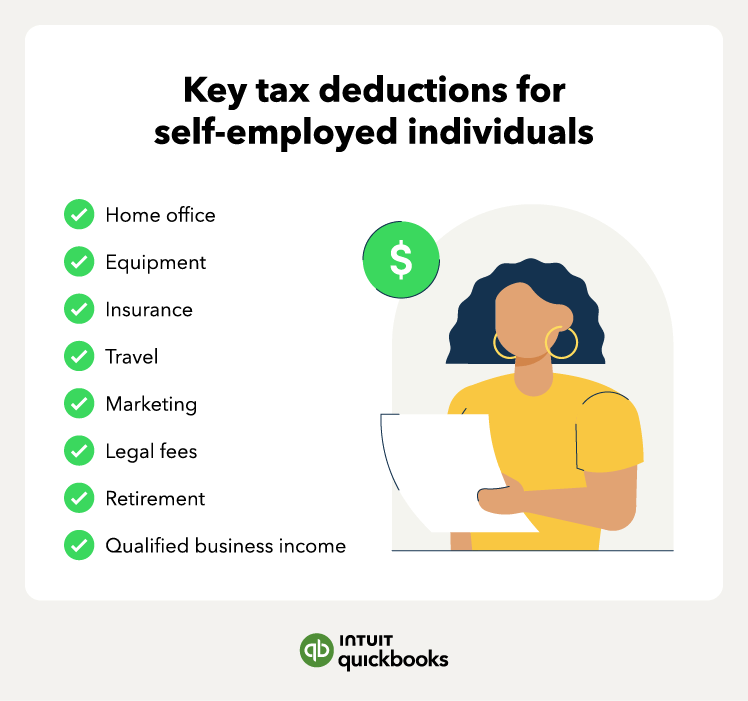

QBI deduction

As a sole proprietor, you may also qualify for the 20% qualified business income (QBI) deduction. This tax deduction allows taxpayers to deduct up to 20% of their qualified business income from their taxable income. The amount of the QBI deduction is your qualified business income times 20%.

Home office expenses

If you have a space in your home that you use just for your business, you may be able to deduct expenses for your home office. The home office deduction can include a portion of rent or mortgage interest, utilities, and even depreciation.

Self-employment taxes

You’ll need to pay quarterly self-employment taxes. These are the employer and employee portions of Social Security and Medicare taxes. However, you can deduct the employer portion from your tax liability.

Health insurance premiums

Sole proprietors who pay for their health insurance premiums may be eligible for a deduction. Deducting health insurance for self-employed individuals includes premiums for medical and dental. Keep in mind that there are certain criteria to qualify for this deduction.

Retirement contributions

As a sole proprietor, you have several options for saving for retirement and reducing your tax burden. Here are a few to consider:

- SEP IRA: A simple plan with high contribution limits. You may contribute up to 25% of net earnings (or the plan’s defined compensation basis) capped at approximately $72,000 for 2026. It’s tax-deductible and easy to set up but offers less flexibility and may not suit you if you plan to hire employees.

- SIMPLE IRA: This allows both employee and employer contributions. For 2026 the employee deferral limit is projected at $17,000 (up from $16,500 in 2025). It’s easy to administer, but the limits are lower than a SEP and you may be required to make matching contributions if you have employees.

- Solo 401(k): Specifically designed for business owners with no employees (other than a spouse). For 2026, the combined (employee + employer) contribution limit is projected at $72,000 (not including catch-up contributions for those age 50+). It offers flexibility (including Roth and traditional options) but can be more complex to administer.

- Other qualified plans: You can explore other options like defined benefit plans, but be aware that they often have higher administrative costs.

SEP IRA: A simple plan with high contribution limits — you may contribute up to 25% of net earnings (or the plan’s defined compensation basis) capped at approximately $72,000 for 2026. It’s tax-deductible and easy to set up but offers less flexibility and may not suit you if you plan to hire employees.

SIMPLE IRA: This allows both employee and employer contributions. For 2026 the employee deferral limit is projected at $17,000 (up from $16,500 in 2025). It’s easy to administer, but the limits are lower than a SEP and you may be required to make matching contributions if you have employees.

Solo 401(k): Specifically designed for business owners with no employees (other than a spouse). For 2026, the combined (employee + employer) contribution limit is projected at $72,000 (not including catch-up contributions for those age 50+). It offers flexibility (including Roth and traditional options) but can be more complex to administer.