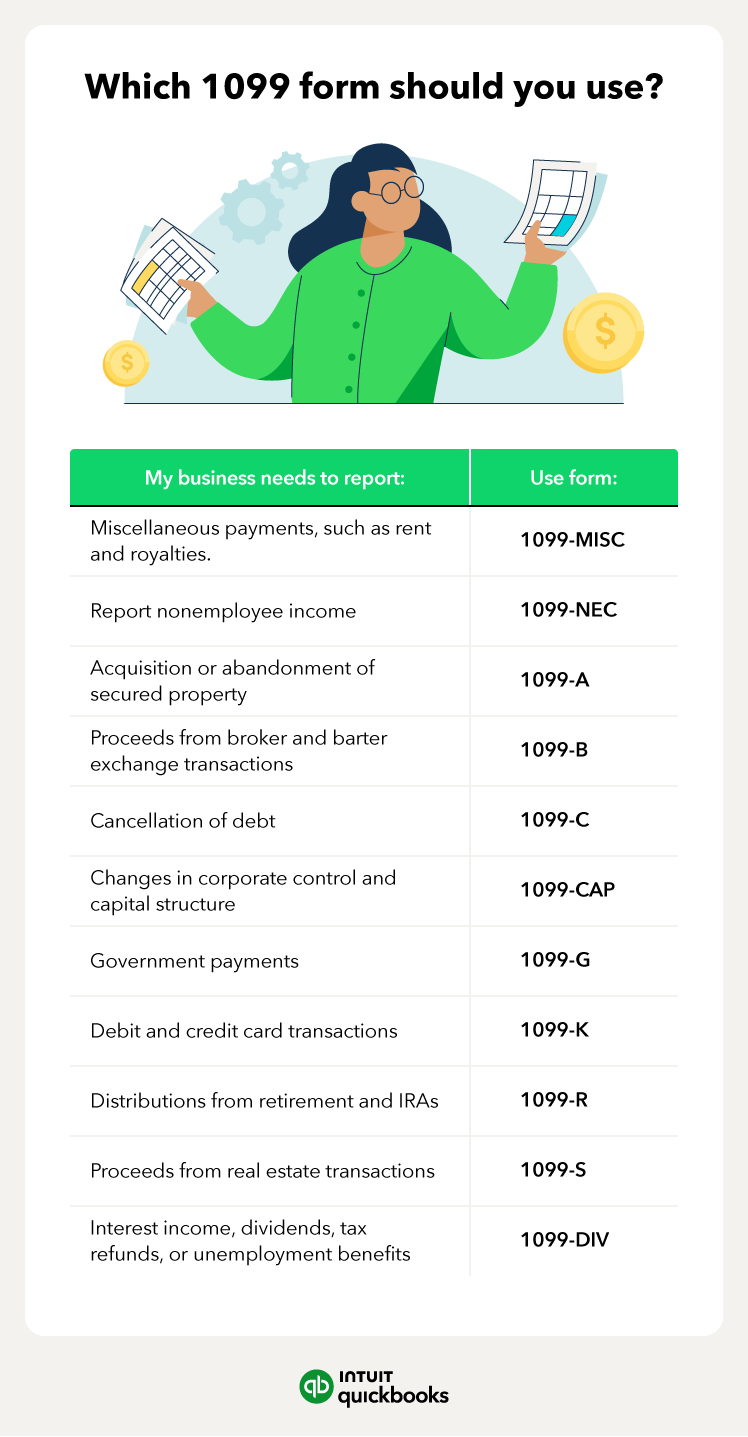

Here are some of the different types of 1099 forms and when you should use them:

1099-MISC

Form 1099-MISC is used to report miscellaneous payments such as rent, awards, royalties, medical and health care payments, and more. Anyone who has paid at least $600 in one of these categories in the past year will typically use a 1099-MISC form.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

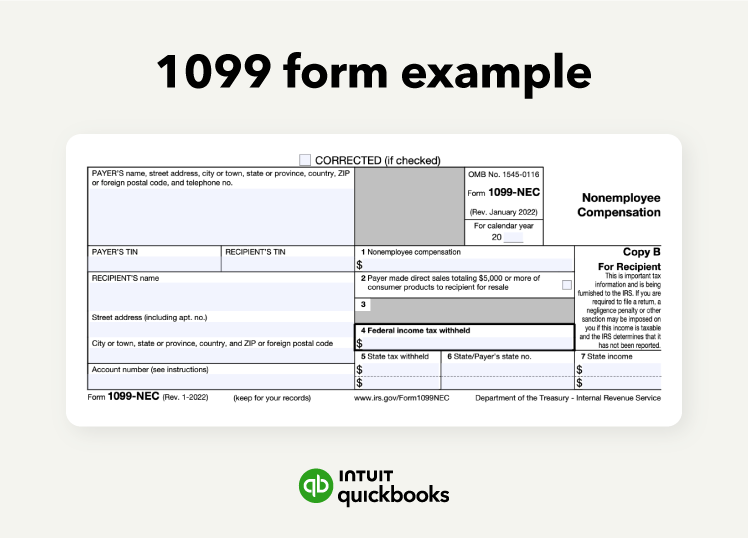

1099-NEC

Form 1099-NEC reports nonemployee income. Independent contractors used Form 1099-MISC in prior years but use the 1099-NEC for tax years 2020 and beyond. You will only need a 1099-NEC for payments totaling $600 or more for the calendar year.

Due to recipient: Jan 31

Due to IRS: Jan 31

1099-A

Form 1099-A reports the acquisition or abandonment of secured property (foreclosure). Lenders typically use this form after transferring a property due to foreclosure.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

1099-B

Form 1099-B reports proceeds from broker and barter exchange transactions. Brokers use this form to report the sale of stocks, securities, and the like. Brokers must submit a 1099-B to each individual to report gains or losses from transactions.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

1099-C

Form 1099-C is for the cancellation of debt. A debtor sends this form to the individual with a canceled debt. This is used for credit card debt forgiveness because the IRS often considers canceled debt taxable income.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

1099-CAP

Form 1099-CAP reports changes in corporate control and capital structure. Businesses issue this form to shareholders who receive cash, stock, etc. from substantial structural changes or acquisitions.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

1099-G

Form 1099-G is for certain government payments. Government agencies use this form to report income paid to taxpayers—typically tax refunds and unemployment.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

1099-K

Form 1099-K reports digital payments and withdrawals through credit cards and third-party payment processors. It reports a total gross income of more than $5,000 for tax year 2024 from debit and credit cards when using online marketplaces and payment apps.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

1099-R

Form 1099-R is for distributions from retirement or IRAs. This form is used for withdrawals from an individual retirement account. You may also use it to report distributions from pension plans, profit-sharing, and annuities.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

1099-S

Form 1099-S is for proceeds from real estate transactions. This form is used to report income from the sale or exchange of real estate, and you may also use it for income from certain royalty payments.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

1099-DIV

Form 1099-DIV is used to reference any interest income, dividends, tax refunds, or unemployment benefits paid out by banks or other financial institutions.

Due to recipient: Jan 31

Due to IRS: By mail: Feb 28. Electronically: March 31.

To comply with

To comply with