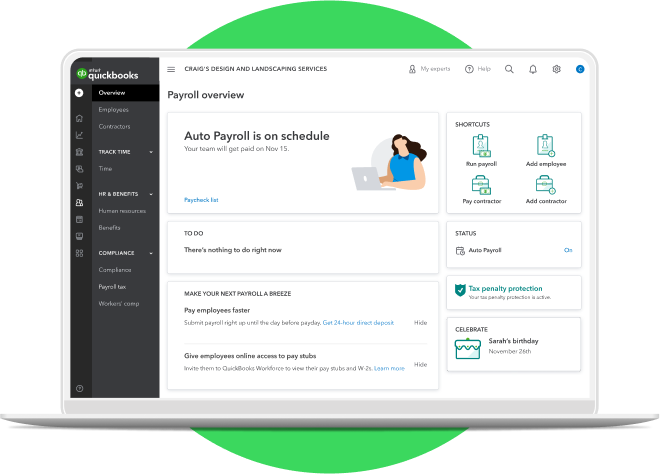

Manage payroll and access tools and services in one place

Expert setup and review

QuickBooks experts can review or complete your payroll setup for you.**

Payroll taxes made easy

We’ll calculate, file, and pay your federal and state payroll taxes automatically.**

Accuracy and compliance

Get built-in employee time tracking to help ensure paycheck accuracy.**

Free direct deposit

Keep cash longer with free direct deposit. Employees are paid quickly every time.**

U.S.-based support

Payroll support experts are available via phone or chat to answer all your payroll product questions.**

Tax penalty protection

We’ll pay up to $25,000 if you receive a payroll tax penalty from an error made while using Payroll Elite.**

Powerful payroll reports

Take a closer look at your business finances with powerful payroll reports.

Auto Payroll

Free up valuable time and set your payroll to run automatically.**

Pick the plan that’s right for you

Payroll Core

Pay your team and get payroll taxes done for you. Time not included.

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Next-day direct deposit

Offer fast direct deposit for your team.

Expert product support

Get step-by-step help, troubleshooting assistance, tips, and resources via phone or chat.**

Take care of your team

Employee portal

Your team can access their pay stubs and W-2s and enter their personal, direct deposit, and tax info online or in app.**

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by Allstate Health Solutions.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**

Workers’ comp administration

Save money and get coverage for on-the-job injuries with a policy by AP Intego.**

Payroll Elite

Access on-demand experts and tax protection. Includes Time Elite.

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Same-day direct deposit

Pay employees faster, for free. Submit payroll up to the morning of payday.

24/7 expert product support

Get troubleshooting assistance, tips, and resources from payroll support experts by phone, chat, or video.**

Expert setup

A payroll expert will complete your setup for you.**

Tax penalty protection

We’ll pay up to $25,000 if you receive a payroll tax penalty.**

Personal HR advisor

Get professional help on critical HR issues and custom handbooks and policies, powered by Mineral, Inc.**

Take care of your team

Employee portal

Your team can access their pay stubs and W-2s and enter their personal, direct deposit, and tax info online or in app.**

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by Allstate Health Solutions.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**

Workers’ comp administration

Save money and get coverage for on-the-job injuries with a policy by AP Intego.**

HR support center

Mineral Inc offers customized job descriptions and best practices on everything from hiring to performance.**

Track your team’s time

Includes Time Elite

Combine project management with time tracking for more insights into how your team is working.

Track projects and time

Mobile app with GPS

See who’s working

Geofencing

Project management tools