Cash flow analysis

Cash flow issues arise when business owners misinterpret profit as cash flow. It’s easy to think that the key to positive cash flow is more sales, but that’s not always the case.

Cash flow can be challenging because income is sporadic, but expenses are recurring. Here’s a simple three-step process for working through an analysis of your cash flow.

1. Create a cash flow statement

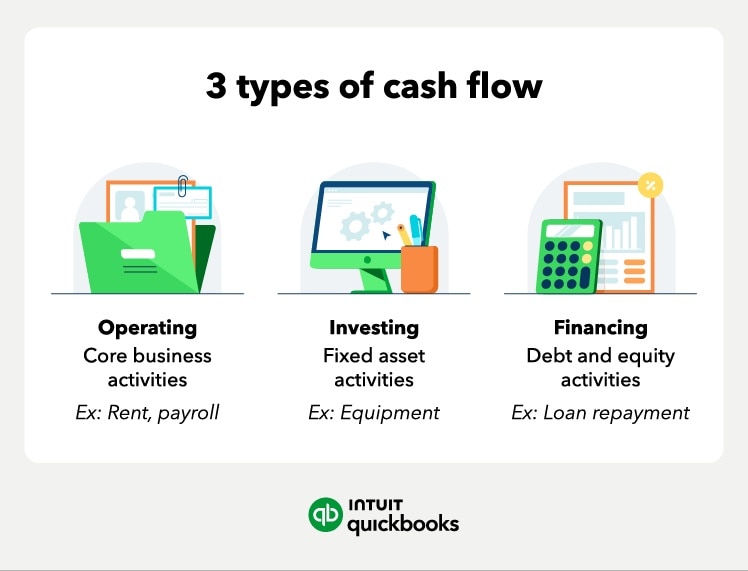

Creating a cash flow statement is easy to generate from your accounting software, if you use it. Or you'll want to compile your income statement and balance sheet. Then use those to calculate your operating, investing, and financing cash flows.

2. Analyze your cash flows

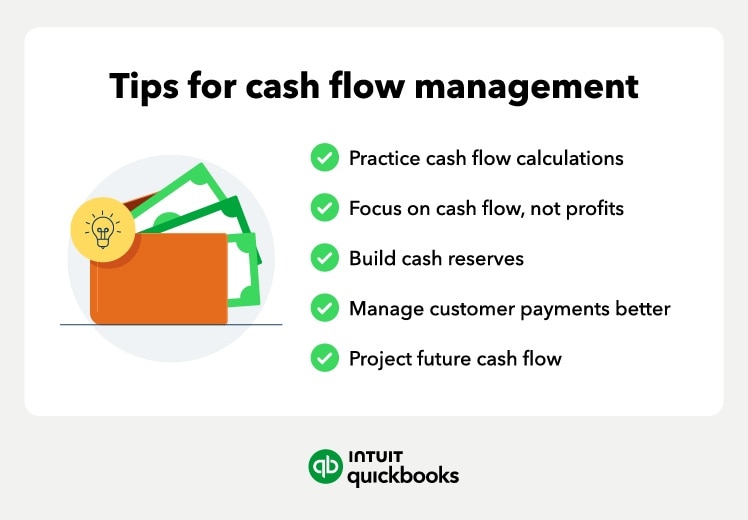

The second step involves looking at your cash flow and identifying trends. Make sure there’s more money coming in than going out, but look for ways to improve those inflows.

Find where the bulk of your cash is going, which could be loan payments or inventory. This could mean you need to refinance debt. Or better manage inventory.

Then see how you can get cash faster. Look at long it takes your average customer to pay if you’re billing them.

A cash flow analysis will provide an accurate view of your business’s finances. From there, you can make smarter budgeting decisions.

Free cash flow

Free cash flow is a helpful metric for analyzing cash flows. It’s the operating cash flow a company generates minus capital expenditures. Capital expenditures (CapEx) is the money you invest in your fixed assets over a period, plus the depreciation expense.

Free cash flow = operating cash flow - capital expenditures

Think of free cash flow as the money a business makes from operations after investing in fixed assets. Free cash flow helps assess your ability to repay debt or pay dividends.

3. Set cash flow goals

Now that you know the major issues, you can address them a bit easier. That means making sure your cash flow aligns with your near-term goals.

These goals can include reducing the time it takes to collect money from customers. Or bringing in additional cash by selling unused assets.

QuickBooks helps small businesses manage finances with automated cash flow analysis reports. Such tools can free up time for owners to focus on growth. Explore how QuickBooks’ cash flow tools can help you forecast the money you’ll have coming in and going out of your business.