3 journal entry examples

The process of creating journal entries in accounting can seem complicated if you’re not sure what they’re supposed to look like. Here are a few journal entry examples to give you a general idea of what to expect, whether you’re using a cash basis accounting method or an accrual accounting method.

1. Sales journal entry

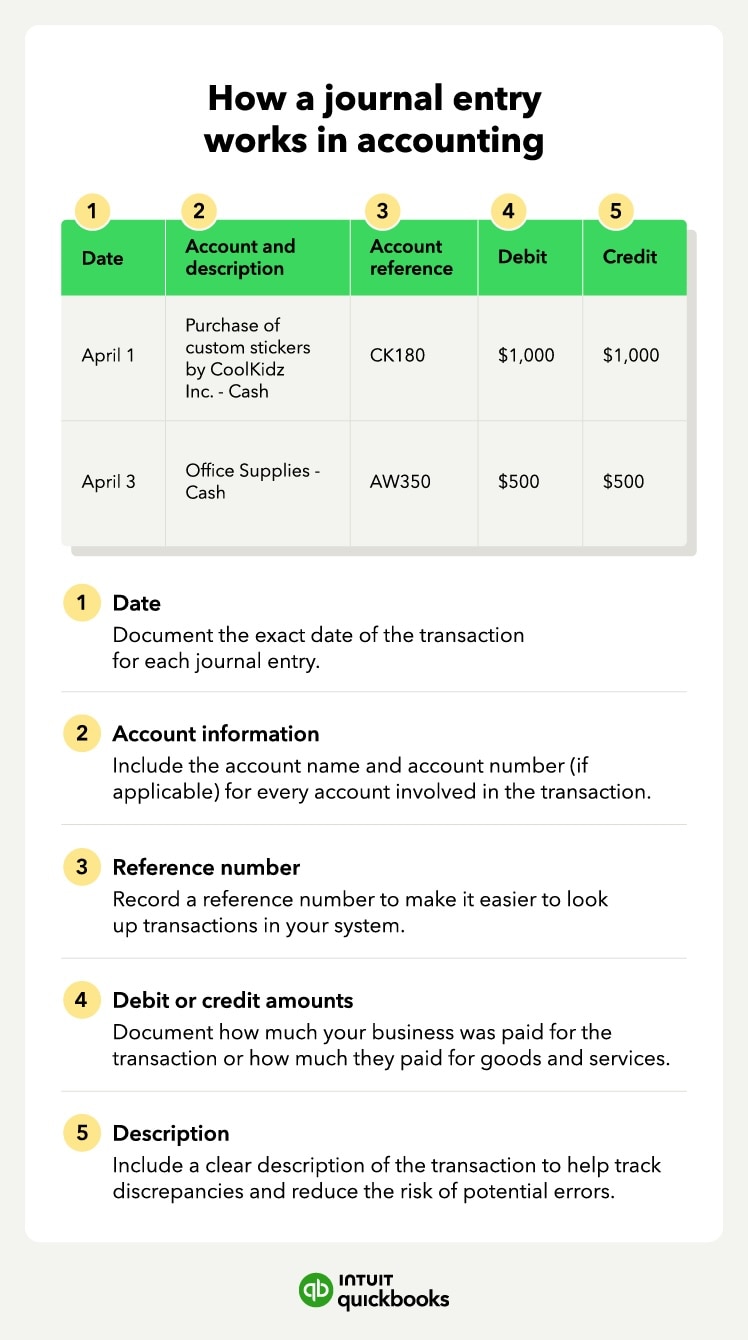

Say you own a custom sticker business and sell $1,000 worth of custom stickers to a customer who pays with cash. Your customer, CoolKidz Inc., pays you the full $1,000, and you deliver the stickers to them.

The $1,000 is reflected in both the debit and credit columns. This is because accounts receivable is considered an asset and the value increases after the sale, so it’s debited on your journal entry. And since your sales revenue also increases, it’s credited in your journal entry by the amount of the sale.

2. Purchase journal entry

Say your business buys $500 worth of office products with cash. Purchasing office supplies means you’re purchasing goods which are a type of business asset. Since the value of your total assets increased, the amount you paid is debited. And since you paid cash which is also an asset, the value of your assets decreases, so it’s credited in the journal entry as part of your accounts payable.

3. Purchase journal entry with a note payable

Say your business purchases equipment worth $10,000 by signing a note payable with a 5% interest rate. The note is due in one year, meaning you have one year to pay the balance off in full plus any interest accrued.

Again, since your equipment is classified as a business asset, your total asset value increases, so it’s highlighted in the debit column. And since notes payable are liabilities, and your total liability increases, the amount is credited to the journal entry.

Since your purchase journal entry won’t account for the interest you pay on the one-year note, you’ll need to add a separate entry to account for that interest.

Record journal entries for each transaction your business makes, whether you’re selling goods or purchasing them for use in your company.

Record journal entries for each transaction your business makes, whether you’re selling goods or purchasing them for use in your company.