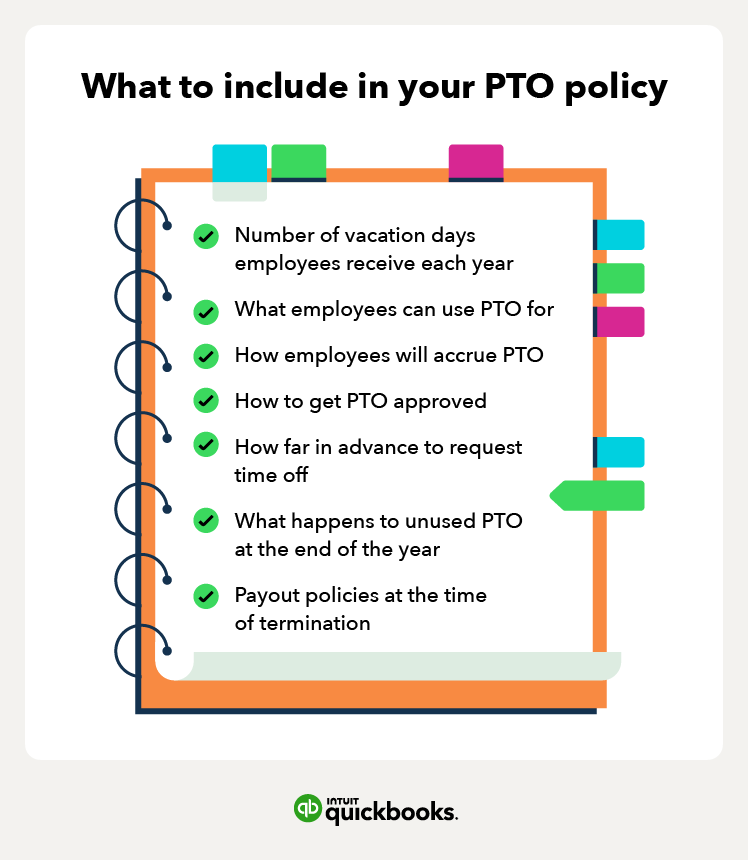

2. Clearly outline your PTO payout policy in your employee handbook

Once you have your policy set in stone and have ensured you’re staying compliant with your state's laws, you’ll want to include your vacation payout policy in your employee handbook so your team has it to reference. In addition to adhering to state laws, make sure your business policy on PTO payout is clearly outlined. You should structure these policies in a way that’s easy to digest to avoid any confusion.

If your business has multiple locations in different states or has remote employees in different states, you’ll also want to include each state-specific law in your policy.

3. Stay on top of requests with a PTO tracker

A PTO tracker can help your business stay on top of your time off policies and help you track and manage your employee’s leave all in one place.

Our PTO tracker makes it easy for employees to submit time off requests and keep track of how much PTO they have left, while also helping to prevent miscommunication, missed shifts, and payroll errors.

4. Encourage time off

Though some states don’t require employees to use their PTO by the end of the year, some have a use it or lose it policy that states otherwise. Our PTO survey found that 60% of employees had leftover paid time off at the end of the year.

If employees don’t feel comfortable requesting time off, their earned PTO hours could be left on the table. Make sure to encourage your employees to take their time off so PTO hours don’t go to waste. Employees should feel comfortable requesting time off, and you should remind them to use this benefit to take some much-needed rest when they need it.

Know the answers to common PTO payout questions

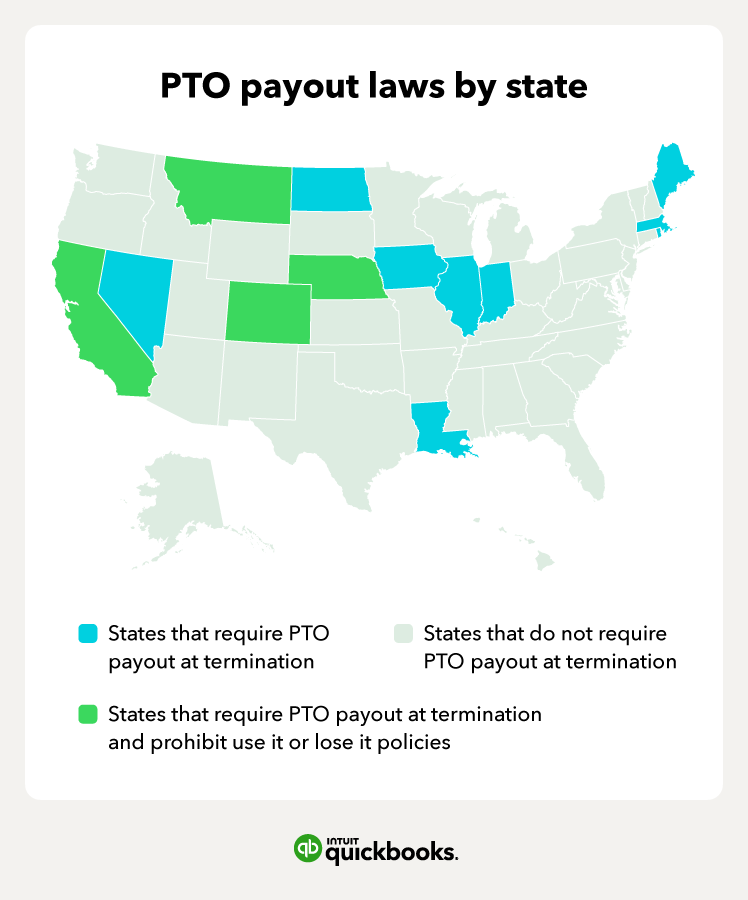

PTO payout can be confusing, which is why knowing your state laws and regulations is important. Here are some answers to common PTO payout questions you may be asking yourself.

Can you cash out PTO?

By law, some states require employers to pay employees for their unused PTO hours should they leave the company. For those still employed, companies are not required to pay employees for unused PTO hours, but they may allow employees to roll over unused vacation time to the following year. Make sure to check your state’s laws for specific guidelines on whether or not you’re required to cash out an employee’s PTO at termination.

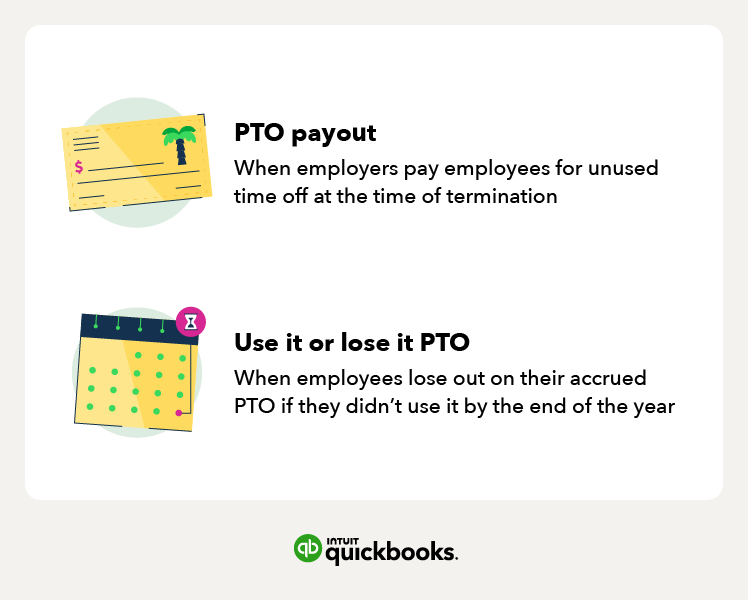

What’s the difference between PTO payout and use it or lose it PTO?

PTO payout is when an employer pays an employee for unused vacation time either at the time of termination or at the end of the year. Use it or lose it PTO is when an employee will need to use their accrued PTO hours by the end of the year or they lose out on those hours and will not be compensated or able to roll them over into the following year.

Some employers may have a use it or lose it PTO policy, however, a few states prohibit employers from implementing this policy, including California, Montana, Colorado, and Nebraska.

Does PTO payout get taxed?

Yes. Since the IRS considers PTO payouts as supplemental wages, these funds are subject to tax withholdings. Supplemental wages are any wages outside of an employee’s regular pay. This can include bonuses, commission, severance pay, back pay, and payment for unused PTO.

Manage employee time off with PTO tracking

Managing employees’ time off requests can be easy once you have a proper PTO policy set in place. Stay compliant with PTO payout laws and start using QuickBooks Time today to better manage employee time off requests, stay on top of their accrued PTO, and give them easy access to your business’s PTO policy.