Know your timing

Whether your accounting period is monthly, quarterly, or annually, timing is crucial to implementing the accounting cycle properly. Mapping out plans and dates that coincide with your accounting deadlines will increase productivity and results.

Troubleshoot errors quickly

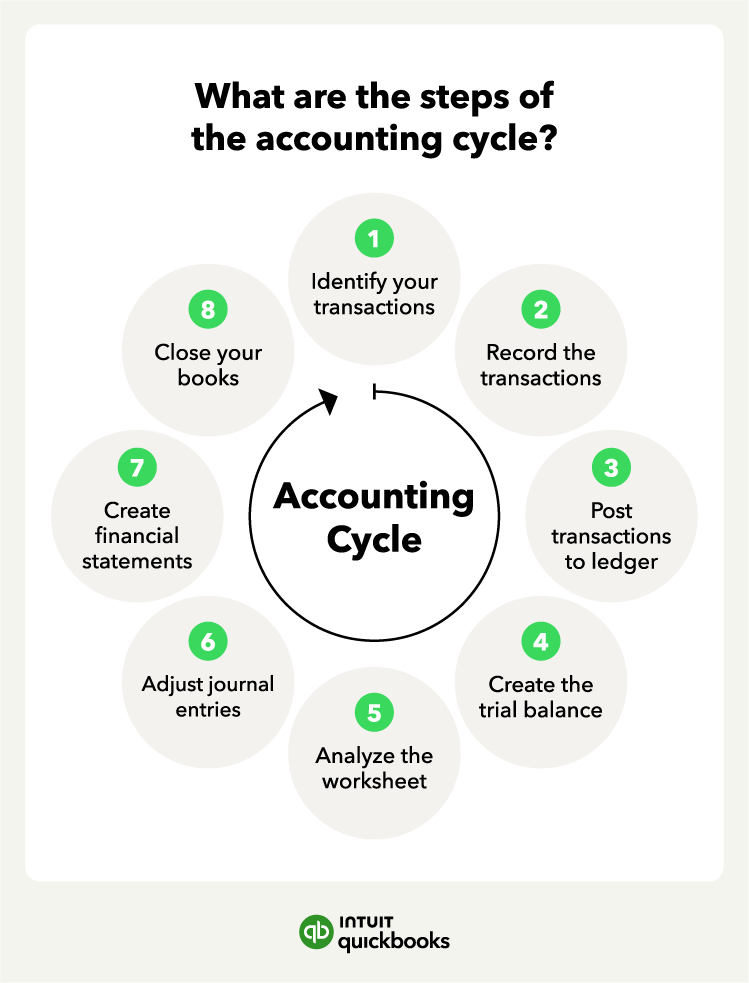

Identifying and solving problems early in the accounting cycle leads to greater efficiency. It is important to set proper procedures for each of the eight steps in the process to create checks and balances to catch unwanted errors.

Modify the process to fit your needs

There is no one-size-fits-all solution for accounting practices. Each industry, company, and team operate differently. You might find early on that your system needs to be tweaked to accommodate your accounting habits.

Set your team up for success

If you have a staff, give them the tools they need to succeed in implementing the accounting cycle. This could mean providing quarterly training on best practices, meeting with your staff each cycle to find their pain points, or equipping them with the proper accounting tools. The better prepared your staff is, the more efficient they can be.

Try accounting software to lighten the load

Tools such as QuickBooks Online can help streamline the accounting process. Access to QuickBooks Live Expert Assisted can make it even easier to manage your company’s finances.* There are many tasks that you can automate through a business accounting platform.

QuickBooks also offers an AI accounting agent designed to take repetitive tasks off your plate. The AI agent can automatically categorize transactions, flag potential errors, and surface insights to help you make smarter financial decisions.

Schedule regular trial balance check-ins. Don’t wait until the end of the year; review your trial balance monthly to catch discrepancies early and avoid time-consuming fixes during tax season.

Schedule regular trial balance check-ins. Don’t wait until the end of the year; review your trial balance monthly to catch discrepancies early and avoid time-consuming fixes during tax season.