While it can be challenging to determine your marginal revenue and costs, if you’re researching these metrics, your business is at a crossroads. You’re ready to start producing more products, but you want to make sure it’s worth it.

A growing business comes with growing pains. Including finding the balance between increasing your profitability and overproduction. Let’s look at what marginal revenue and marginal costs are and how to analyze your profits best:

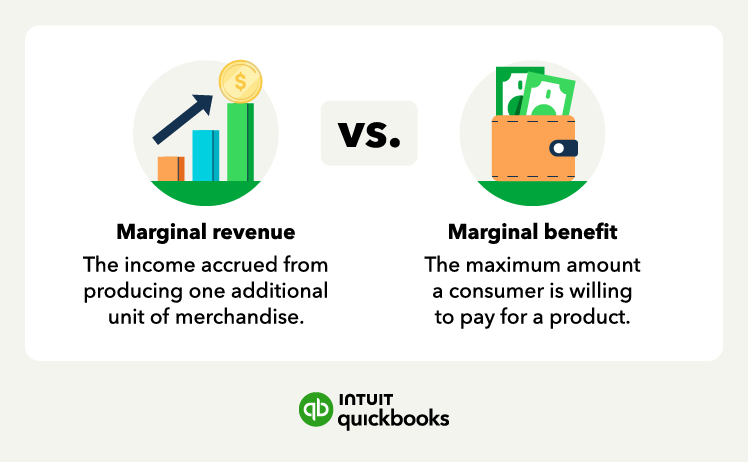

What is marginal revenue?

Marginal revenue is the revenue or income you gain from producing additional units. Marginal revenue is an important business metric because it’s a measure of revenue increase due to an increase in unit sales. When marginal costs exceed marginal revenue, a business isn’t making a profit and may need to scale back production.

Marginal revenue formula

The marginal revenue formula divides the change in revenue by the change in quantity or number of units sold:

Marginal revenue = Change in revenue / Change in quantity

The change in revenue is your new revenue minus your previous revenue, while the change in quantity is your new quantity minus your old quantity.

The major cause of a decrease in marginal revenue is simply the rise in marginal cost. The sweet spot is anything that results in marginal cost being equal to marginal revenue, also known as break-even. Otherwise, the company is either underproducing or overproducing, and either way that creates a loss of money.

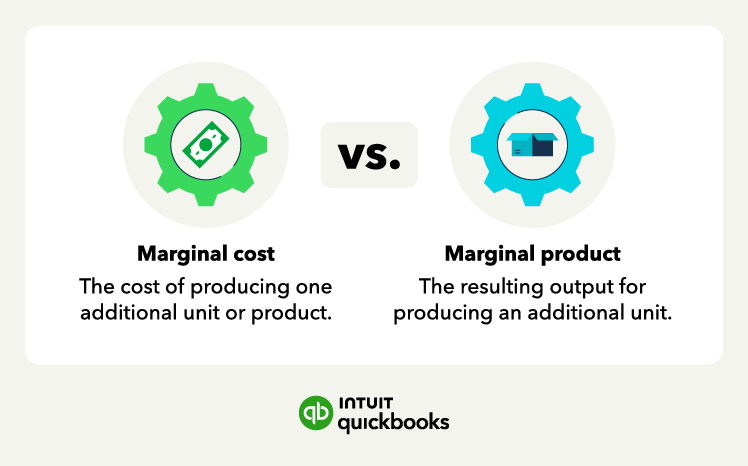

What is marginal cost?

Marginal cost is how much money it costs your company to produce one additional unit of your product or merchandise. As a growing company, you don’t want to run the risk of inventory shortages, but you also don’t want to overproduce and not see the return on your investment (ROI).