes to the operating profit:

Net profit = Operating profit - Business income tax

Calculation example

If a car parts company has an operating profit of $100,000 but owes $21,000 in taxes, its net profit would be $79,000.

Benefits and uses

- Reinvest it into the business for further growth

- Distribute as dividends to shareholders

- Pay off debts

- Acquire other businesses, acquire more assets, etc.

Remember that it’s not a bad thing if your net profits equal zero for the first couple of years. That’s called “breaking even,” and it’s actually a positive sign that your business is doing well. Over 30% of businesses fail because they run out of capital before breaking even. (CBInsights)

Profit margin

Now that you know your business’s bottom line, you can learn how to calculate profit margin. This metric represents the proportion of sales a company keeps as profits after deducting all costs and expenses. It helps investors and management to indicate how efficiently the company generates profits relative to the amount of revenue it has already generated.

Formula

Profit margins are usually expressed as a percentage, which you calculate by dividing revenue into net profit and multiplying that by 100:

Profit margin = (Net profit / Revenue) x 100

Calculation example

A furniture store earns $250,000 in net revenue and has a gross profit of $200,000. In that case, the company's profit margin would be 80%. ($200,000/ $250,000) x 100 = 80%.

Benefits and uses

- Compare your profitability to that of your competitors

- Make impactful pricing decisions

- Helps you decide when to decrease or increase overhead

Calculating Profit FAQ

For a business to be successful, you need to fully understand how to calculate profit. Since this topic is so important, we’ve included some frequently asked questions below.

How do you calculate profit from sales?

Profit from sales is the money from a sale after subtracting the cost of goods sold (COGS). Calculate the profit from sales by subtracting the COGS from the revenue earned.

Profit from Sales = Revenue – Cost of Goods Sold

What is profitability and why does it matter?

Profitability tells you how efficient the company is in generating revenue from its operations and can influence its ability to attract investment, attract customers, and make long-term plans.

When a company measures its profitability, it gets a snapshot of how much profit the business is making, which is an important metric for investors and management to measure the success of its strategies. To determine overall profitability, companies can also use profitability ratios.

How to calculate the profit percentage on the selling price?

To calculate the profit percentage, divide the profit by the selling price and multiply that by 100. For example, if the profit is $20 and the selling price is $100, then the profit percentage would be 20%.

Profit Percentage = (Profit / Selling Price) x 100

Streamline your small business profit calculations

Being aware of where your business stands financially can help you make well-informed decisions that will benefit the overall performance of the company.

Now that you know how to calculate profit for your business, you can start making confident choices for future success. But if you’re running a small business, you might not have time to focus on every aspect of its finances. Our accounting software can help you streamline expense calculations, invoicing, inventory, bills, and more.

Simplify your business accounting today with Quickbooks.

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.