How Intuit Enterprise Suite supports your value-based pricing strategy

Implementing a successful value-based pricing strategy requires more than understanding your customers; it demands robust tools to manage the intricate data and in-depth analysis necessary to achieve it. Intuit Enterprise Suite offers a powerful system with features designed precisely for this purpose.

Let's unpack a few of them:

Gain deep customer and profitability insights

A core tenet of value-based pricing is understanding where your value truly resonates—and how that translates into profitability. You need to pinpoint which customers and offerings contribute most to your bottom line.

Intuit Enterprise Suite provides advanced, customizable reporting capabilities that go far beyond standard financial statements, allowing you to filter, sort, and tailor reports to dissect profitability from numerous perspectives.

Some of the most critical customer insights you'll need include:

- Profitability breakdowns by customer, type, job, product, service line, and geographic region

- Identification of your most and least profitable customer segments.

- Analysis of sales trends to reveal which offerings command stronger prices or margins

- Understanding the revenue and profit generated by the different value propositions you offer

Understand true costs and value

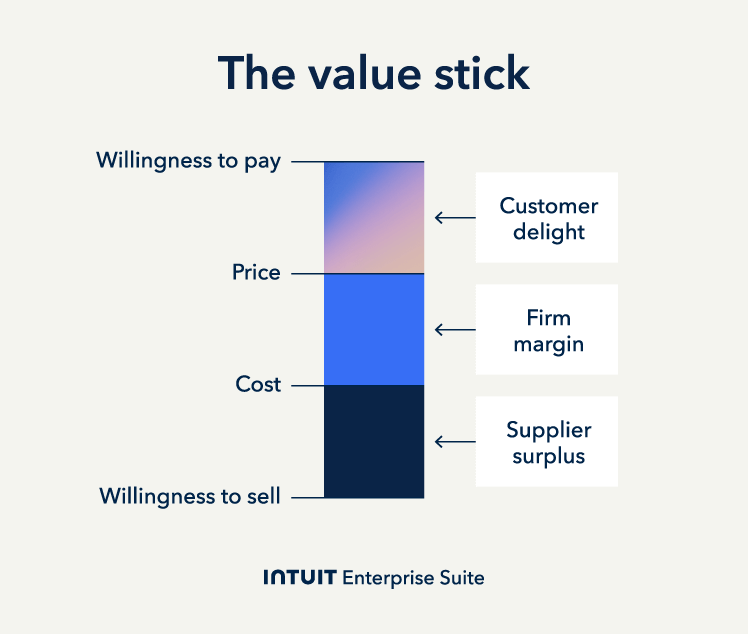

Accurate cost data helps establish your price floor and allows you to calculate your margin (Price - Cost, if you refer back to our value stick diagram above) for each transaction.

Intuit Enterprise Suite's job costing features enable businesses, particularly those project or service-based, to meticulously track all expenses tied to specific jobs or deliverables.

Cost elements you can track include:

- Direct material costs

- Actual labor hours and associated payroll expenses

- Fees paid to subcontractors

- Applied overhead based on your defined allocation methods

- Other expenses linked to specific jobs

With transparent data around these actual costs, you ensure that the value-based prices you set align with customer willingness to pay and guarantee profitability for your business.

Segment your customers effectively

Recognizing that customer segments perceive value differently and possess varying willingness to pay (WTP) is central to VBP. Intuit Enterprise Suite facilitates multi-dimensional tracking through features like class tracking and customizable fields. This allows you to categorize transactions according to relevant criteria and segment reporting.

Examples of valuable segments include:

- The specific industry or vertical your customer operates in

- The size of the customer's organization (like SMB vs. enterprise)

- The particular bundle of products or services the customer purchases

- The customer's geographic location or sales territory

- Key value drivers for the customer

- The channel through which the customer was acquired

Implement flexible, value-driven prices

Value-based pricing rarely involves a one-size-fits-all approach; it often necessitates implementing pricing tiers, customer-specific rates, or feature-based pricing models.

Intuit Enterprise Suite offers advanced pricing solutions that empower you to establish sophisticated pricing rules—some of which can even be automated.

Examples of pricing rules that support VBP implementation:

- Distinct pricing tiers tailored to different customer types, classes, or even individual customers

- Volume-based discounts that align with larger purchases increase the value for the customer

- Price adjustments based on specific product or service combinations, reflecting the added value of bundles

- Defined start and end dates for promotional pricing tied to specific value-driven offers

- Rules to override standard pricing based on particular job types or contractual agreements

Track key performance indicators (KPIs)

Adapting your pricing strategy as markets change is critical for VBP success. KPIs provide crucial insights into whether your pricing effectively captures value, maintains profitability, and resonates with customers (indicated by retention and satisfaction).

Intuit Enterprise Suite captures sales figures, cost data, customer information, and more—all of which can help track essential KPIs directly through customizable reports.

Relevant KPIs for evaluating your pricing strategy include:

- Gross Profit Margin analyzed by customer segment, product line, and individual customer

- Customer Lifetime Value (CLV) with comparison between high-value and low-value segments

- Average Revenue Per Customer (ARPC) broken down by segment

- Customer Retention and Churn Rate are indirect indicators of customer satisfaction and perceived value

- Trends in sales volume and revenue following the implementation of new pricing structures

Scale your strategy across multiple entities and complex operations

For larger businesses or those with multiple locations, divisions, or legal entities, a consistent and well-monitored VBP strategy is essential. Intuit Enterprise Suite is designed to handle the complexities and scale associated with such operations.

Tools you'll need for a business of that scale:

- The ability to manage financial data for multiple company files or utilize consolidation tools for a unified view

- A robust database infrastructure capable of efficiently processing large volumes of transactions

- Support for more concurrent users compared to more basic accounting software

- Features enable standardizing reporting and pricing rules across different operational units

- Advanced inventory management capabilities

Segment your total addressable market by specific needs, pain points, and the perceived value your offering delivers to each group. This granular understanding is key to a value-based pricing strategy.

Segment your total addressable market by specific needs, pain points, and the perceived value your offering delivers to each group. This granular understanding is key to a value-based pricing strategy.

Value-based pricing allows you to capture a greater share of the value you create. By focusing on your product's benefits, you can command premium prices that reflect its true worth to the customer.

Value-based pricing allows you to capture a greater share of the value you create. By focusing on your product's benefits, you can command premium prices that reflect its true worth to the customer.