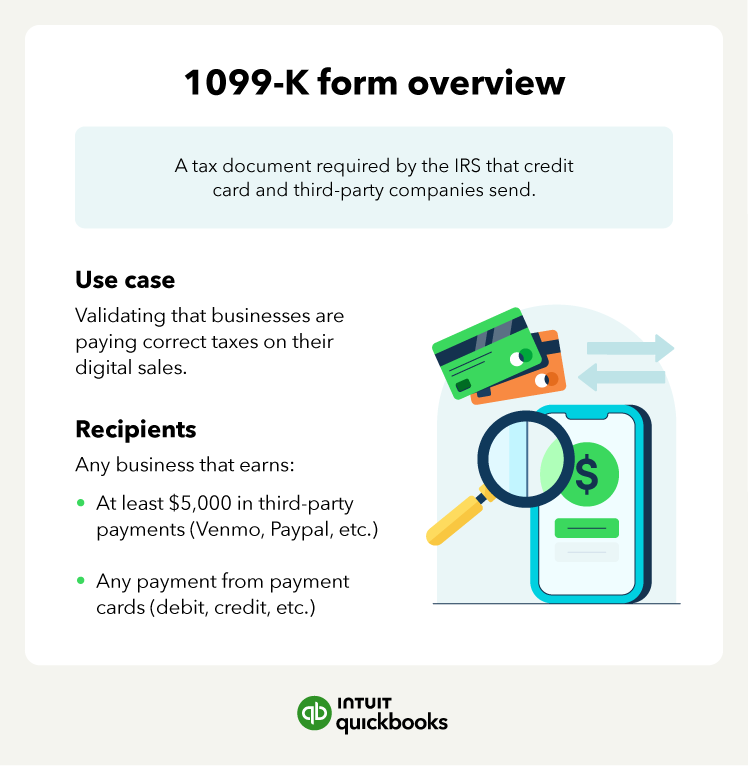

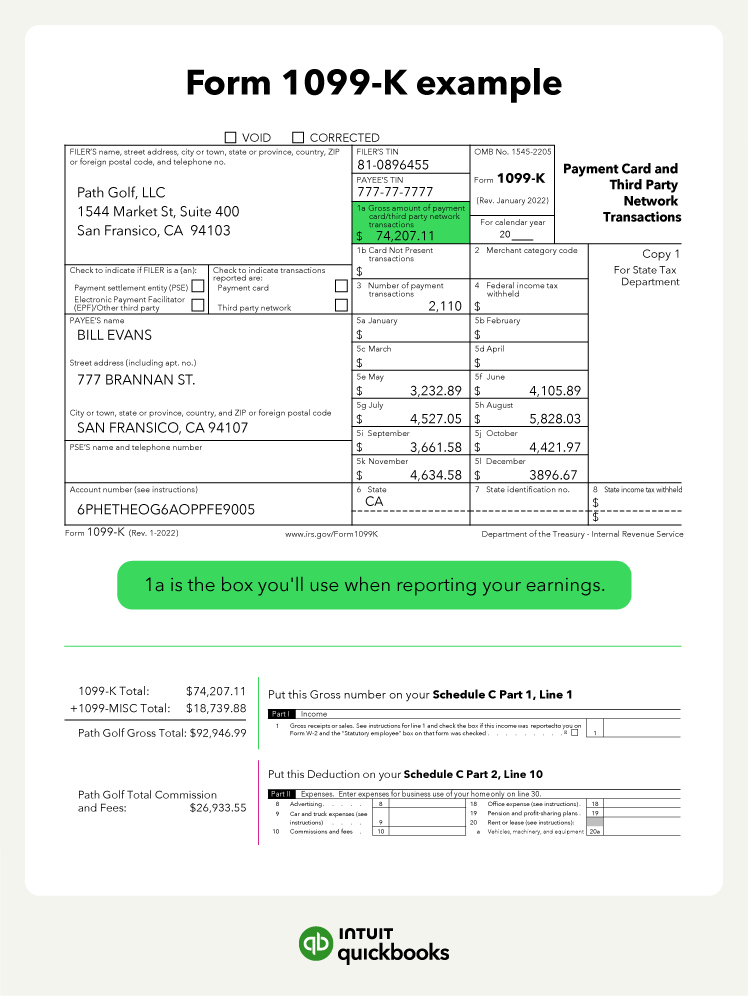

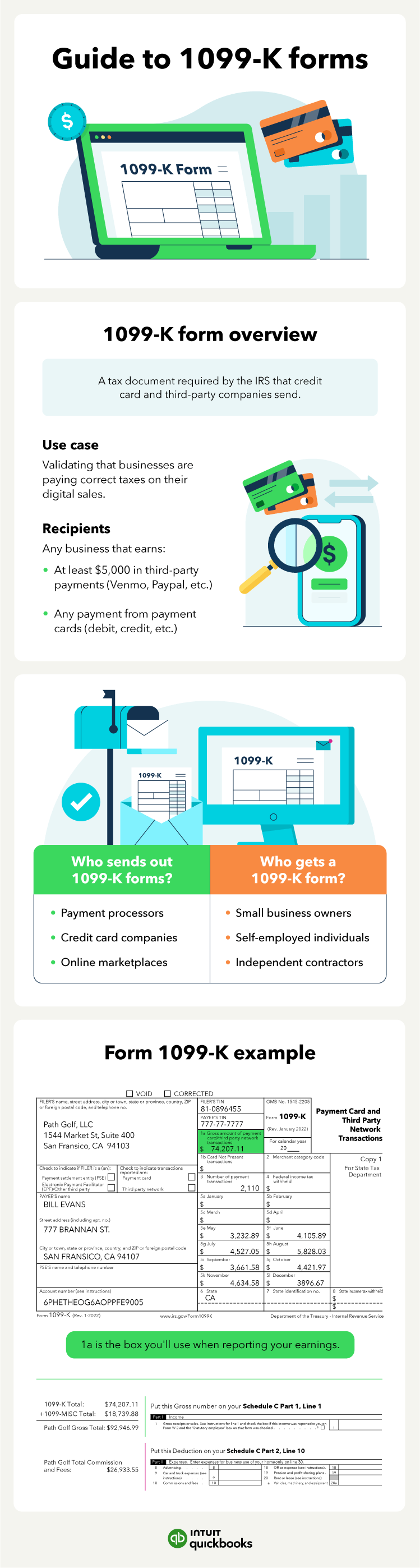

As a small business owner, you're likely familiar with the mountain of tax paperwork that comes with the territory, from issuing W-2 Forms to your employees or gathering your income and expenses for your tax return. One other form you might encounter is Form 1099-K, which reports certain payment transactions.

In the past, you only received a 1099-K if you had over $20,000 in online transactions. Now, the threshold is just $5,000. This means many more businesses and individuals will receive a 1099-K for their 2024 earnings. Since each company you transact with sends its own 1099-K, you could receive multiple forms.

Let's explore what Form 1099-K is, why you're receiving it, and what you need to do.

Jump to: