How to calculate FUTA taxes

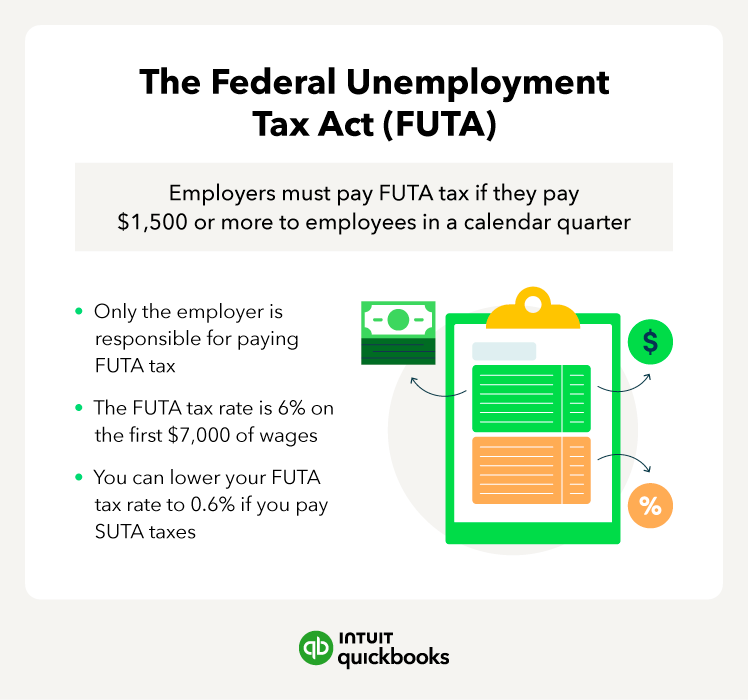

Calculating FUTA taxes is a straightforward process. If everyone at your company earns more than $7,000 per year, the basic equation for determining FUTA tax is as follows:

$7,000 x 0.06 x Number of employees = FUTA tax liability

For example, let’s say you run a company with 20 employees, each of whom earns $50,000 per year.

Since everyone makes over $7,000 per year—and FUTA tax only applies to the first $7,000—we can calculate your company’s FUTA payroll liability with the following formula:

$7,000 x 0.06 x 20 = $8,400

Your company’s FUTA tax liability is $8,400. Depending on the state your business is in, you may also owe state unemployment taxes and get a credit to lower your FUTA tax rate.

Your equation will differ if you have one or more employees who make less than $7,000.

Let’s say you run a company with 10 employees—eight employees earn $40,000, one earns $6,500, and one earns $4,000.

Here’s how to calculate your FUTA taxes if you have a mixture of employees making above and $7,000 a year:

- Calculate your liability for eight employees making over $7,000, which is $7,000 x 0.06 x 8 = $3,360.

- Calculate your liability for your employee making $6,500, which is $6,500 x 0.06 = $390.

- Calculate your liability for your employee making $4,000, which is $4,000 x 0.06 = $240.

- Add up each to get your total liability of $3,990.

Depending on the state your business or employees are in, you may also owe state unemployment taxes.

If your business operates in multiple states, you'll likely need to comply with the SUTA requirements in each state.

If your business operates in multiple states, you'll likely need to comply with the SUTA requirements in each state.