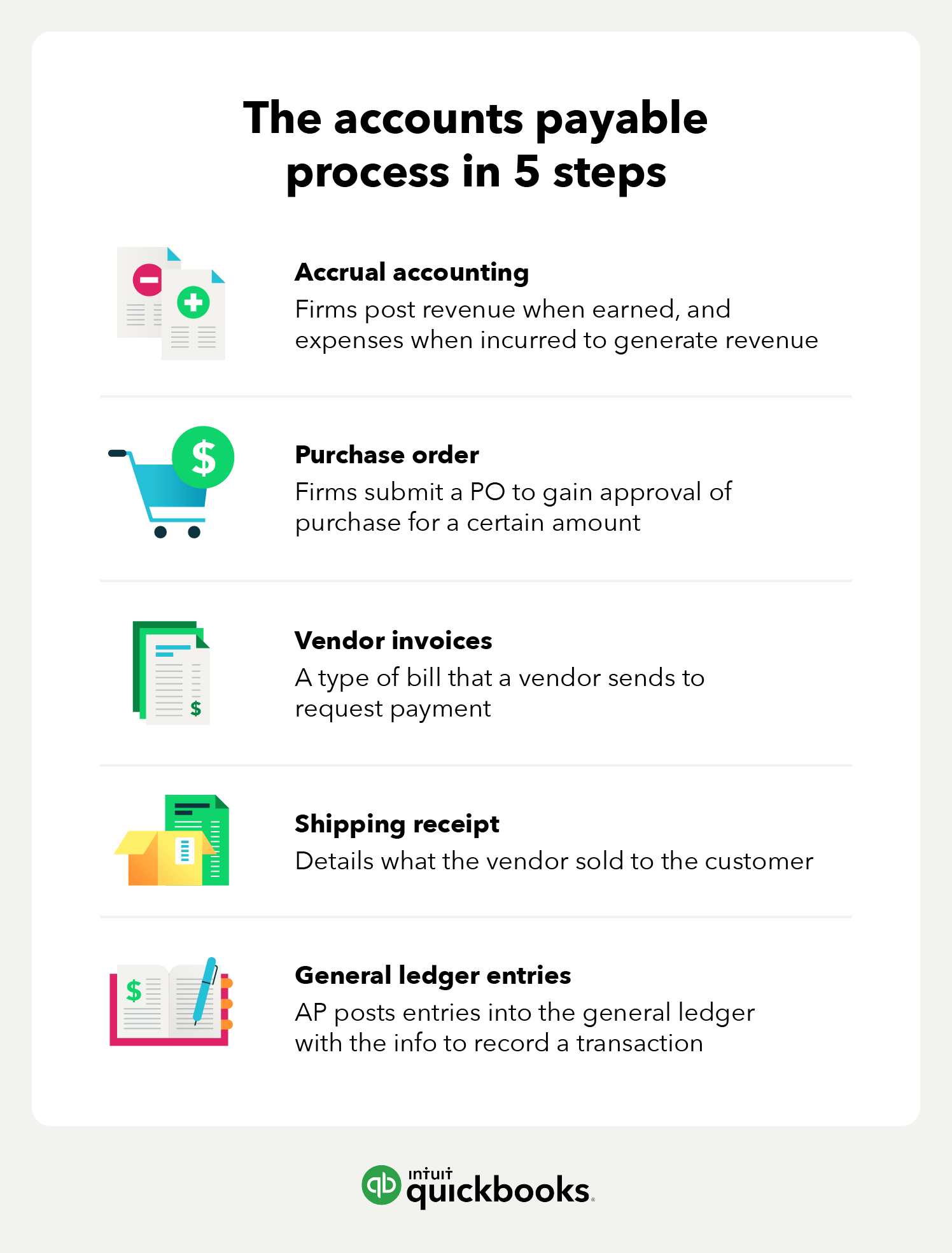

Let's walk through the five steps of the accounts payable process:

1. Use accrual accounting

Accrual accounting requires firms to post revenue when earned and expenses when incurred. All businesses should use accrual accounting so that revenue can be matched with expenses, regardless of the timing of cash flows.

The accounts payable department should use accrual accounting to post transactions and for financial reporting. To set up a clearly defined process, meet with your AP department. If your business is smaller, a bookkeeping employee may handle accounts payable.

2. Issue the purchase order

Most spending decisions require a purchase order (PO). Assume, for example, that Acme Manufacturing needs to order a $10,000 piece of machinery. Before the order is placed, the plant manager must complete a PO, which lists the machinery’s price and other details.

The owner or someone else with financial responsibility (like the CFO) approves the PO. At this point, the order can be placed. Small purchases, such as $40 in office supplies, don’t need a PO. Generally, POs are used only for larger purchases over $1,000. Purchase orders help a business control spending and keep management in the loop of outgoing cash.

3. Receive the vendor invoices

When the order is placed, the vendor will send an invoice. The person responsible for accounts payable tasks should record the following information in the accounting system:

- Due date: The date when the invoice should be paid

- Payment terms: Some vendors offer a discount if the invoice is paid within 5-10 days. If a discount is offered, you may decide to pay the invoice in a shorter period of time.

- Contract information: Includes the vendor’s name, address, email, and the client’s invoice number. If the vendor takes electronic payments, include that information with the invoicing data.

- Purpose: If you need to plan the payment for larger purchases, include a description of the purchase.

When the item is received, the vendor should include a shipping receipt.

4. Request a shipping receipt

The shipping receipt details what the vendor sold to the customer. The receipt includes a description and the number of items included in the shipment.

The data on the purchase order, invoice, and shipping receipt should be the same. Reviewing these documents ensures that the order was approved and that you received the items that were ordered.

If the data matches, the accounting department can generate a check. The owner should review all of the documents before signing the check and paying the invoice.

In addition to managing paperwork, the AP department needs to post accounting entries.

5. Post general ledger entries

The accounts payable department posts journal entries into the general ledger. A journal entry contains all of the information needed to record a transaction. There are two common journal entries for accounts payable: a purchase on credit and an invoice paid in cash.

Let's unpack this using the example of Acme Manufacturing purchasing a $10,000 piece of machinery on credit:

- Purchase on credit:

- The business receives the machinery (an asset). This increases the Machinery Asset account by $10,000.

- The business takes on a debt (a liability). This increases the Accounts Payable Liability account by $10,000.

- Invoice paid in cash:

- The business pays the vendor, settling the debt. This decreases the Accounts Payable Liability account by $10,000.

- The business's cash goes down (an asset reduction). This decreases the Cash Asset account by $10,000.