According to a recent QuickBooks survey, 54% of respondents said they’re thinking about starting a new business in 2025. For many of these new entrepreneurs, one of the first decisions is how to manage their books: Stick with Excel, a familiar option, or upgrade to dedicated accounting software?

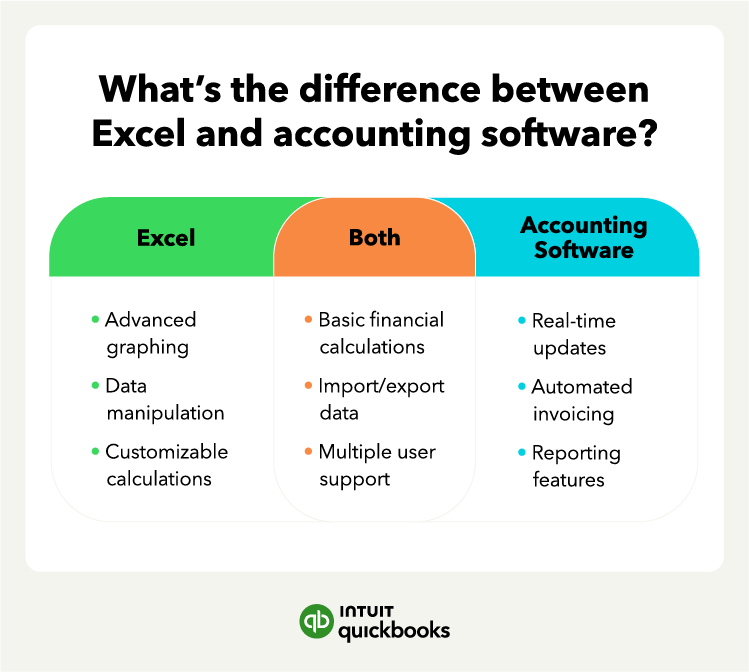

While both can handle financial data, the choice comes down to scalability, accuracy, and efficiency. Let’s explore the differences so you can make the right call for your business.

Jump to:

- 5 notable differences between Excel spreadsheets and accounting software

- Pros and cons of using Excel for accounting

- Pros and cons of accounting software

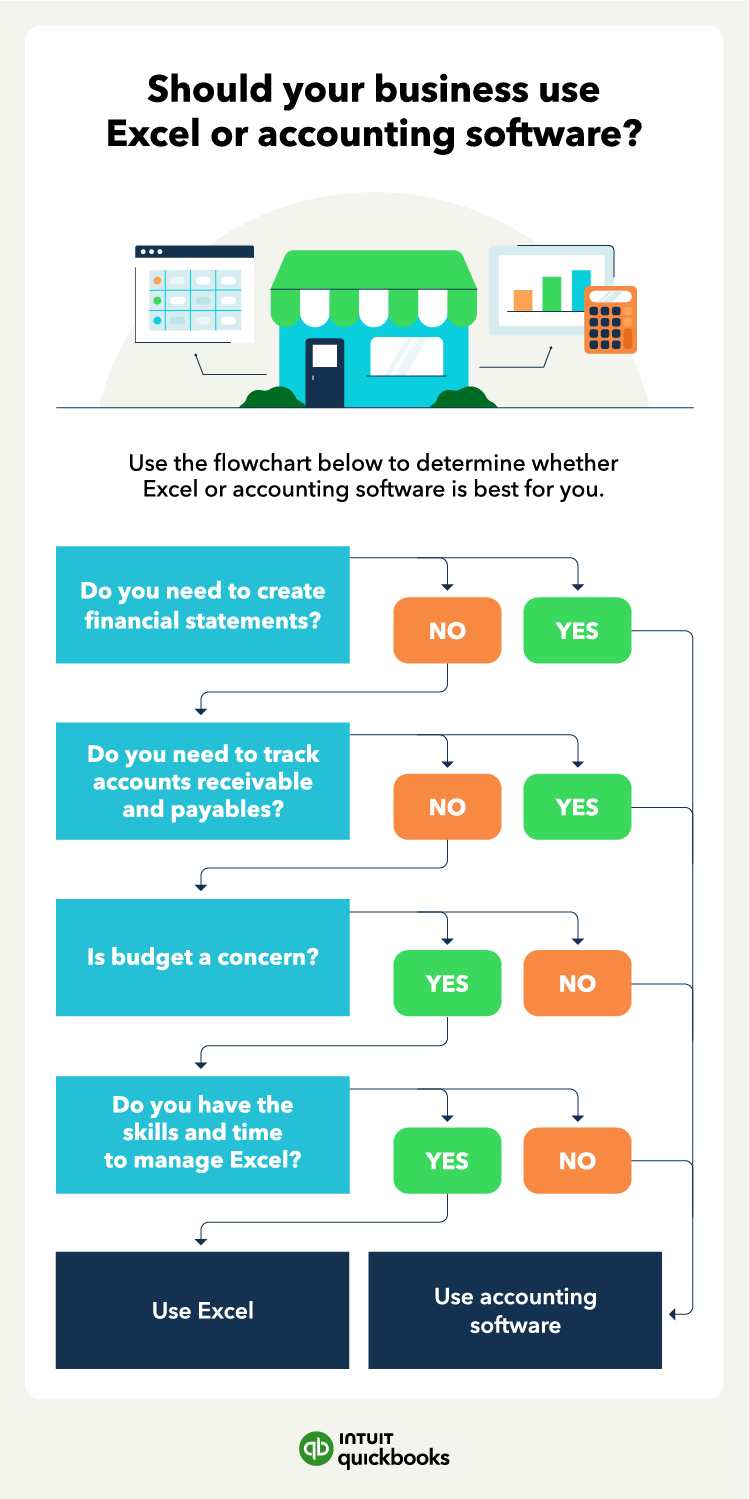

- How to choose between Excel and accounting software

- Common mistakes to avoid when using Excel or accounting software

- Streamline your accounting and save time