Much like a fingerprint, no two businesses are the same. No two companies will have the exact same expenses either. The good news is that the profit equation is fairly straightforward and only requires punching in some variables. The profit formula is:

Profit = revenue – expenses

Revenue is all the money you make from sales. Expenses are everything you spend, from supplies and materials to phone bills and rent.

Profit formula example

Business owners use the profit formula to see how much income they generate. For example, let’s say you have a boot store that generates $100,000 in annual revenue. Once you take out the cost of the leather, you have $80,000 (this is your gross profit).

Next, you take out your operating costs and other expenses, such as the salary of your part-time cashier, the rent, taxes, and utilities. This comes out to $35,000. Now take the $80,000 and subtract the $35,000. This leaves you with a profit of $45,000.

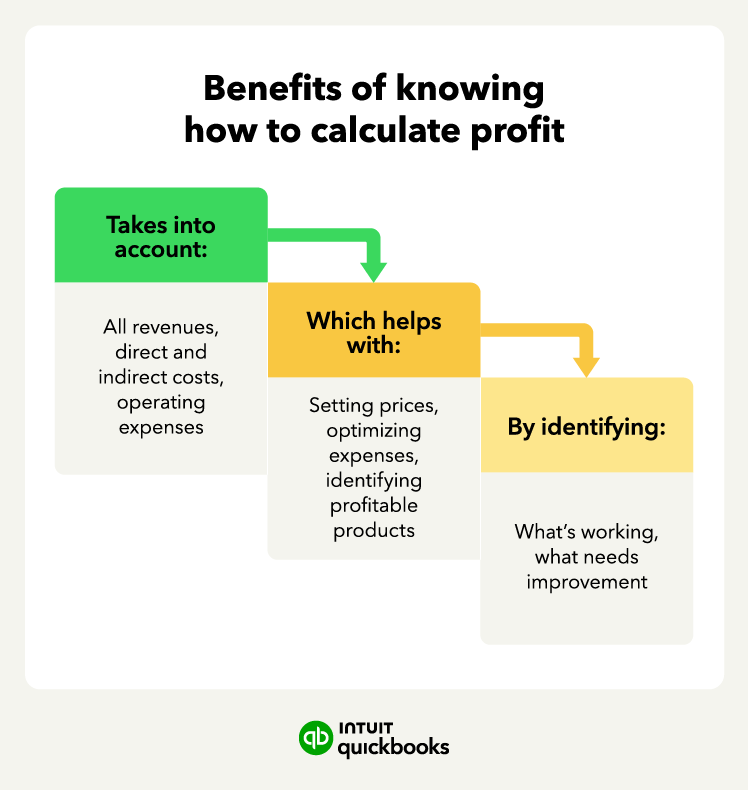

You can also use the equation for profit to look at the profitability of certain products. For example, your boot store may offer three different product types and find that, although overall company sales are steady, your leather boot sales have declined in recent months. After figuring out the profit for that particular product line, you may decide to discontinue the product.

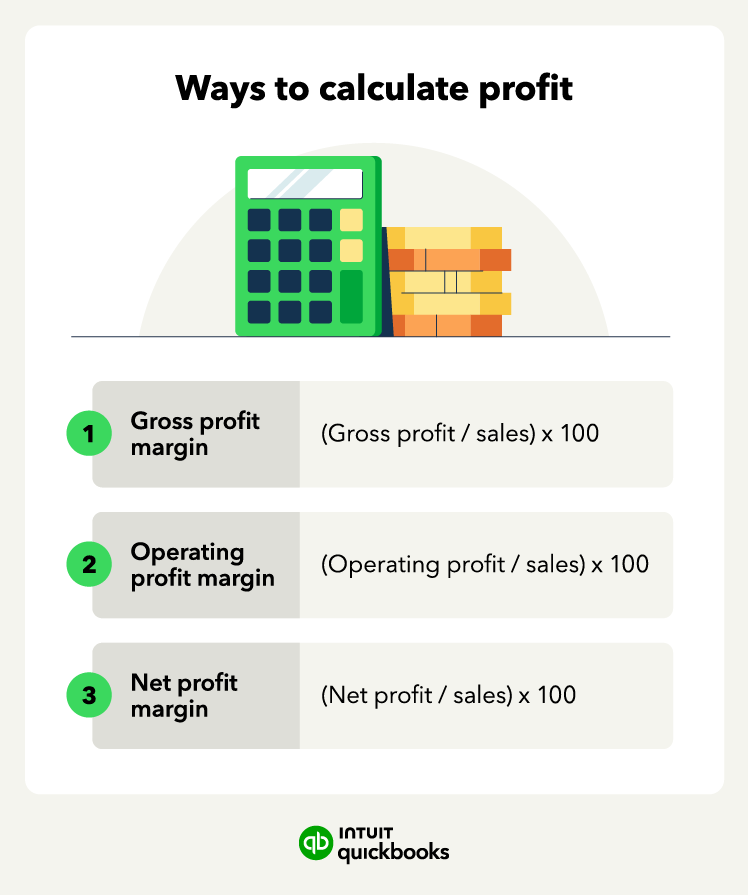

Once you have the profit formula down, you can use other profit formulas and financial KPIs to see how efficiently you use your resources.

Different types of profit formulas