QuickBooks Money: QuickBooks Money is a standalone Intuit product that includes QuickBooks Payments, and currently does not connect with other QuickBooks products such as QuickBooks Online (and QuickBooks Checking), QuickBooks Self-Employed, or GoPayment. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and QuickBooks Visa Debit Card are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services, including Same Day Deposit, are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Card Reader: Data access subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance. Product registration and QuickBooks Payments account required. Terms, conditions, and features subject to change.

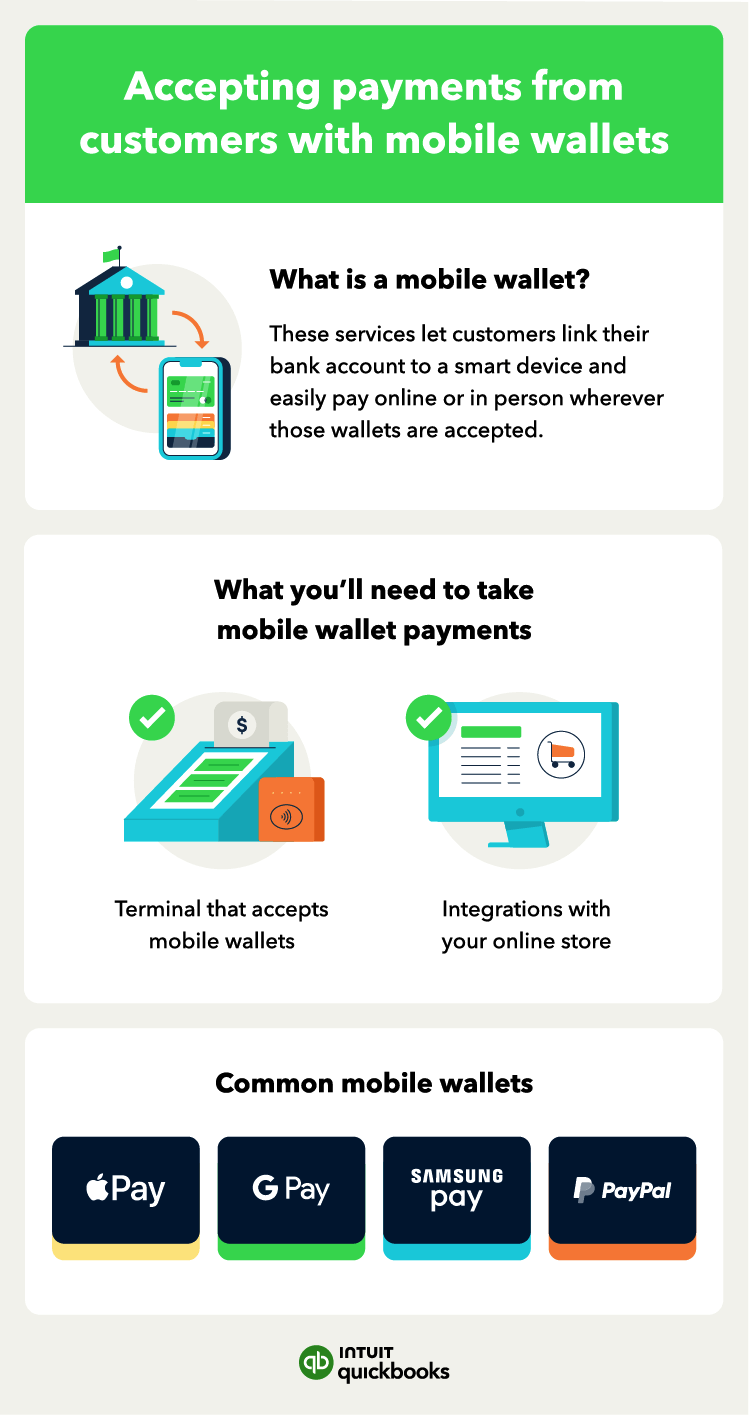

Apple Pay: Apple Pay is a registered trademark of Apple Inc.

Google Pay: Google Pay is a trademark of Google LLC.

PayPal and Venmo: Not currently available on invoicing through QuickBooks Online Advanced subscription.

Venmo is available only in the US.