With fast payment deposits and high-yield savings, a QuickBooks Checking bank account lets you move, manage, and grow your money with confidence.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by Green Dot Bank.

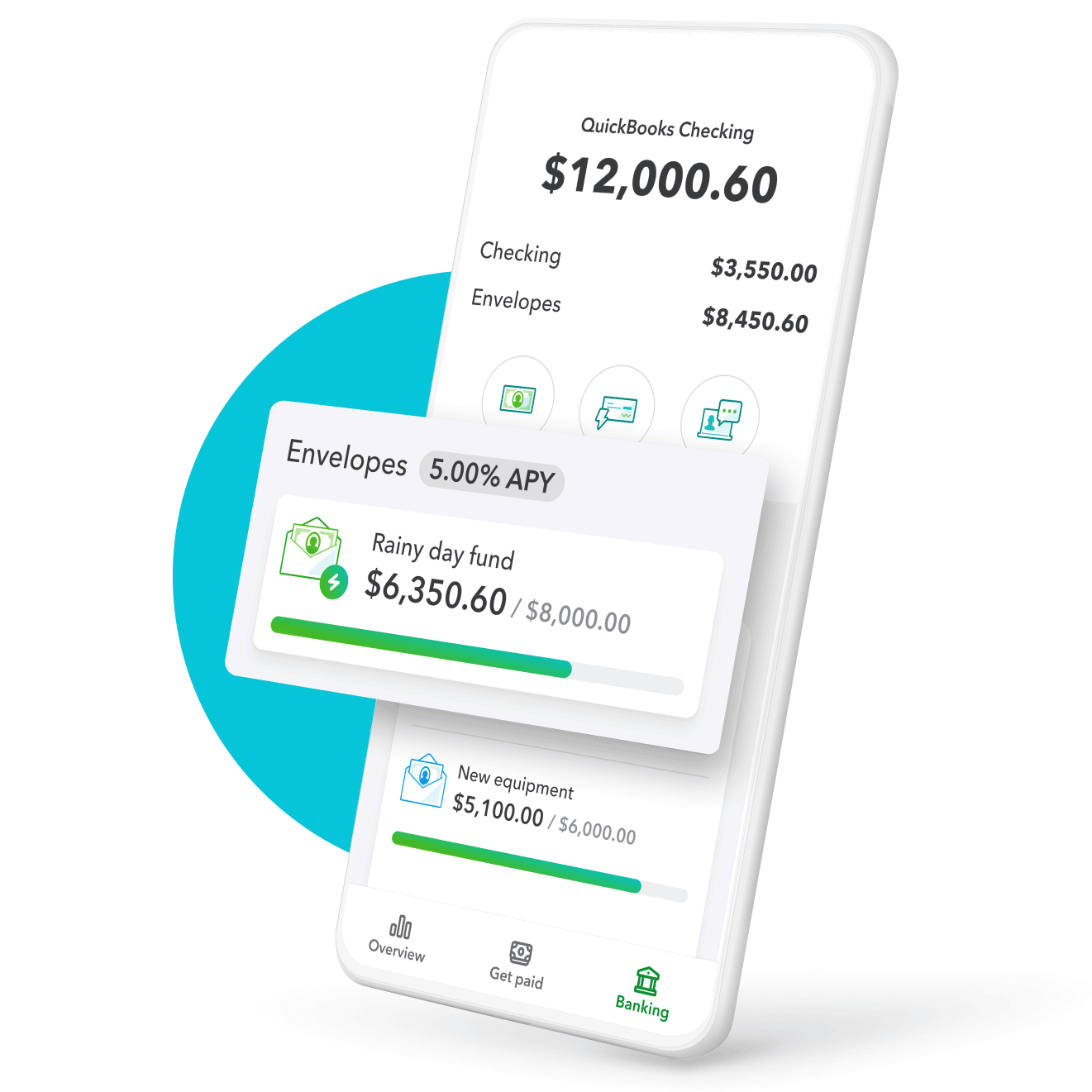

Discover smart ways to save

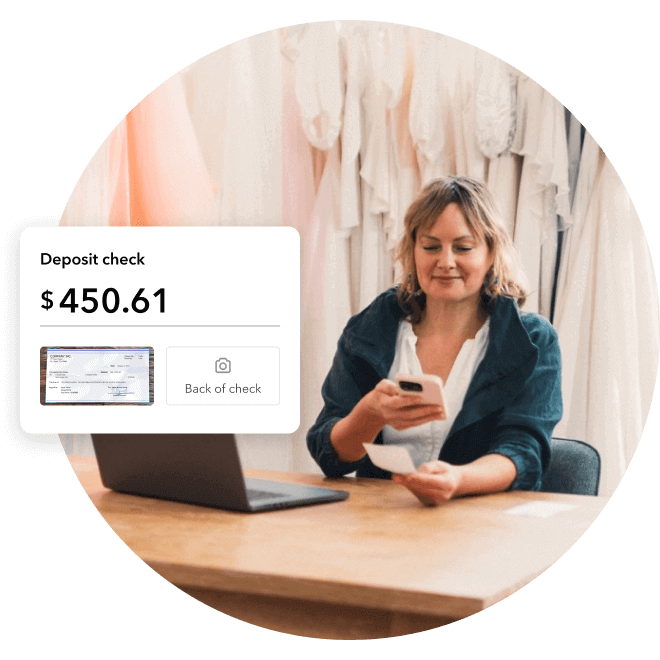

Payments go straight to the bank

Deposit eligible payments into QuickBooks Checking to see your money faster—without the fees.**

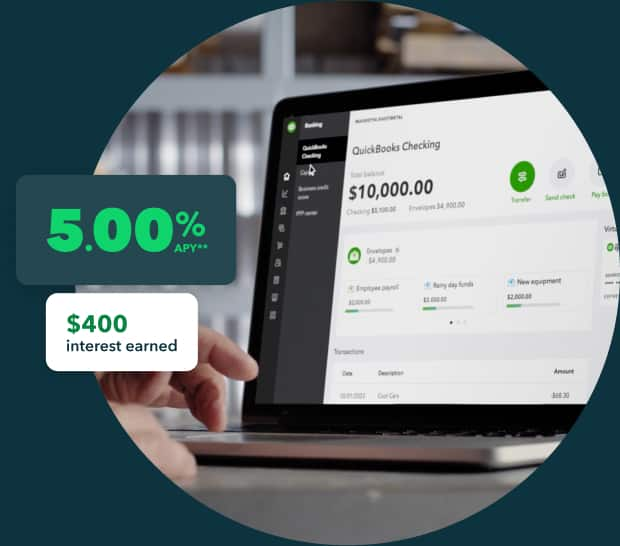

Maximize money with high-yield savings

Make your money work harder—move funds to savings envelopes and earn 5.00% APY.**

Fewer fees, more money for your business

Your checking account is free to open—no monthly fees, overdraft fees, or minimum balances.**

Complete banking, made for you

With QuickBooks, you have everything you need to streamline money management and then some.

Deposit customer payments, upload checks, and match them to invoices in real time. Use ACH and wire transfers to move money when you need to—no matter where you’re working.

Every dollar put away in savings envelopes earns you interest at over 70x the U.S. average. Build your rainy-day fund and rest easy knowing your money’s working, even when you’re not.1

Once deposited, spend funds right away using your QuickBooks Debit Card. Or visit over 19,000 fee-free AllPoint ATMs, and even add your card to Apple Pay or Google Pay.**

QuickBooks can automatically move what you owe in sales taxes to a separate envelope so you stay ready. If you have a QuickBooks Online plan with QuickBooks Payroll, you can set aside what you owe for payroll and QuickBooks will automatically apply those funds when you pay your team.**

Do even more with QuickBooks Online

Get an accounting plan to keep your banking and books connected, so you’re always up to date.

Get instant deposit at no added cost

Get paid faster by depositing payments into QuickBooks Checking. Eligible payments hit the bank instantly, and we waive the 1.75% fee.**

Do bookkeeping without the busywork

QuickBooks matches your payments and spending for you and lets you attach receipts to transactions.** Read-only access helps accountants stay informed.

Discover all-in-one financial clarity

Your QuickBooks Checking bank account connects with other QuickBooks tools like payments, payroll, and bill pay to help you manage everything in one place.

Banking that fits your business

Compare our QuickBooks solutions to see what’s right for you. Manage just your business money or get a plan with accounting tools, too.

Just pay per transaction

Discover the key differences

Compare our main features to see which plan is right for you.

QuickBooks Money

QuickBooks Online plans

Free-to-open bank account

No monthly fees or minimums**

![]()

![]()

5.00% APY

Stash money in Envelopes and earn**

![]()

![]()

Accounting

Your bank and books stay connected**

![]()

Free-to-open bank account

No monthly fees or minimums**

QuickBooks Money

![]()

QuickBooks Online plans

![]()

5.00% APY

Stash money in Envelopes and earn**

QuickBooks Money

![]()

QuickBooks Online plans

![]()

Accounting

Your bank and books stay connected**

QuickBooks Money

QuickBooks Online plans

![]()

Frequently asked questions

Build your knowledge

Check out these helpful resources to learn the ins-and-outs of opening a business bank account.