Another December is upon us, probably sooner than we all expected. But we’re excited to have another full month’s worth of updates to share. It’s been a productive fall, and we hope you feel the same way.

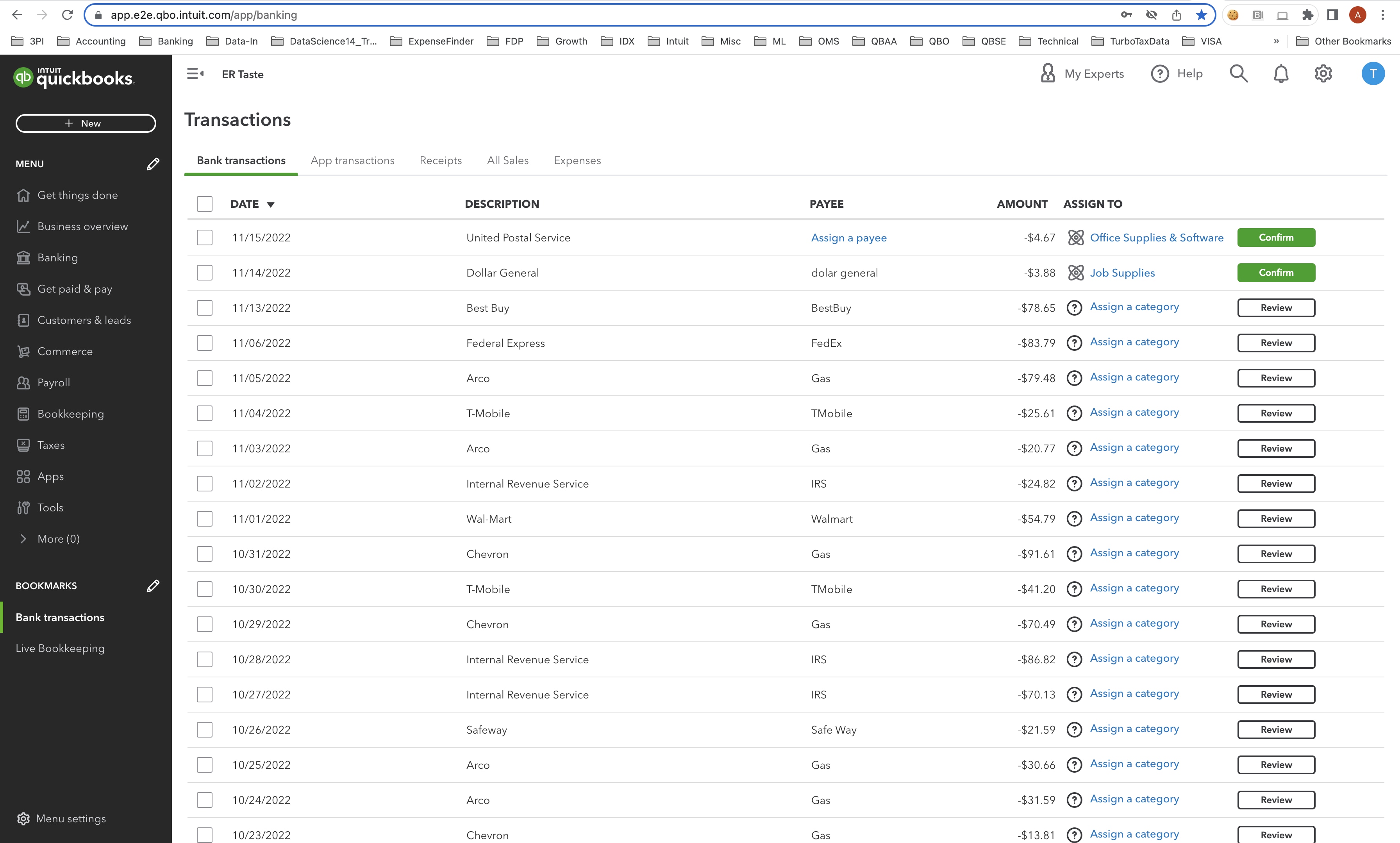

Updated auto-add rules lead to fewer duplicates

Now you can turn on auto-add rules with confidence and get fewer duplicates. After hearing feedback that using auto-add rules created duplicate transactions, we updated the way the feature works. We also changed the order in which the steps are automated, and were able to prevent tens of thousands of duplicates per week in our internal tests.

Turn on auto-add rules with confidence, knowing QuickBooks® will prevent duplicates by locating matches before auto-adding transactions.

Automatically apply payee info to your bank transactions

In a nutshell: QuickBooks now applies payee information to many bank transactions automatically, so you don’t have to.

Over time, experts have provided a lot of helpful information to our machine-learning model. That means QuickBooks is now able to add payee information to 30%+ of bank transactions automatically. So, rather than spending hours adding payee information to make transactions compliant and audit-proof, you can count on QuickBooks to save you time.