Accounting software is a suite of programs designed to help businesses automate bookkeeping and accounting tasks like invoicing and expense tracking.

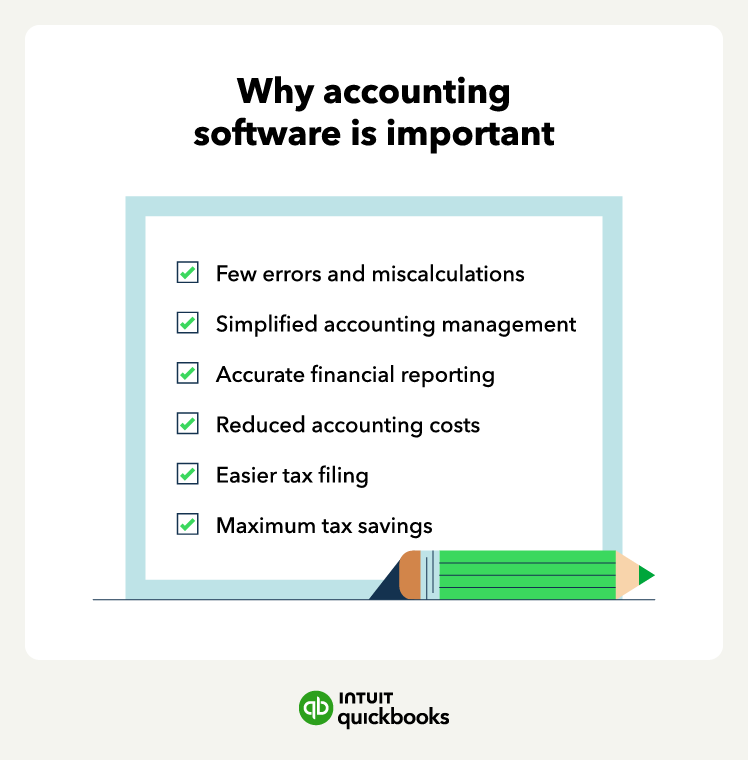

Small business accounting—from proper bookkeeping and cash flow management to invoicing—is essential to your financial success. Accounting software can impact the big picture and directly impact the financial aspects of your business as such:

- It can keep your books up to date.

- It can improve payment collections, as automated invoicing and payment processing make it easier to stay on top of what customers owe.

- It can reduce errors from miscalculations, incorrect reporting, and missed transactions.

- It can generate more accurate financial reports and documentation.

- It can lower costs.

- It makes it easier to calculate and file business taxes.

- It can maximize tax deductions for greater savings. You can store receipts for expenses and track mileage within the QuickBooks app.

The many benefits of accounting software make it an essential tool for running your small business more efficiently (with fewer headaches). With accounting software, small businesses can use their (often limited) resources more efficiently and increase productivity.

In other words, you can spend less time studying bookkeeping, managing time tracking, chasing down payments, or struggling with inventory management.

Tips for selecting the best accounting software for your business

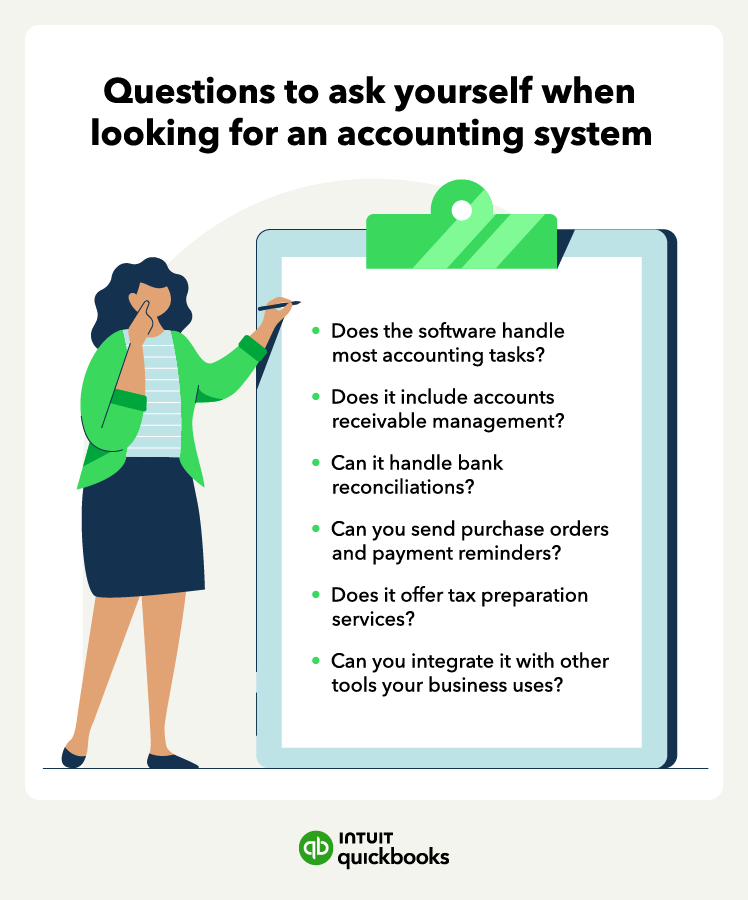

With many different accounting software solutions available, navigating the sea of virtually endless options can be difficult.

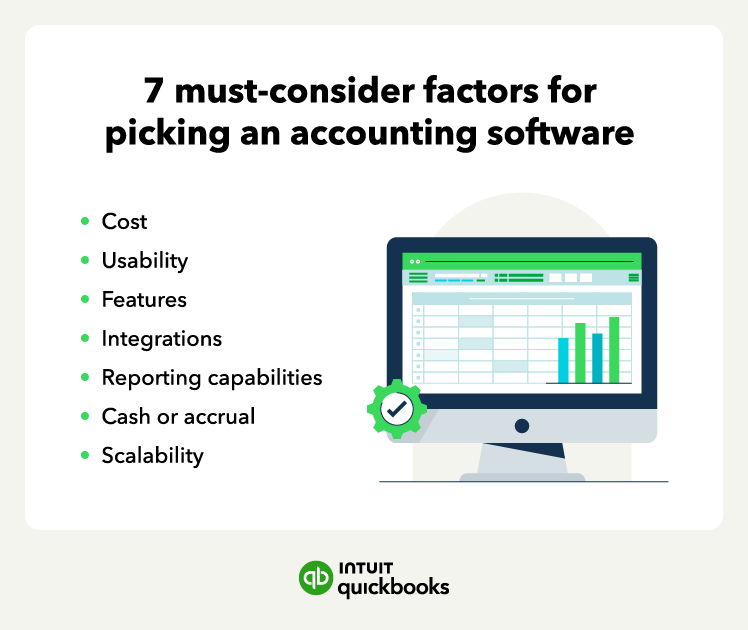

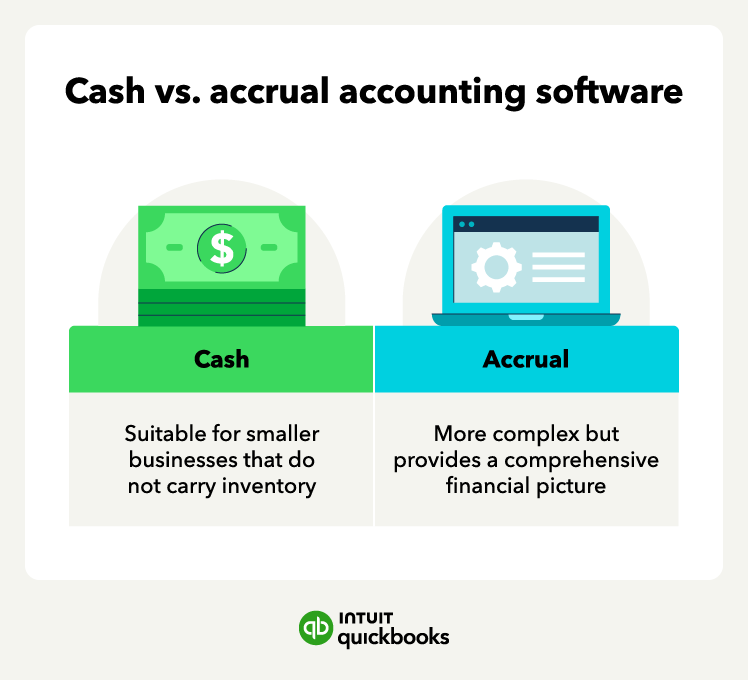

The best accounting software option is the one that’s suited to your company’s needs. If you’re considering using one for your business, review these factors to ensure you choose the right accounting software for your organization:

- Identify your business's financial needs first.

- Look for software that suits your business size, complexity, and budget.

- Consider the software's features, such as invoicing, payroll processing, and reporting.

- Ensure the software integrates with other business applications and banking systems.

- Check the software's security features and data protection measures.

- Read reviews and compare pricing plans before making a final decision.

Only you can determine the right accounting solution for your business. Consider your priorities, whether a low-cost subscription fee or a comprehensive solution and narrow down your options. Ideally, you’ll want to find online accounting software that provides the greatest value (has the most useful features to meet your business needs) for the most reasonable cost.

There are plenty of software solutions available. Popular accounting software companies include QuickBooks, FreshBooks, Sage, Wave, and Xero.

Streamline your accounting and save time

Let’s face it—no matter how tech-savvy you are, making an accounting software selection can be challenging. With any new product or service, especially one that can significantly impact your business, it’s important to know whether there’s easily accessible customer support.

Simplifying your process with accounting software is a big step in the right direction to better manage your business finances, make more informed decisions, and take the uncertainty out of tax season—especially if there’s a free trial.