1. Start with a business idea and conduct market research

A business without a vision is like a ship without a sail. Defining your business’s vision sets everything else in motion.

Drafting a mission statement should serve as the foundation for your vision. In a few paragraphs, identify your company goals and the high-level strategies you’ll use to accomplish them.

Find your big idea

To find a good business idea, consider these key points:

- Do something you love: Passion is essential for sustaining a business through challenges and setbacks. Choose something you enjoy and will remain enthusiastic about in the long run.

- Do something you're passionate about: Leverage your existing skills and knowledge to build a strong foundation for your business.

- Do something profitable: While passion is important, your business needs to be financially viable. Make sure there's a demand for your product or service and that you can generate a profit.

Finding the right business idea requires a balance of passion, skills, and market demand. Take your time exploring different options, and don't be afraid to brainstorm and experiment until you find the perfect fit.

Research the market

Once you have a promising idea, it's time to validate it through market research. This involves:

- Selecting a product or service: Decide your value proposition and unique selling proposition, which is what you’ll sell and how you plan to stand out from the competition.

- Validating your product idea: Research the market and see what’s trending around your product, pitch to your target market and see the response, and test if your product generates leads.

- Defining your target market: Identify your target market with demographics like age, gender, income, and location. Then, create personas and a customer journey map.

- Knowing your market size or opportunity: Figure out the total addressable market (TAM) of your potential customer base. Estimating the current and future value of your business idea and setting reasonable goals can help you win a piece of the pie.

Conduct competitive analysis

Another component of market research is conducting a competitive analysis. This helps you understand the playing field, identify opportunities to differentiate your business, and develop effective strategies. A SWOT analysis is a valuable tool for this purpose:

- Strengths: What are your competitors good at? What advantages do they have?

- Weaknesses: Where do they fall short? What could they improve?

- Opportunities: Are there any gaps in the market that you can fill? Are there emerging trends you can capitalize on?

- Threats: What external factors could negatively impact your business?

Understanding your competitors' strengths and weaknesses will help you develop strategies to position your business for success.

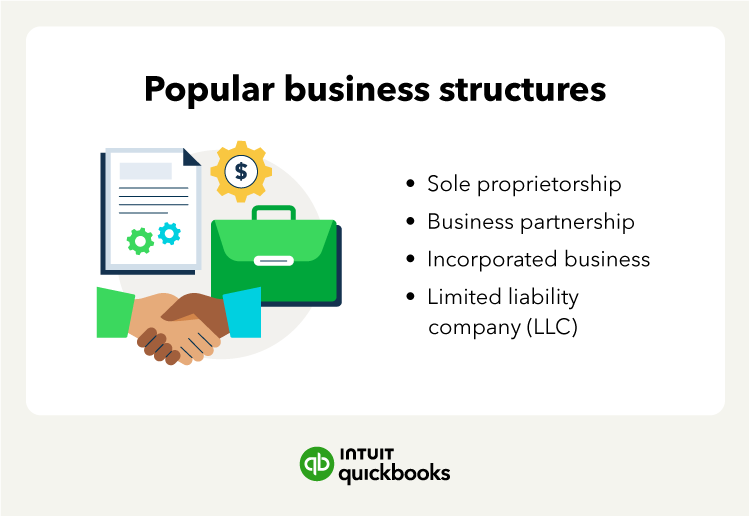

There are several other business structures to choose from, depending on which country you live in.

There are several other business structures to choose from, depending on which country you live in.

Cross-reference banks’ advice with your

Cross-reference banks’ advice with your