Let's face it: You know accounting is an important part of your business. It helps you understand your business’s financial situation and plan for the future. But the truth is, there are many different types of accounting, and you might be wondering which will provide you the most benefit.

So, what are the types of accounting? In this post, we’ll go over the different accounting types to help you understand which types of accountants your business might need.

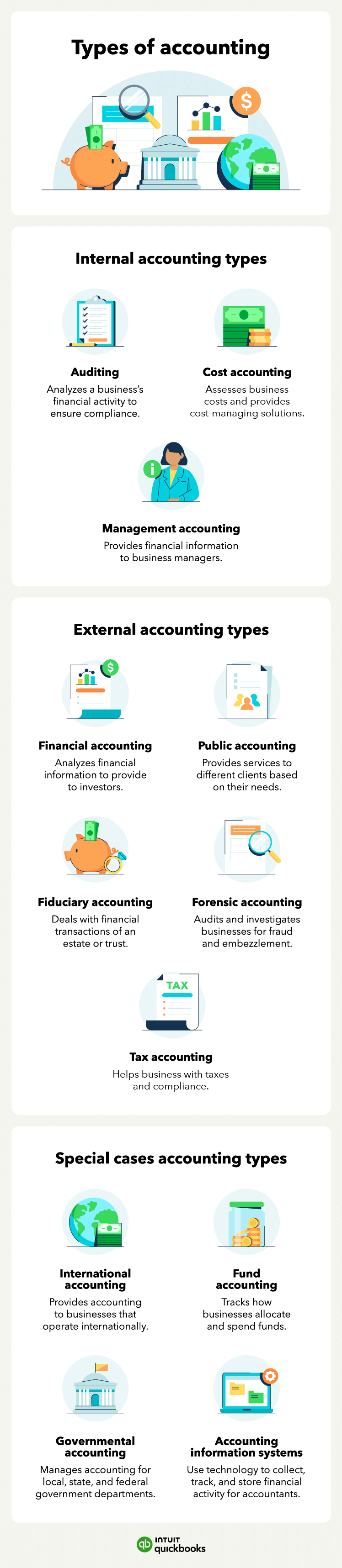

The 12 different types of accounting include: