4. Federal unemployment tax

Mandatory, employer-paid tax

Unemployment taxes are paid by employers to fund federal and state unemployment programs. These programs provide temporary financial assistance to workers who have lost their jobs through no fault of their own. At the federal level, the Federal Unemployment Tax Act (FUTA) dictates the tax, while state unemployment taxes (SUTA) vary by location.

Employers are responsible for paying FUTA tax and reporting it on Form 940.

According to the IRS, FUTA tax is 6% of the first $7,000 of each employee's wages. However, employers can receive a tax credit of up to 5.4% if they pay their SUTA taxes on time, reducing the effective FUTA tax rate to 0.6%.

SUTA tax rates and wage bases (the maximum amount of wages subject to tax) vary by state.

5. Wage garnishments

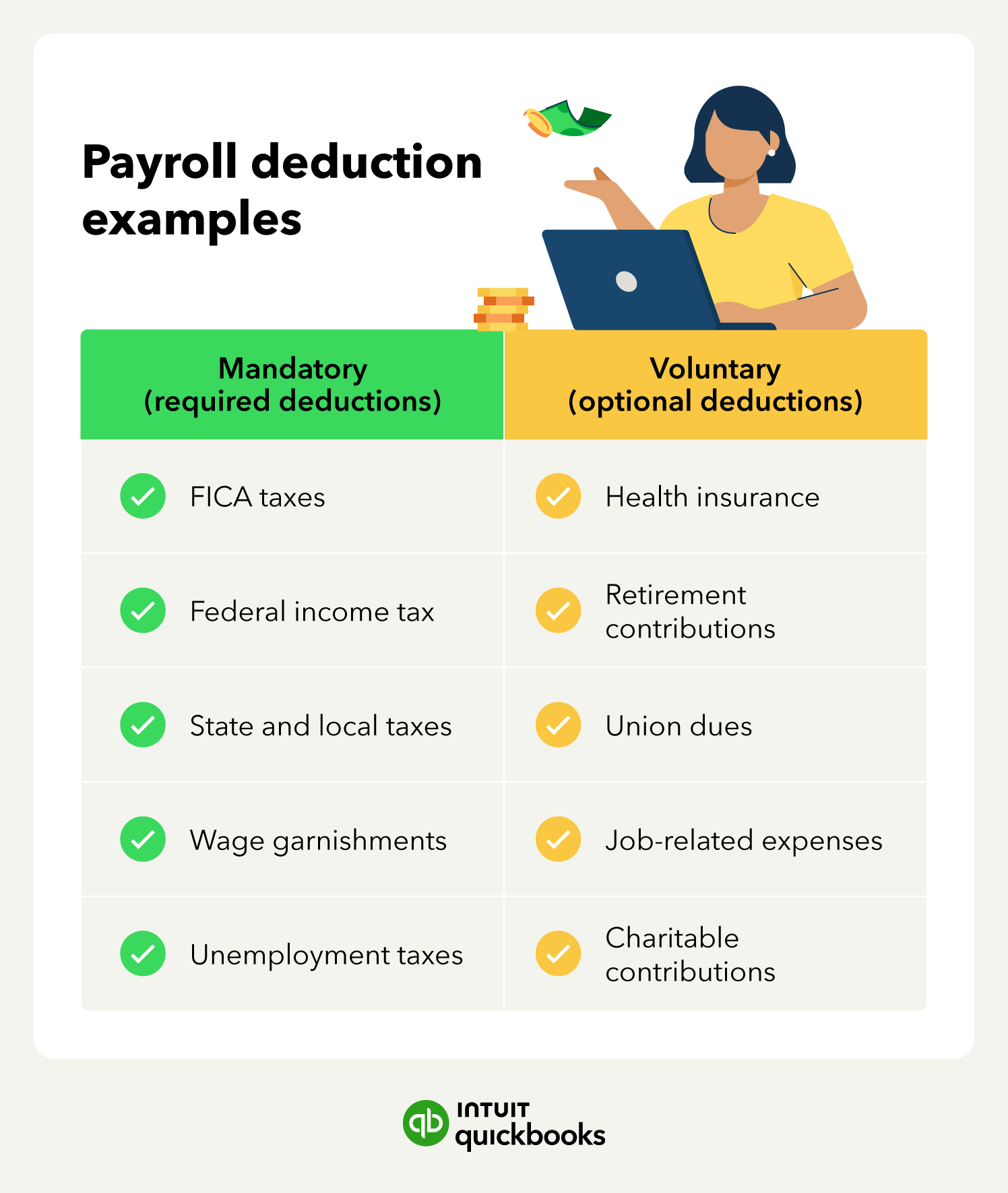

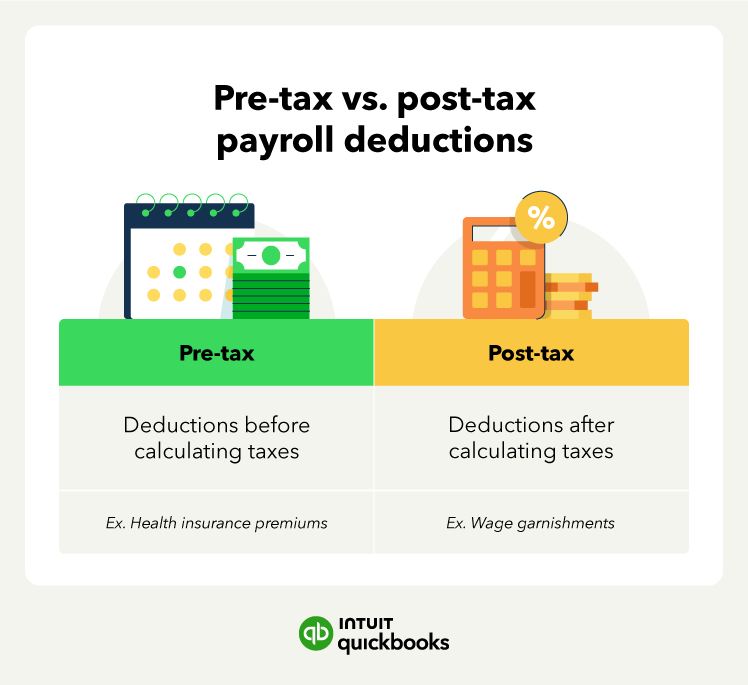

Mandatory, post-tax payroll deduction

Employees with unpaid debt or other obligations may have wage garnishments as payroll deductions. Wage garnishments are sent by a court or government agency like the IRS and require employers to withhold money from an employee’s paycheck.

The deductions are on a post-tax basis and usually go toward debts or obligations like:

- Taxes

- Alimony

- Child support

- Defaulted loans

The wage garnishment letter will explain how much of an employee’s paycheck has to be withheld and where the money has to be sent.

6. Paid Family and Medical Leave (PFML)

Mandatory, post-tax payroll deduction

Paid family and medical leave (PFML) is a mandatory benefit that allows employees to receive regular payments to make up for lost income when they are unable to work. For 2026, 13 states and the District of Columbia have enacted these programs.

Employees can use this leave for reasons such as their own serious illness, pregnancy, childbirth, adoption, or to provide care for a family member. Depending on your state’s laws, the employer may cover the full payroll tax. In some states, the cost is split between the employer and employee through a small paycheck deduction.

7. Health, disability, and life insurance

Voluntary, pre-tax payroll deduction

Health insurance and other premiums are voluntary payroll deductions that are typically made on a pre-tax basis. If you offer health benefits for your employees, you can have them pay part of their premiums via paycheck deductions. This also includes other health benefits, such as dental insurance or health savings plans.

8. Retirement plan contributions

Voluntary, pre-tax payroll deduction

As another employee perk, companies can offer retirement plans, such as a 401(k) plan that lets employees save for retirement. Employees can have a part of their paycheck withheld as a voluntary deduction and invested in their 401(k).

An employer can offer a few retirement plan options, and the type of retirement plan will determine whether it’s pre-tax or post-tax. For example, money put into a traditional 401(k) can be pre-tax, while money put into a Roth 401(k) must be post-tax.