Look for patterns, not just numbers

Financial statements are a historical record, but they also offer a glimpse into the future. Don't get bogged down in analyzing every single number. Instead, pay special attention to patterns within the data across different reporting periods.

Are revenues consistently growing year-over-year? Are operating expenses under control? Have profit margins been steadily increasing or declining? Identifying trends allows you to spot areas of strength and weakness, potentially revealing the company's future trajectory.

Keep context in mind

Financial statements shouldn't be analyzed in a vacuum. When interpreting the data, consider both internal and external factors that might influence the company's performance. Internally, has there been a recent change in management or a restructuring within the company? Externally, are there any industry-wide trends or economic factors affecting the company's operations?

For instance, a significant drop in sales for a retail company might be due to a company-specific issue like a product recall. However, it could also be a result of a broader economic downturn impacting consumer spending across the industry.

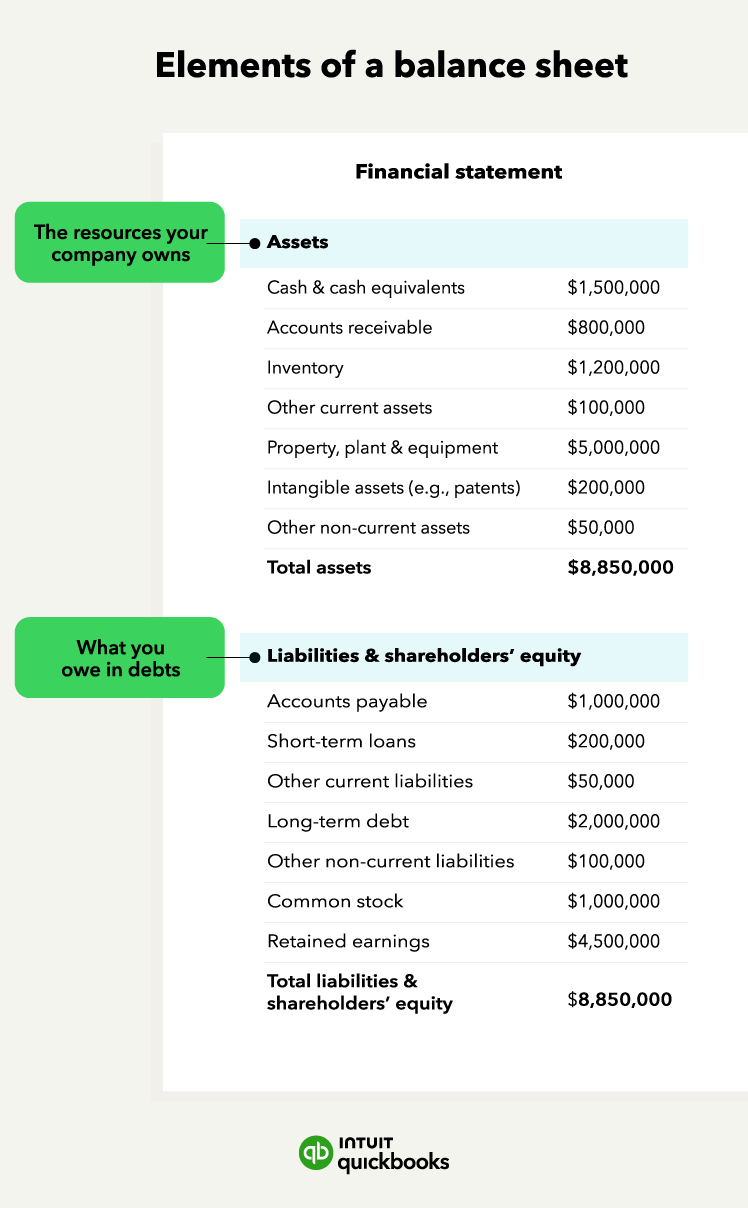

Don't interpret the balance sheet in isolation. Consider the company's business model, recent events, and overall economic climate.

Don't interpret the balance sheet in isolation. Consider the company's business model, recent events, and overall economic climate.