4 key financial statements for nonprofit accounting

Nonprofits use financial statements to provide transparency and accountability so nonprofit stakeholders, donors, and government agencies can evaluate the organization’s financial health. This is especially important since board members have a fiduciary duty—requiring them to be transparent about finances.

Keep in mind that financial reporting should be accurate and consistent and reflect the true nature of the organization's operations.

Additionally, you’ll need financial statements to obtain and maintain funding, grants, and other forms of support. Accurate financial statements also ensure nonprofits manage charitable resources responsibly, ethically, and according to applicable laws.

1. Balance sheet

Also known as the Statement of Financial Position, a balance sheet is an important document that nonprofits use to track their assets, liabilities, and net assets. When building out your balance sheet, you’ll use this formula:

Net assets = Assets - Liabilities

The point of this statement is to help determine whether or not the organization meets its goals or has enough funds to support its programs. You’ll be able to provide a snapshot of the organization's financial health so that stakeholders can assess its performance and decide its future direction.

To accurately fill out your balance sheet, follow these steps:

- Begin by entering the company’s assets: These include cash, accounts receivable (invoices due to the nonprofit), inventory, prepaid expenses, equipment, investments, and any other assets that the organization holds.

- Enter the organization’s liabilities: These include accounts payable (monies owed to creditors or vendors), notes payable, deferred income, and any other liabilities the nonprofit has incurred.

- Calculate the organization’s equity: This is the difference between the assets and liabilities of the nonprofit, and you can calculate it by subtracting the liabilities from the assets. Equity represents the net worth of the nonprofit.

- Ensure all totals are accurate: It is important to double-check that all assets and liabilities are accurate and the equity figures are correct.

- Make sure totals on both sides are balanced: Once you make all entries on both sides of the balance sheet, ensure that total assets match total liabilities. If these do not match, it may indicate a calculation error and must be corrected accordingly.

2. Statement of cash flows

A statement of cash flows is a financial statement that provides information about a nonprofit organization's cash receipts and payments. It helps to illustrate how cash flows in an organization and cash balance changes over time.

The statement of cash flows includes three basic activity types:

- Operating activities: Cash inflows from operations (donations, grants, etc.) and cash outflows from operations (employee salaries, supplies, administrative costs)

- Investing activities: Cash inflows from investments (income from investments) and cash outflows from investments (purchasing investments)

- Financing activities: Cash inflows from financing sources (loan payments) and cash outflows from financing sources (loan repayments)

To correctly fill out a statement of cash flows as a nonprofit organization, you’ll need to provide data on the cash received or expended during the period in question, including the following items:

- Cash from operations: This figure represents the total cash generated from donations, grants, and other revenue-generating activities. This can include sales from merchandise, ticket sales, and fundraising events.

- Cash from investments: This figure represents the total cash generated from investments like stocks, bonds, and securities.

- Cash from financing activities: This figure represents the total cash generated from loans, donor contributions, and other financing sources.

- Net cash flow: Calculate this figure by subtracting the total cash outflows (including payments made on loans) from the total cash inflows during the period in question. It is an important measure of overall financial performance.

You may also need to provide other information, like unrealized gains or losses on investments and noncash transactions, such as depreciation or amortization expenses. As with any financial statement, ensure that all figures are accurate and up to date before submission.

3. Statement of functional expenses

A statement of functional expenses for nonprofit organizations is a financial report that itemizes expenses according to their purpose. This report provides information on where resources have been committed and allocated within an organization.

Typical categories include program services, management and general, fundraising, and other sources of income. You can use the statement to assess the usage of funds, track performance, and make decisions about future operations.

Follow these steps to fill out your statement of functional expenses:

- Enter your organization's total expenses for the accounting period.

- Divide your total expenses into two categories: administrative and program costs. Administrative costs refer to expenses such as salaries and rent, while program costs are the costs associated with delivering your core services, such as materials, activities, and staff.

- Enter the administrative expenses and their corresponding amounts. This might include office or organizational supplies, office rent and utilities, payroll, insurance, and other operating costs.

- Enter the program-related expenses and amounts, such as staff salaries, professional fees, material costs related to delivering services and activities, etc.

- Calculate the total amount of income from all sources, including donations, grants, investments, and any other income sources earned during the accounting period.

- Enter the total income next to the "total expenses" line near the top of the statement.

- Calculate your organization's total net income by subtracting total expenses from total income. You should display this amount on your statement as well.

4. Income statement

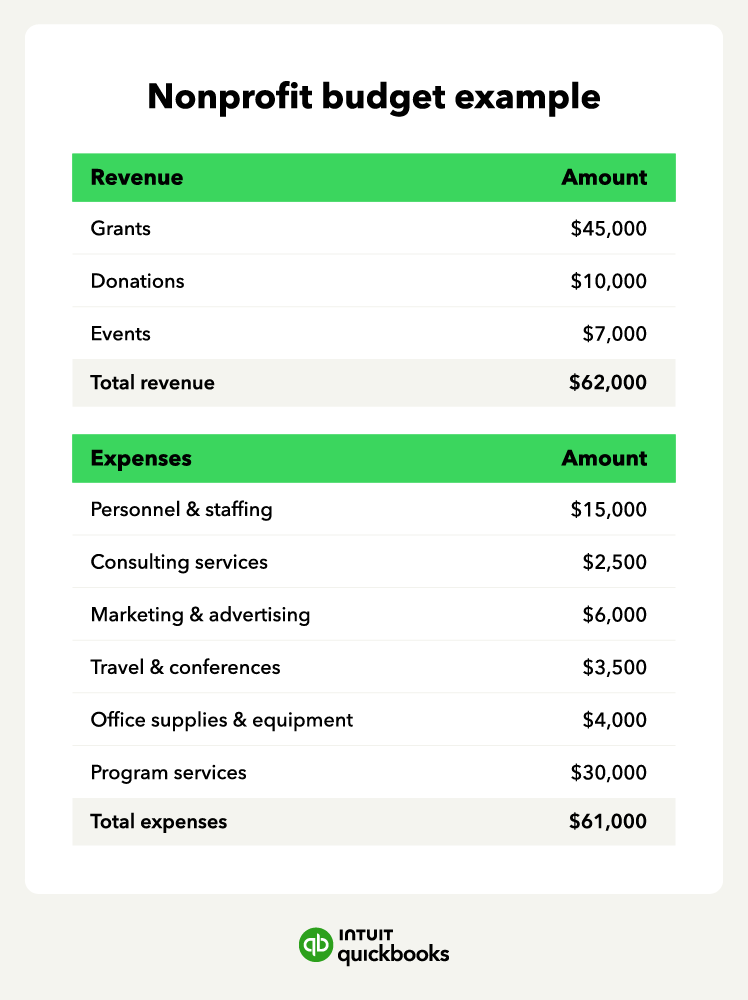

An income statement for nonprofits is a financial statement that shows the sources and uses of funds over a set period. It typically details all revenue, such as contributions, grants, salaries, administrative costs, and program costs.

The net income on an income statement for nonprofits is what remains after subtracting total expenses from total revenues.

Here’s how to fill out your nonprofit income statement:

- Revenue: Begin by listing all sources of income for the nonprofit, including grants, donations, membership dues, and earned income. Include any other noncash income you may have received, such as in-kind donations or donated services.

- Expenses: List all expenses associated with running the nonprofit, such as payroll, office supplies, and rent. Include operating expenses such as administrative fees, travel expenses, and other costs. Also, include any overhead costs such as overhead or depreciation on assets.

- Net operating income: Calculate the net operating income by subtracting the total expenses from the total revenue. This will give you a final figure that indicates whether the nonprofit is making a profit or loss.

- Other revenues and expenses: In this section, list any other types of special revenues or expenses that do not fit into either the revenue or expense category. This could include items like capital gains/losses, gains/losses from investments, or taxes paid/refunded.

- Total income: Add up all the revenue sources, including income from other sources, to determine the total income for the nonprofit.

- Total expenses: Add up all expenses incurred to operate the nonprofit, including expenses from other sources, to calculate total expenses for the nonprofit.

- Net income: Calculate the overall net income by subtracting total expenses from total revenue to determine the overall.

Cash basis is the more convenient method when your organization is new and small, but you should consider fund accrual accounting for the long term.

Cash basis is the more convenient method when your organization is new and small, but you should consider fund accrual accounting for the long term.