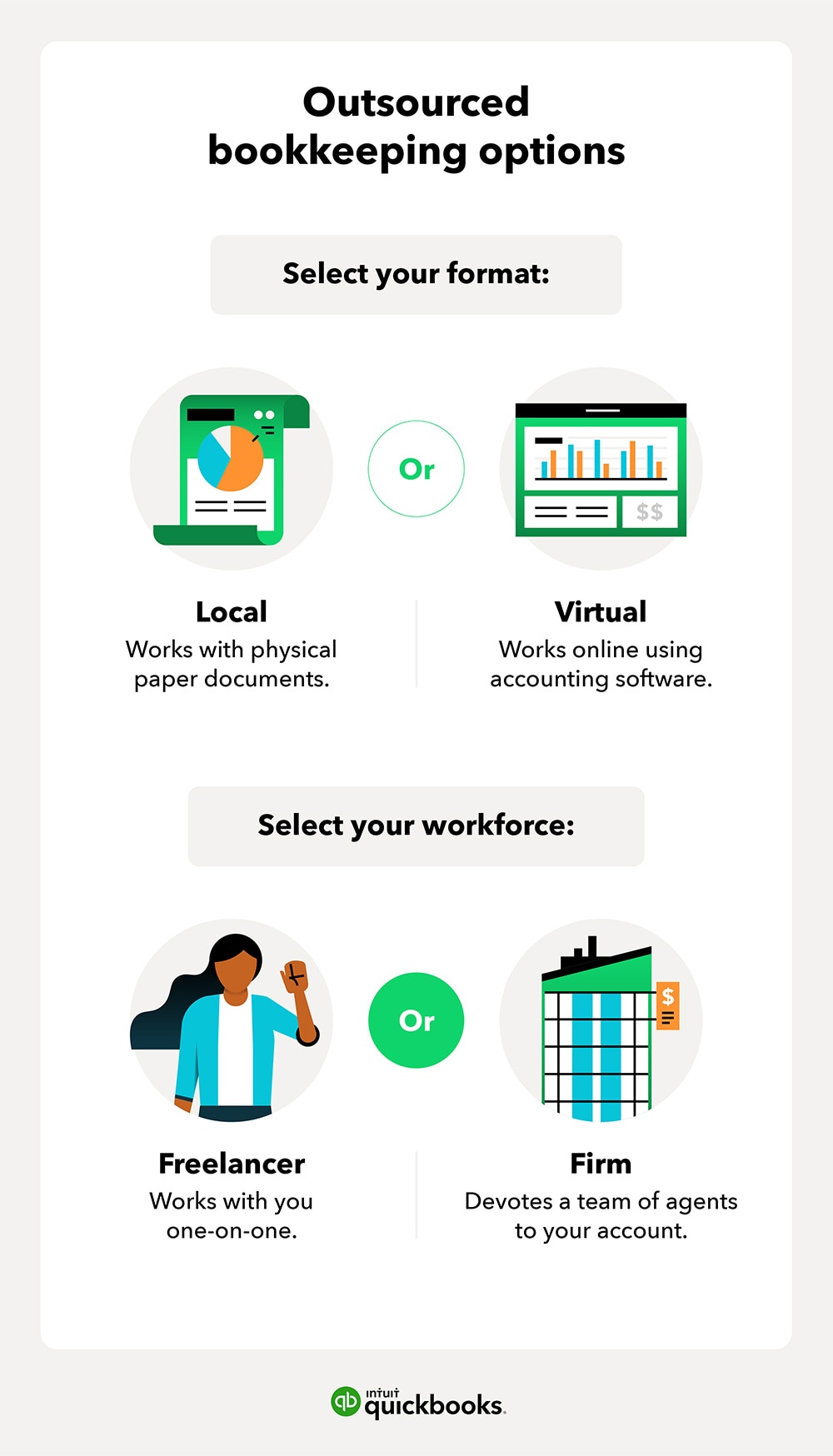

There are a few decisions to make when outsourcing bookkeeping—most notably, local vs. virtual and freelancer vs. firm. All options have pros and cons that depend on what you’re looking for from your bookkeeping service. Follow these steps.

Step 1: Select your format: local vs. virtual bookkeeping

When outsourcing, you’ll first need to decide whether you prefer a local or virtual bookkeeping format. Each offers its own advantages depending on your business needs.

Local bookkeeping

Hiring a local bookkeeper involves working with someone in your area who may visit your office and handle physical documents. It’s a good fit if you prefer face-to-face meetings or keep paper records.

Benefits:

- In-person collaboration and relationship-building.

- Easier to manage physical paperwork.

- May understand local business nuances and regulations.

Potential drawbacks:

- May charge more for travel or in-person visits.

- Limited by local talent availability.

- Often slower to adopt cloud-based tools.

Virtual bookkeeping

Virtual bookkeeping is done remotely using cloud-based tools. It offers real-time access to your financial data and is ideal if you're comfortable with digital communication and paperless processes. Some services provide on-demand bookkeeping support when you need it.

Benefits:

- Access to a broader talent pool.

- Typically more affordable due to lower overhead.

- Real-time updates and easy collaboration through cloud platforms.

Potential drawbacks:

- No in-person support.

- Requires comfort with technology and digital communication.

- Time zone differences may affect response times.

Step 2: Select your workforce: freelancer or bookkeeping firm

Once you’ve chosen between local and virtual bookkeeping, the next step is deciding who will handle the work: an independent freelancer or a full-service bookkeeping firm. Both have unique benefits depending on how much support you want and how you prefer to collaborate.

Freelancer

A freelance bookkeeper is a self-employed professional who works independently and may serve multiple clients. They typically work remotely or on a flexible basis and are hired directly by your business, usually on an hourly or flat-fee basis.

Benefits:

- One-on-one attention and personalized service.

- Often more flexible with pricing and hours.

- Easier to build a consistent working relationship.

Potential drawbacks:

- Limited availability, especially during busy seasons.

- May lack backup if they take time off or become unavailable.

- May not offer a full suite of services like payroll or tax filing.

Bookkeeping firm

A bookkeeping firm is a company that provides professional bookkeeping services. It typically assigns a team or a dedicated point person backed by a team—to your account. Firms may specialize in bookkeeping alone or offer broader accounting and advisory services.

Benefits:

- Access to multiple professionals and broader expertise.

- Reliable coverage, even if one person is unavailable.

- Often includes additional services, like payroll or tax prep.

Potential drawbacks:

- May be more expensive than working with a freelancer.

- Less personal since communication may go through different team members.

- Less agility to tailor services or processes.

Which route is best for you?

Your ideal bookkeeping approach depends on how your business operates, how hands-on you want to be, and how complex your financial needs are. Here’s a breakdown to help you decide.

Consider a bookkeeping firm if:

- You run a growing business with high transaction volume or multiple revenue streams.

- You need full-service support, including payroll, tax preparation, or budgeting help.

- You prefer having a team available so nothing falls through the cracks, even when someone’s out of office.

Best for: E-commerce brands, professional service firms, franchises, or companies scaling quickly.

A freelancer may be a better fit if:

- You need help with basic tasks like invoicing, categorizing expenses, or reconciling accounts.

- You prefer a one-on-one working relationship with a single point of contact.

- You’re cost-conscious but still want experienced support.

Best for: Freelancers, independent contractors, sole proprietors, or small local businesses.

Go local if:

- You want someone nearby who can work with paper records or meet in person.

- You need help with tasks that involve physical documents or prefer face-to-face collaboration.

Best for: Brick-and-mortar shops, trades businesses, or businesses new to digital bookkeeping tools.

Think about virtual if:

- You’re comfortable using cloud-based tools and want access to real-time financial data.

- You prefer digital communication and automated processes.

Best for: Remote-first companies, tech-savvy entrepreneurs, or businesses that value flexibility.

Step 3: Interview candidates

After narrowing down what type of outsourced bookkeeping will work best for your business, it’s time to meet potential candidates and ask the right questions.

Whether you're talking to a freelancer or a firm, virtual or local, use the interview to assess their experience, skills, communication style, and business knowledge.

Tips for interviewing candidates

To make the most of your time with potential candidates, plan your questions carefully. Here are some questions to ask:

- What industries do you typically work with?

- How do you usually communicate with clients (email, phone, virtual meetings)?

- Are you comfortable working with my preferred accounting software (e.g., QuickBooks Online)?

- What’s your typical response time for questions or updates?

- What’s included in your standard services? What might be extra?

- Can you walk me through your onboarding process?

- How do you handle time off or coverage?

- Are you insured or bonded?

When communicating with your candidate, you’ll want to pay attention to the following:

- Professionalism: Do they reply promptly, respectfully, and clearly during your early interactions?

- Clarity and transparency: Can they explain their processes, pricing, and expectations in plain terms?

- Tech proficiency: Do they show confidence working with your accounting tools and demonstrate experience with similar systems?

- Assessment readiness: Are they willing to review your current books and provide feedback on the scope and level of support needed?

Additional tips when interviewing outsourced bookkeeping professionals:

- Ask for examples: Have your candidate walk through how they’ve helped other businesses similar to yours improve processes or catch errors.

- Request references: Follow up with past clients to get a sense of reliability, communication, and work quality.

- Check for compliance knowledge: Ask how they stay updated on tax laws or regulatory changes that might affect your industry.

- Discuss availability: Make sure their working hours align with your expectations.

- Gauge flexibility: Ask how they handle urgent requests, shifting workloads, or onboarding to your preferred systems.