1. Balance sheet

Also known as the statement of financial position, the balance sheet gives a snapshot of a nonprofit’s financial health. It lists what the organization owns (assets), what it owes (liabilities), and the difference between the two (net assets).

Balance sheet formula:

Net assets = Assets - Liabilities

This statement helps stakeholders assess whether the organization can meet its goals and fund its programs. It’s a key tool for tracking financial stability and making strategic decisions.

How to create your balance sheet:

1. List your assets

Include everything the nonprofit owns, such as:

- Cash

- Accounts receivable (invoices owed)

- Inventory

- Prepaid expenses

- Equipment

- Investment

- Other assets

2. List your liabilities

Capture everything the nonprofit owes, including:

- Accounts payable (bills to vendors)

- Notes payable

- Deferred income

- Other outstanding debts

3. Calculate your net assets

Subtract total liabilities from total assets to find the organization’s net assets. This represents the nonprofit’s net worth.

4. Double-check your numbers

Review all entries for accuracy. Every asset and liability must be precisely recorded.

5. Make sure it balances

Your total assets should always equal the sum of liabilities and net assets. If they don’t, recheck your calculations—there may be an error.

2. Statement of cash flows

The statement of cash flows shows how cash moves in and out of a nonprofit over a specific period, tracking where cash comes from, how it’s used, and how the cash balance changes. It offers a clear view of liquidity and operational sustainability.

3 cash flow categories:

- Operating activities: Cash inflows from donations, grants, program income, and other day-to-day operations. Cash outflows for expenses like salaries, supplies, and administrative costs.

- Investing activities: Cash inflows from interest, dividends, or selling investments. Cash outflows from purchasing assets.

- Financing activities: Cash inflows from loans, large donor contributions, or restricted funds. Cash outflows for loan repayments or other financing costs.

How to complete a nonprofit cash flow statement:

- Cash from operations: Include all income from core activities—donations, grants, ticket sales, fundraising events, and merchandise.

- Cash from investments: Track income from financial investments (such as stocks or bonds) and asset sales.

- Cash from financing activities: Record proceeds from loans, restricted contributions, or capital campaigns.

- Net cash flow: Subtract total cash outflows from total inflows to determine your net cash flow for the period. This number reflects your organization’s short-term financial health.

Additional details to include:

- Unrealized gains or losses on investments

- Noncash transactions, like depreciation or amortization

As with all financial statements, double-check for accuracy and ensure all figures are current before submission.

3. Statement of functional expenses

The statement of functional expenses breaks down a nonprofit’s spending by function (why the money was spent) and nature (what it was spent on). This report gives a detailed view of how resources are allocated, helping stakeholders evaluate how effectively the organization uses its funds.

Common expense categories:

- Program services: Costs directly tied to the nonprofit’s mission and services

- Management and general: Administrative expenses like office rent, salaries, and insurance

- Fundraising: Expenses related to donor outreach, campaigns, and events

This statement helps you track spending patterns, ensure compliance, and make informed budgeting decisions.

How to complete a statement of functional expenses:

1. Start with total expenses. List all expenses for the accounting period.

2. Categorize expenses by function. Split total expenses into:

- Administrative: Office rent, utilities, payroll, insurance, etc.

- Program-related: Costs directly associated with delivering services (e.g., staff salaries, supplies, contractor fees)

- Fundraising: Expenses for campaigns, events, and donor communications

3. Assign amounts to each category. Enter specific expenses under their appropriate functional categories.

4. Include total income. Record all income received during the same period, including:

- Donations

- Grants

- Investments

- Other revenue sources

5. Calculate net income. Subtract total expenses from total income to determine your net income (or net loss) for the period. Display this figure clearly on the statement.

4. Income statement

Also called a statement of activities, the nonprofit income statement shows how money comes in and goes out over a specific period. It outlines revenue sources and expenses, helping you understand whether the organization is operating at a surplus or deficit.

Unlike for-profit businesses that focus on profit, nonprofits track net income, which represents what’s left after covering expenses. This figure indicates whether the organization can sustainably support its mission moving forward.

What to include in a nonprofit income statement:

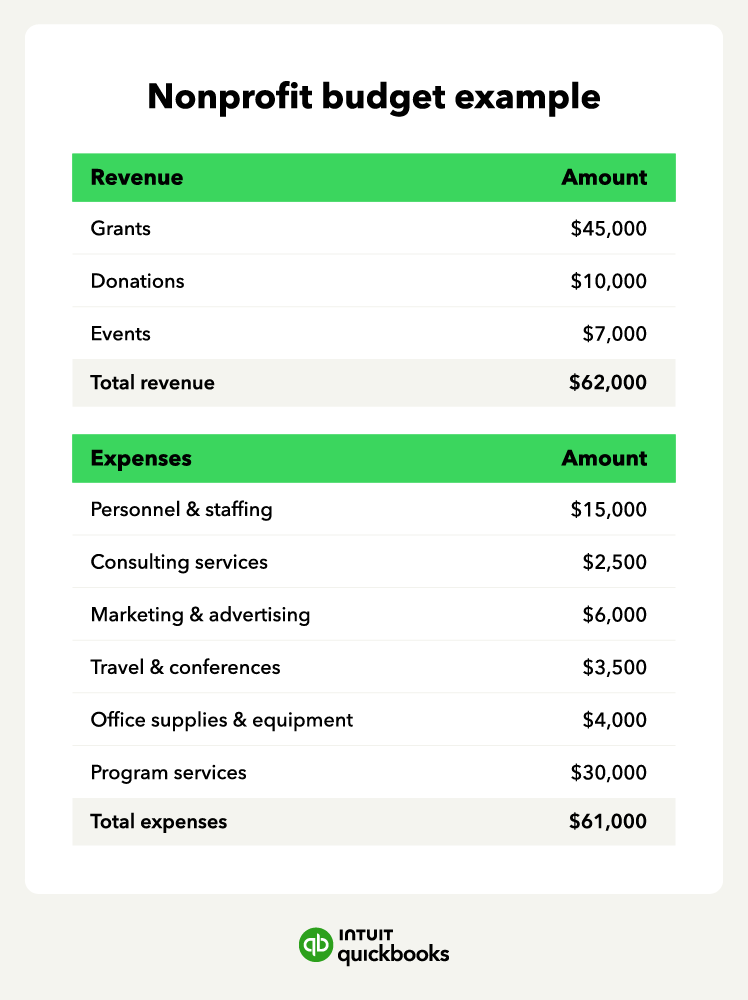

1. Revenue

List all income sources, such as:

- Grants and contributions

- Membership dues

- Program service fees

- Earned income (e.g., ticket or product sales)

- In-kind donations or donated services

2. Expenses

Break down your costs by category, including:

- Salaries and benefits

- Office supplies and rent

- Administrative and overhead costs

- Program delivery expenses

- Depreciation or amortization

3. Net operating income

Subtract total expenses from total revenue to calculate your net operating income. This figure shows whether your nonprofit is running at a gain or loss for the period.

4. Other revenue streams and expenses

Include items outside regular operations, such as:

- Investment gains or losses

- One-time grants

- Tax refunds or payments

5. Total income and expenses

Add up all revenue and expenses, including operating and non-operating items.

6. Net income

Finally, subtract total expenses from total income to determine your net income: the amount available for future programs, reserves, or reinvestment in your mission.

Cash-basis accounting is the more convenient method for new or small organizations, but as you achieve

Cash-basis accounting is the more convenient method for new or small organizations, but as you achieve