“If I wanted to try accounting software, how would I get started?”

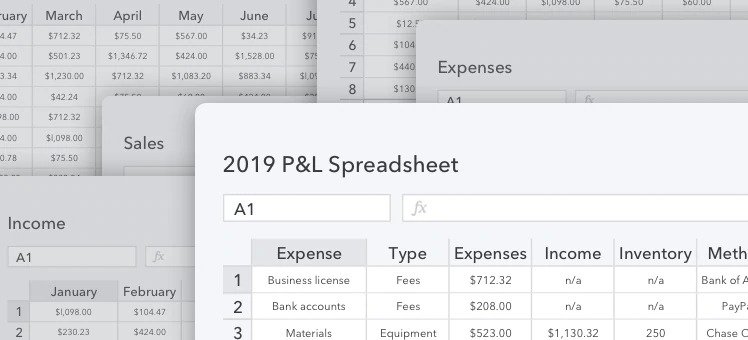

Research is key. Think about what your business needs are now and what they might be in the future. The best accounting software will grow with your business and offer services and features that you’ll need when the time comes.

Look for the features you need now and the options for the things you may need in the future. Features like: generating purchase orders, setting up payment reminders, the ability to track inventory and grow your ecommerce presence. Choosing a comprehensive software package with the tools you need for the life of your company will allow you to move forward with confidence in your ability to take on any challenge your business may face.

Small business accounting software providers typically provide a complete list of accounting services and proven benefits on their web sites, and you may decide to take advantage of a free trial before deciding on the best accounting solution.

Ultimately, cloud accounting software allows you to spend less time doing data entry and more time with prospective customers, current clients, employees and even family. Before long, you’ll have your software set up, and you may end up asking yourself, “Why did I wait so long?”