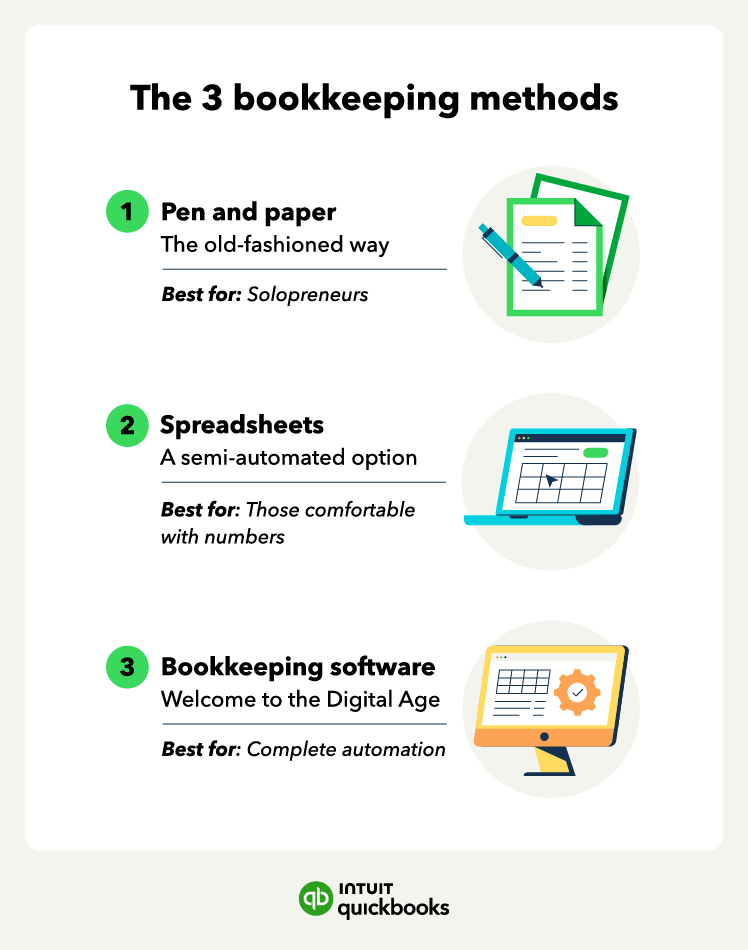

Pen and Paper

Pros: Simple and low-cost.

Cons: Time-consuming, error-prone, and difficult to analyze data.

This method is ideal for very small businesses with minimal transactions. A few ways to best utilize this method include:

- Use a dedicated bookkeeping notebook: Keep all your financial records organized in one place.

- Maintain separate ledgers: Dedicate sections for income, expenses, accounts payable, and accounts receivable.

- Record transactions daily: Regularly update your notebook to avoid a backlog of entries.

- Balance your books monthly: Regularly reconcile your records to ensure accuracy.

Spreadsheets

Pros: More affordable than bookkeeping software, allows for customization.

Cons: Requires some technical knowledge, formulas can be complex, and data sharing can be cumbersome.

Spreadsheets offer more flexibility and organization than pen and paper. Here’s how:

- Utilize bookkeeping templates: Many online resources offer free bookkeeping spreadsheet templates to get you started.

- Separate sheets for different purposes: Dedicate sheets to income, expenses, accounts payable, and accounts receivable.

- Leverage formulas: Spreadsheets allow for automatic calculations, saving you time and reducing errors.

- Back up your data regularly: Protect your data by regularly saving your spreadsheet to a secure location.

Bookkeeping software

Pros: Streamlines data entry, automates tasks, facilitates reporting and analysis, and secures cloud storage.

Cons: Typically requires a monthly subscription fee and can have a learning curve.

Bookkeeping software offers the most robust features and automation, which is ideal for businesses with significant transaction volume or complex financial needs. Here are some tips:

- Choose user-friendly software: Select software with a clear and intuitive interface to simplify data entry and reporting.

- Integrate with your bank accounts: Many programs allow automatic downloads of bank transactions, saving you time and reducing manual entry errors.

- Explore automation features: Utilize features like automatic bill pay and recurring invoices to streamline your financial processes.

- Invest in training: If needed, consider professional training to ensure you're using the software to its full potential.

Accounting software can cater to your bookkeeping needs and offers the most robust features and automation available. This is a great option for busy business owners who want to streamline their bookkeeping.

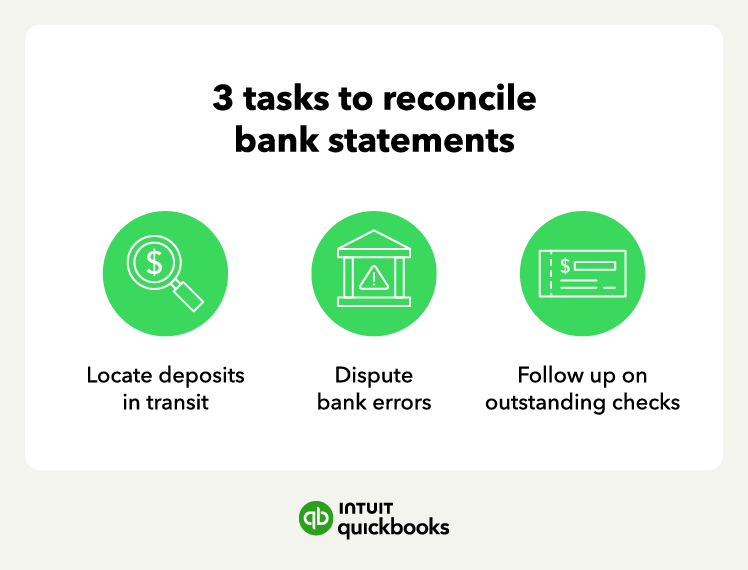

Schedule time for routine bank reconciliations. Regular reconciliation prevents errors from snowballing and ensures your financial records are accurate and reliable.

Schedule time for routine bank reconciliations. Regular reconciliation prevents errors from snowballing and ensures your financial records are accurate and reliable.