Get the most out of invoicing

Take a closer look at how fast and flexible QuickBooks makes invoicing, from start to finish.

Make it your own

Personalize invoices in seconds. Tailor logos, colors, and more, with previews that show exactly what customers will see.

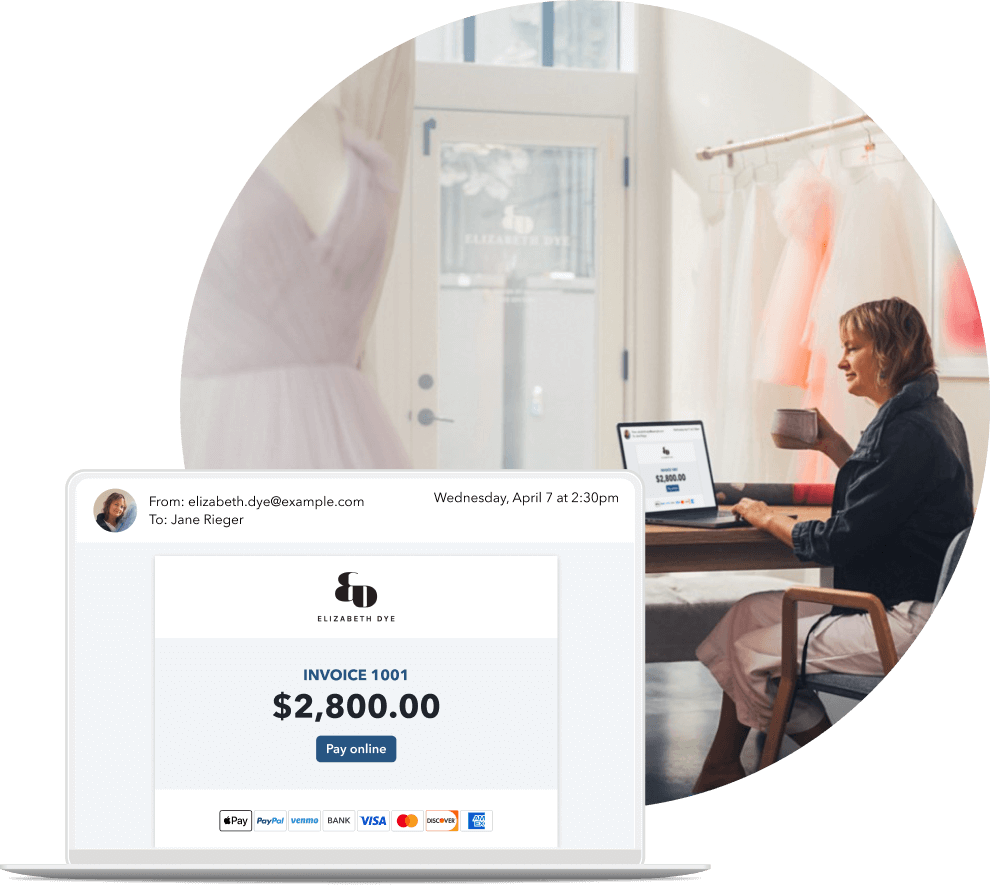

Send or schedule

Send instantly payable invoices with products, services, sales tax, and ways to tip Not included with QuickBooks Money or automate recurring invoices Scheduling or automating recurring invoices not included with QuickBooks Money .

Track invoices

You’ll know when customers view and pay your invoices, so you can follow up when you need to and stay in control.

Get paid

Customers can settle up via credit or debit, ACH, Apple Pay®, PayPal, or Venmo** so you get your money 4x faster.1

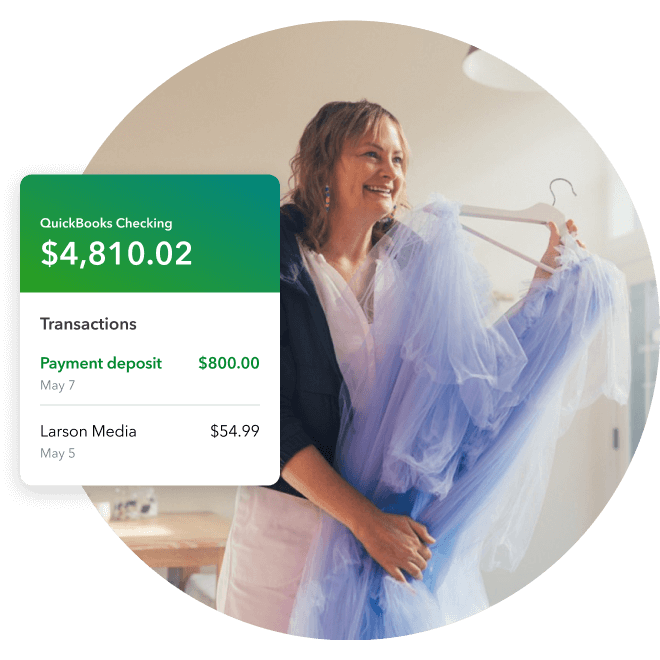

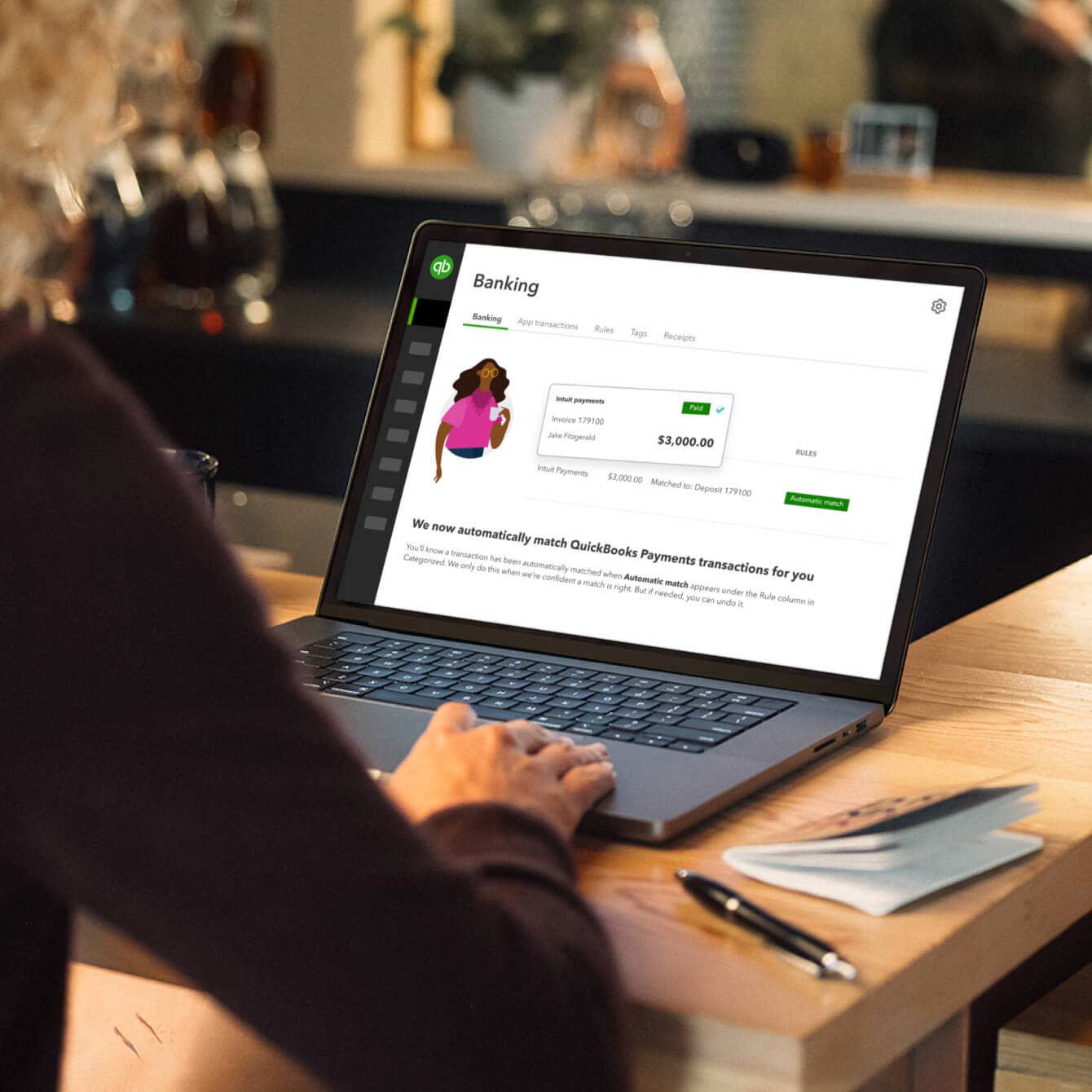

Bookkeeping without the busywork

Paid invoices are automatically recorded in QuickBooks Online. Avoid tedious upkeep, knowing your bottom line is accurate.**

Not included with QuickBooks Money