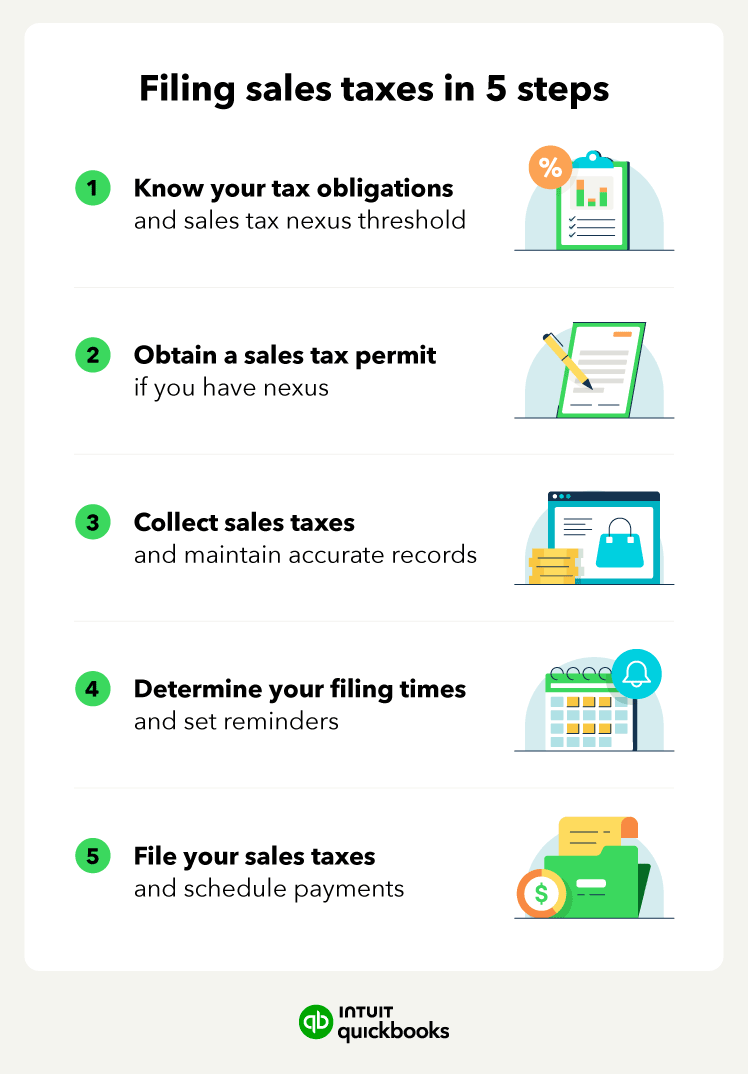

4. Determine filing frequency

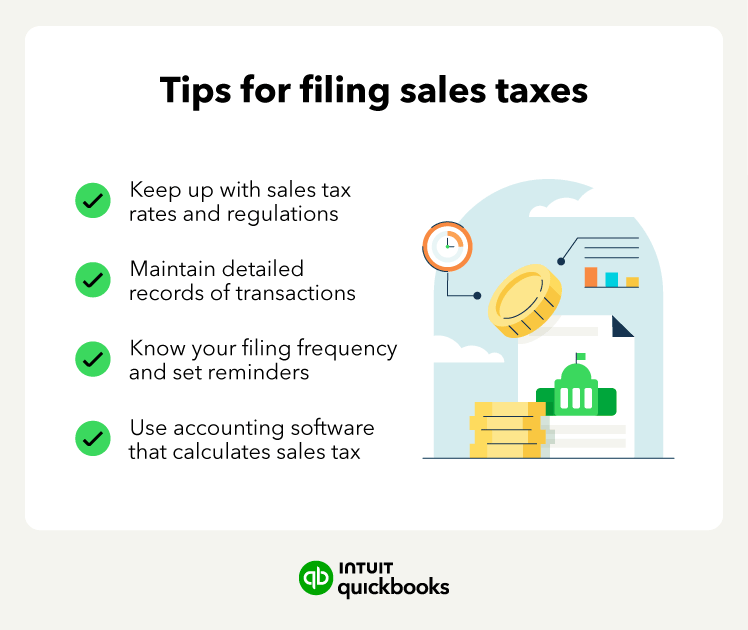

When you register your business to collect and report sales and use tax, the tax authority provides a notice to the business of the filing frequency per tax type, which may change depending on location.

The filing frequency defines when you must report and pay the tax authority. This frequency is usually based on revenue and often set to monthly, with tax due on or before the 20th of the month following the period reported.

For example, an October monthly return may be due on or before November 20. Some states have worked to unify their filing rules under the Streamlined Sales Tax (SST) and require monthly filing, but those filing rules only apply to certain sellers using automated calculation and filing software.

Some states, however, differentiate tax administration by tax types:

- Sales tax: Applies to Intra-state sales, which are sales occurring within a state

- Sellers use or vendors use tax: Applies to Inter-state sales, which are sales occurring between states

- Consumers use tax: Applies to purchases for which tax was not properly paid

Jurisdictions that make tax type distinctions typically require separate registration and reporting per tax type. Reporting for the correct tax types helps small businesses minimize out-of-pocket tax expenses.