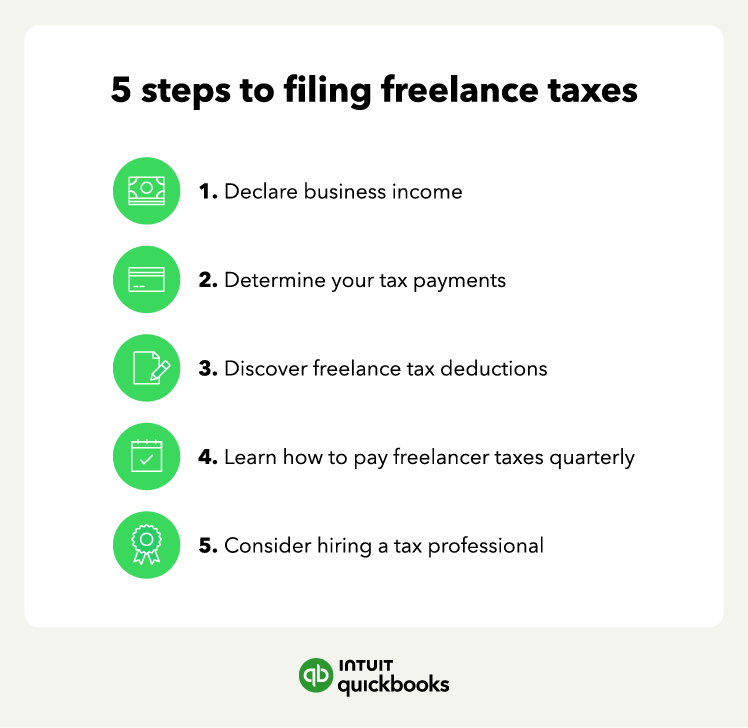

2. Determine your tax payments

To succeed as a freelancer, you have to be proactive. Just like you have to take the initiative to find work, you need that same mindset to plan ahead for filing small business taxes—like income tax and self-employment tax.

Income tax

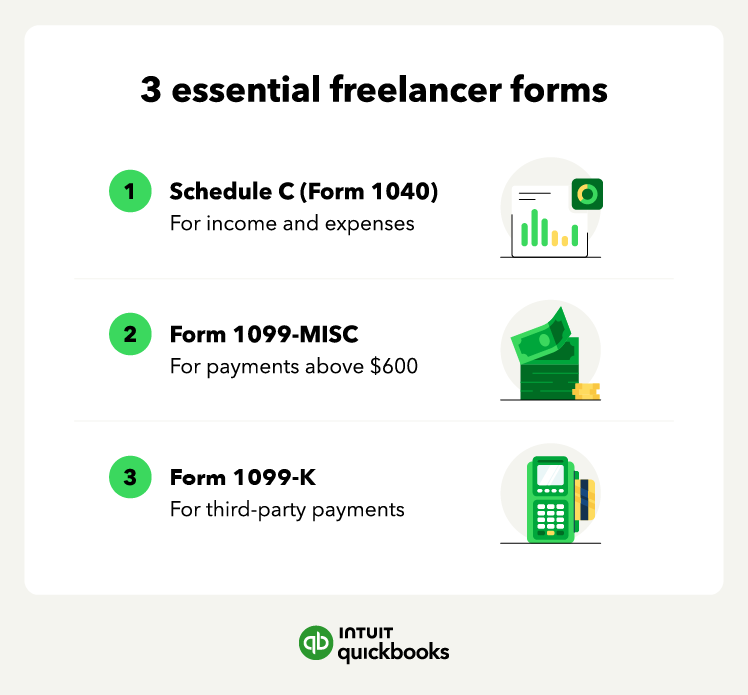

You’re responsible for reporting business income and expenses in a Schedule C and deducting allowable expenses on your tax return. The record of your profits and losses will determine the amount of income tax you’re responsible for paying. Meticulously track your earnings and deductible expenses throughout the year to ensure accurate reporting, which you can streamline with accounting software.

Self-Employment Tax

Employers withhold each employee’s share of FICA and Medicare taxes from gross pay. Freelancers, on the other hand, must pay those taxes using Schedule SE (Self-Employment Tax). Currently, freelancers pay a 15.3% tax rate for FICA and Medicare taxes, with one-half of those taxes posted as a deduction from taxable income on Form 1040.

Tax liability

Planning ahead also helps you avoid paying penalties, fees, and interest on your tax underpayments. Accurately estimate your tax obligations, make timely estimated tax payments, and maintain thorough records of your income and expenses throughout the year. Proactively managing tax obligations can help you avoid costly penalties and ensure compliance with tax regulations.