Accounting errors can throw a costly wrench in your business plan if left unaddressed, and that's an understatement—a 7.8 billion understatement, to be exact.

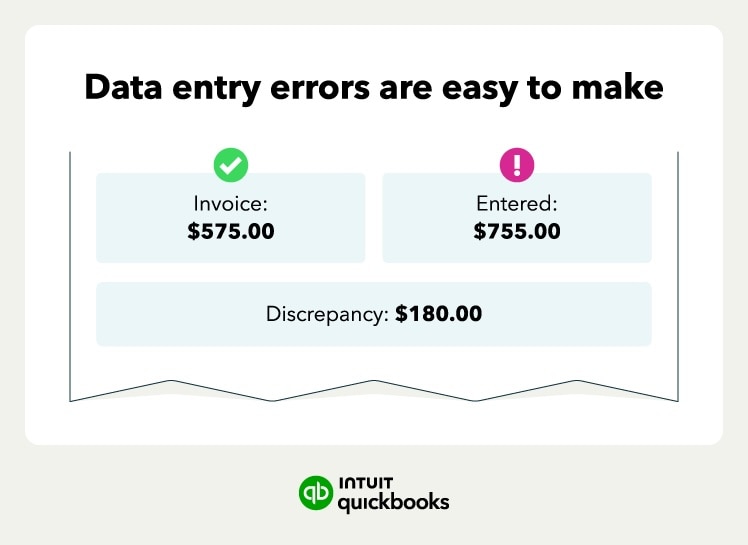

These mistakes may seem small, but even a misplaced decimal can quickly derail your financial reporting or cause critical bills to go unpaid. They can even inadvertently provide an inaccurate report of your business's financial health, which is inconvenient at best… and criminal at worst.

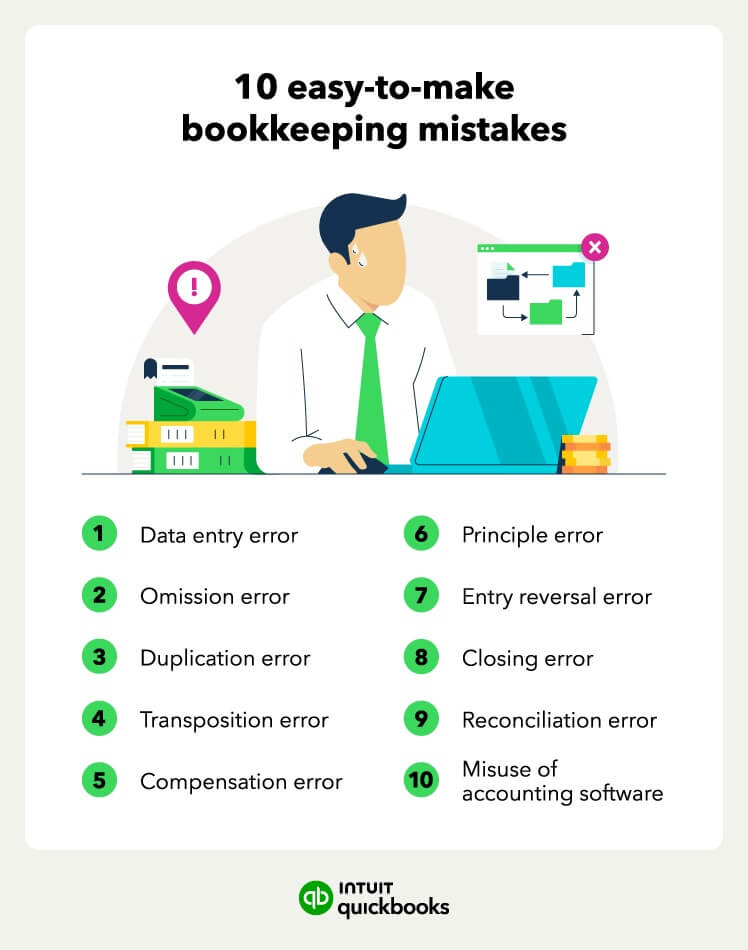

In this guide, we'll cover 10 common accounting errors, including the signs to look out for, how to prevent them, and what impact they can have on your business.

- 1. Data entry errors

- 2. Omission errors

- 3. Duplication errors

- 4. Transposition errors

- 5. Compensation errors

- 6. Principle errors

- 7. Entry reversal error

- 8. Closing error

- 9. Reconciliation error

- 10. Misuse of accounting software

- How to find and eliminate accounting errors

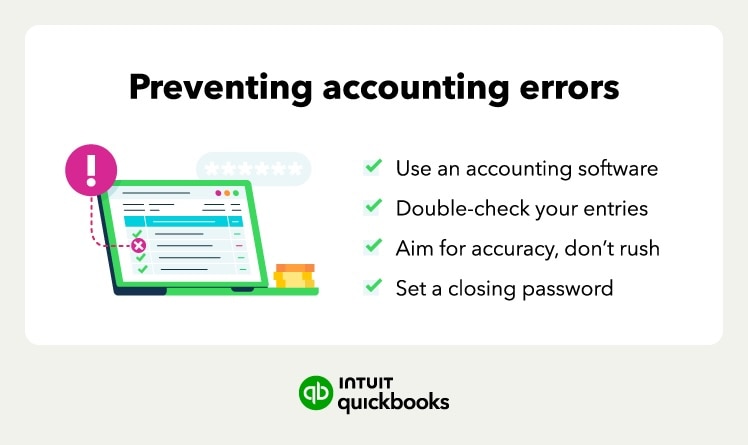

- How to prevent accounting errors

- Solutions to accounting errors

Proactively review payroll data before each run, and always cross-reference employee changes (new hires, raises, terminations) against current figures.

Proactively review payroll data before each run, and always cross-reference employee changes (new hires, raises, terminations) against current figures.