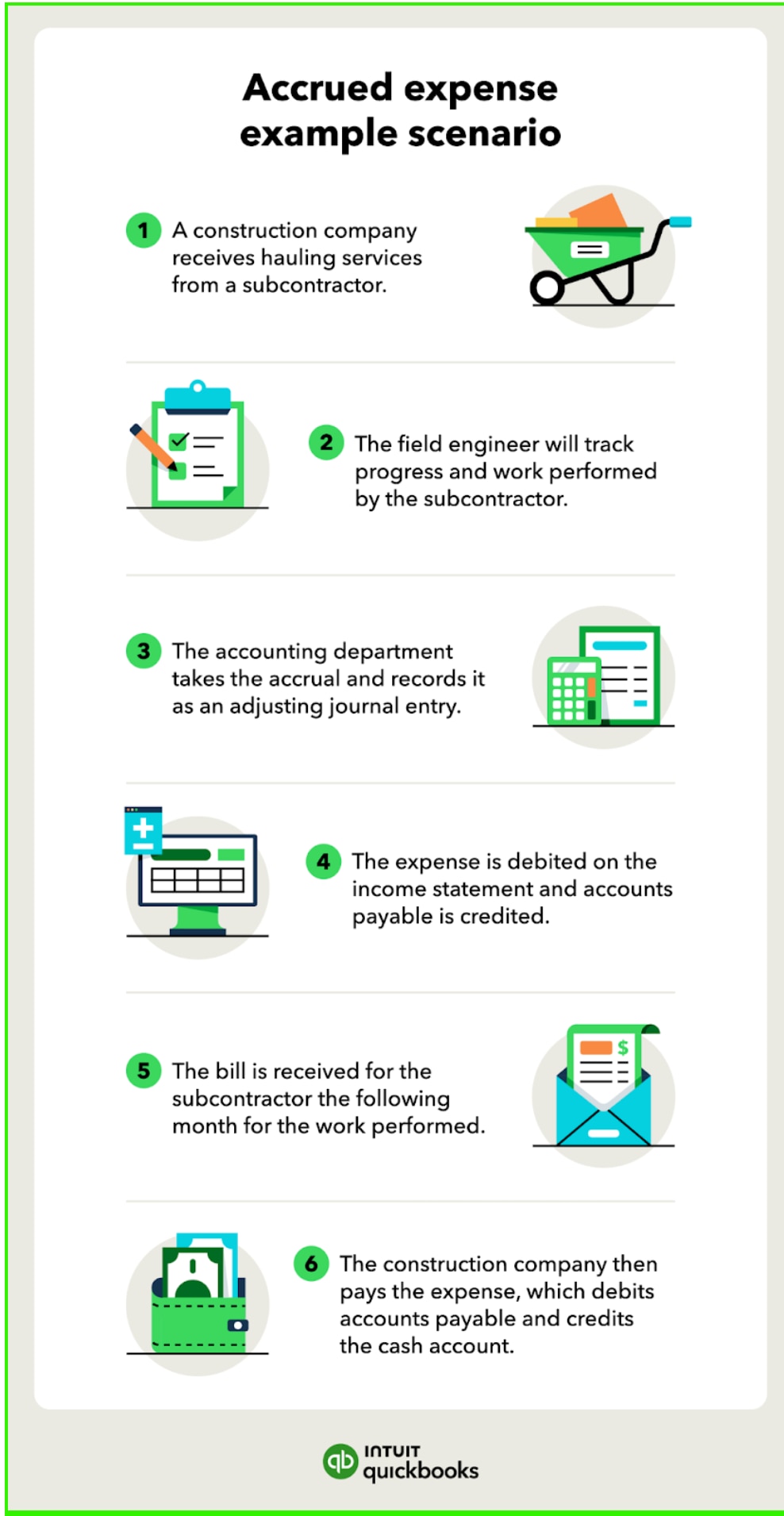

Let’s say a construction company receives hauling services from a subcontractor throughout the month of March. However, the subcontractor doesn’t bill until April. To account for the payout, the field engineer will track progress and work performed by the subcontractor, keeping a record of all expenses that will come to fruition in April.

On March 31, the field engineer confirms with the subcontractor that the numbers he’s tracked are correct. He does this to avoid any discrepancies between what he recorded and what the subcontractor has actually performed (so the billing amount and the accrual amount are the same).

Once the field engineer completes the accrual estimate, the accounting department makes an adjusting journal entry to debit the subcontractor expenses on the income statement and add a credit to the accounts payable on the balance sheet. Once the bill is received from the subcontractor and the debt has been paid, the accounts payable account is debited and the cash account is credited.