Freelancing offers you flexibility, but it also brings tax complexities. In fact, only 48% of small business owners say they’re confident they’re paying taxes correctly. The good news? Taking advantage of freelancer-specific tax deductions—from home office costs to retirement contributions—can help ease that stress and maximize your savings.

Below, we'll walk you through 23 (plus one bonus) freelancer deductions for the 2026 tax season, plus tips to make the most of them.

18. Health savings account (HSA) contributions

22. The 20% self-employment deduction (Qualified Business Income Deduction)

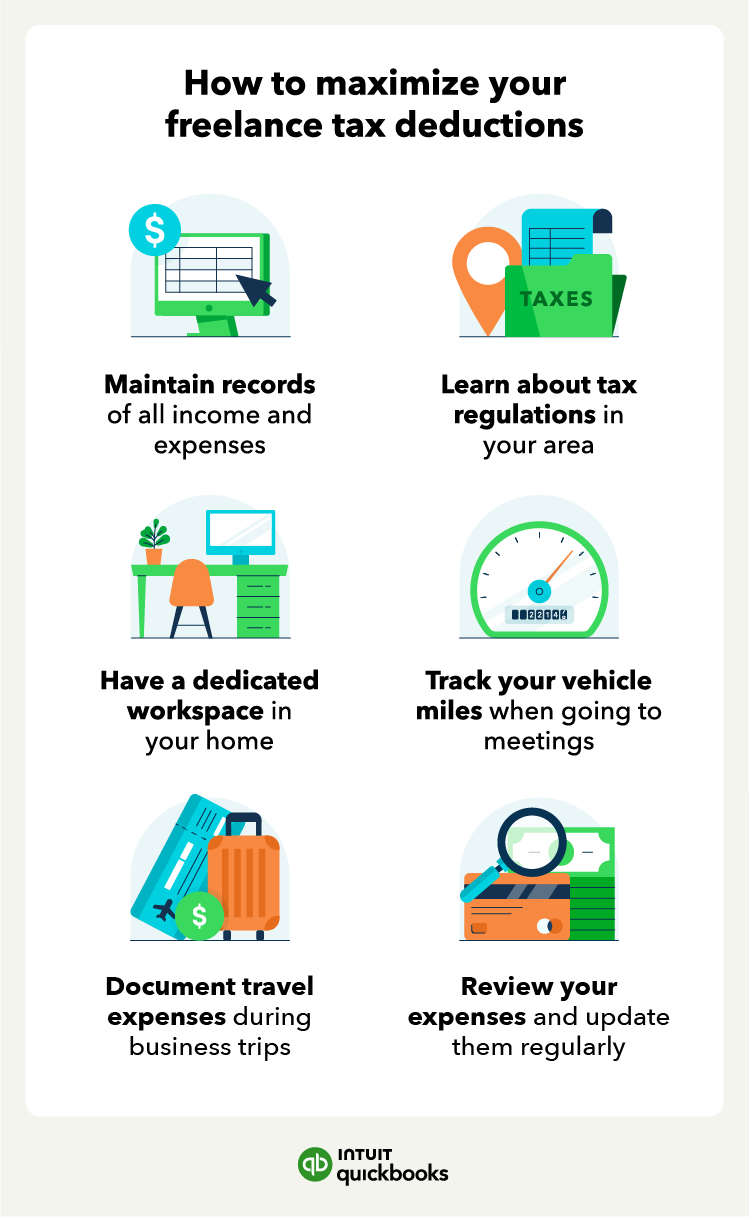

How to claim tax deductions as a freelancer

To qualify for this freelance tax deduction, the costs must add value to your work and improve any necessary skills.

To qualify for this freelance tax deduction, the costs must add value to your work and improve any necessary skills.

Freelancers pay both income tax and

Freelancers pay both income tax and