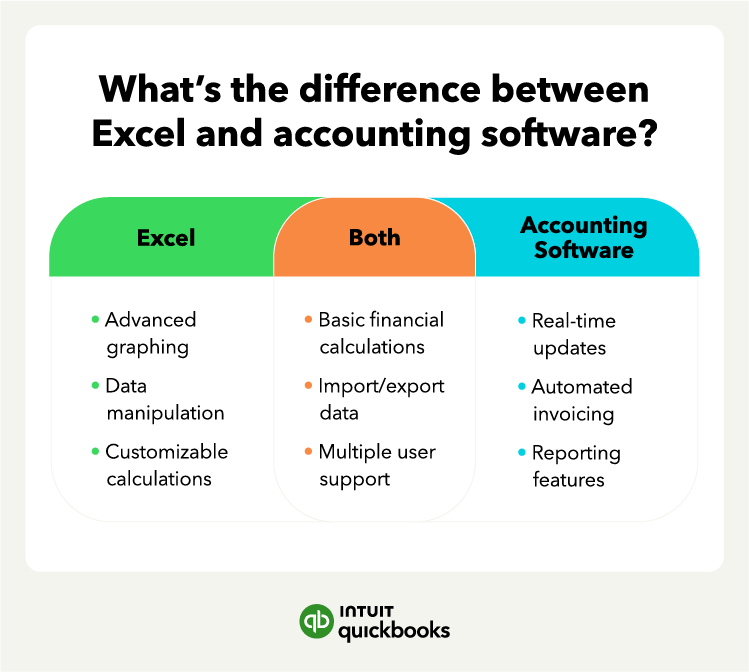

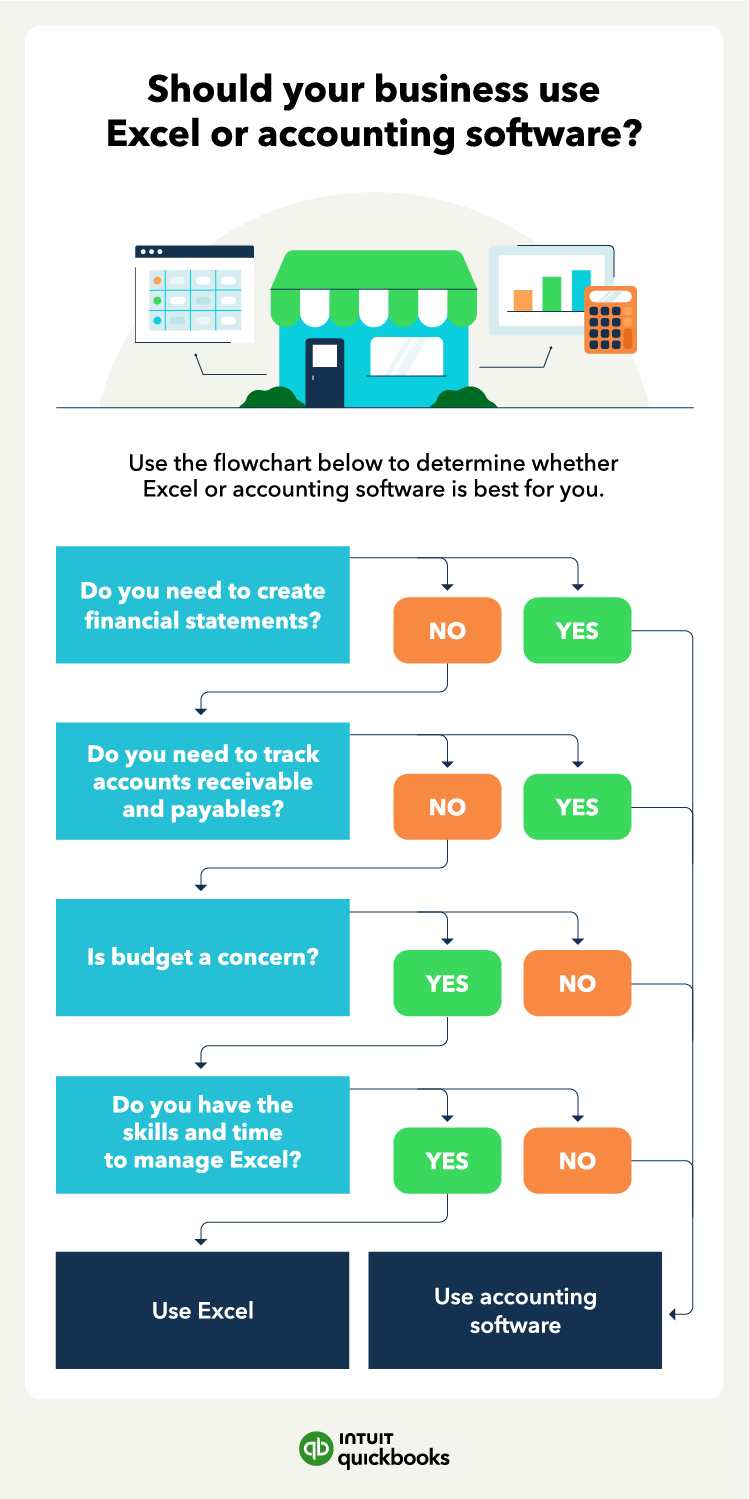

Business owners looking to manage financial data tend to embrace two primary options: Excel spreadsheets and accounting software. While both options may seem similar on the surface, some key differences set them apart. Here are five notable differences between Excel spreadsheets and accounting software:

1. Features

Winner: Accounting software

When choosing between Excel and accounting software, one of the most important considerations is the features each option offers. While you can use both tools for financial management, accounting software exists specifically to meet the needs and requirements of businesses of all sizes.

One key benefit of accounting software is its accounting-specific features, such as:

Excel, on the other hand, is a general-purpose tool you can customize to meet your specific accounting needs. However, it may be more time-consuming to set up and may not offer the same level of depth as accounting software in terms of integrated features.

Nonetheless, Excel accounting spreadsheets still offer several accounting-specific features that can be useful for businesses, such as the ability to create pivot tables and graphical reports.

2. Usability

Winner: Accounting software

Ease of use is a crucial factor when choosing between Excel and accounting software. Excel is a general-purpose tool capable of performing complex calculations, but it may require some technical familiarity to use effectively.

Meanwhile, accounting software focuses on user-friendliness and targets both novices and professionals in the accounting field. Accounting software's intuitive interfaces and helpful resources should make financial management seamless.

For instance, accounting software's straightforward dashboards allow users to recognize their financial position in real-time, providing overall visibility and data that can inform business decisions.

Excel is a versatile tool, but using it for accounting purposes can be challenging for some users. Accounting software is user-friendly, with intuitive interfaces and helpful tools that make financial management easier.

3. Integrations

Winner: Accounting software

For business owners, integrations can significantly improve productivity and efficiency by streamlining workflows and cutting down on manual data entry errors.

In accounting, integrations are critical to ensuring that all financial records and data are accurate.

Most accounting software systems offer integrations with other business applications, such as:

- Inventory management software

- Payment processors

- Customer relationship management tools

- Tax preparation services

These integrations allow businesses to automate the transfer of information between different systems, reducing the need for manual data entry and eliminating the possibility of human error in the process. On the other hand, Excel doesn’t offer such integrations.

Similar to the fact that Excel accounting requires a lot of manual labor, it also does not integrate well with your other financial apps, like credit cards and bank accounts.

Your credit card and bank companies may allow you to download your statements in a spreadsheet format, but you’ll still have to import and organize all of this data into your existing accounting spreadsheet. Again, this takes a lot of time and exposes you to risk.

4. Pricing

Winner: Excel

One of the most significant factors when picking accounting software is pricing. Businesses need to find a solution that fits their budget. When comparing accounting software pricing, businesses should look at the upfront costs and the ongoing fees.

Many software systems charge a one-time fee for installation or setup, while others have a monthly or yearly subscription fee. It's essential to determine which pricing model works best for the business and includes all the necessary features and functions.

Meanwhile, Excel tends to be cheaper than many accounting systems. But the cost of a tool like Excel has nothing to do with the sticker price. It’s all about how much time it requires to manage. Unfortunately, Excel involves a lot of working hours.

You’ll need to enter every business expense by hand. If you practice double-entry bookkeeping, you’ll need to enter every transaction twice. That’s double the manual data entry.

This means that everything from expense reports to the chart of accounts requires manual entry. Not only does this take time, but it also increases the risk of error. Just how much does this cost small businesses?

5. Accuracy

Winner: Accounting software

Accuracy is crucial in accounting. Manual data entry is one of the main culprits of accounting errors. Accounting software removes the need for manual data entry by automating processes such as bank statement reconciliations and invoice tracking.

Meanwhile, spreadsheet errors can have a waterfall effect. Mess up one input with an incorrect digit or a misplaced comma or decimal point, and your spreadsheet will use that to miscalculate other computations.

For example, a small spreadsheet error cost Canadian power generator TransAlta $24 million in 2003. According to The Register, CEO Steve Snyder said the mistake was “literally a cut-and-paste error in an Excel spreadsheet.”

Pros and cons of using Excel for accounting