It’s one of the most vibrant yet perhaps least understood areas of the U.S. economy. Hispanic-owned employers make up roughly 6% of the total nationwide, with roughly 331,000 businesses, according to the latest Census Bureau estimate—and the number is growing.

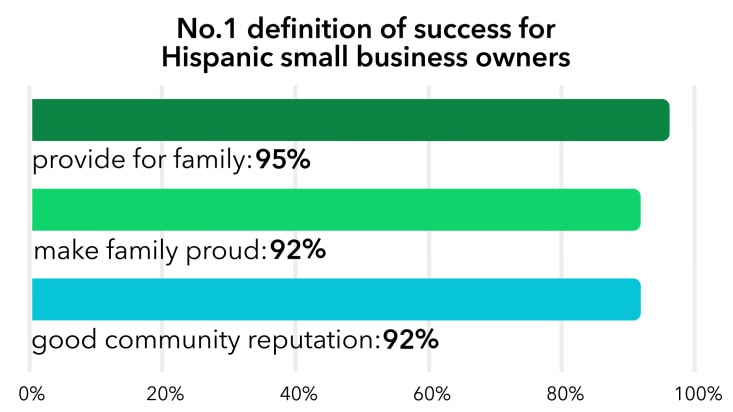

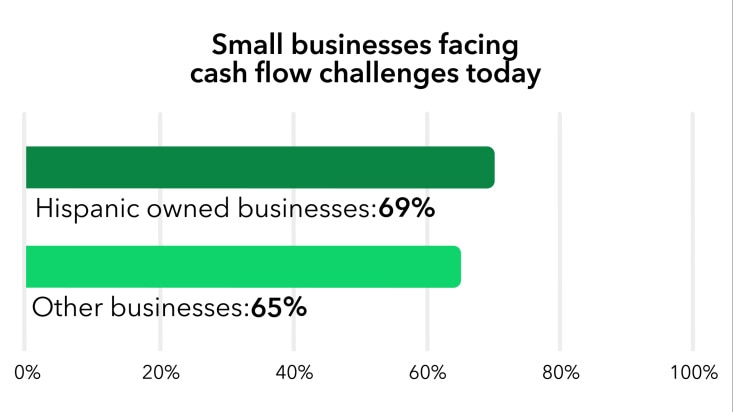

Did you know that the owners of these businesses are typically younger than others? This is one of many fascinating insights from a new QuickBooks survey of 1,811 small business owners and self-employed people. In the survey, we reached out to 456 people who describe themselves as Hispanic or Latina/o/x (the majority chose the former so we’ll use it here) to ask them about the challenges and opportunities they face when starting and growing a business.

Use the links on the left hand side to quickly jump through the survey’s key findings.