Maintaining a healthy business requires more than just making sales. You need to ensure the money from those sales actually makes it into your bank account. The stakes are higher than many realize: a single late payment threatened payroll or bills for 39% of owners in the past year.

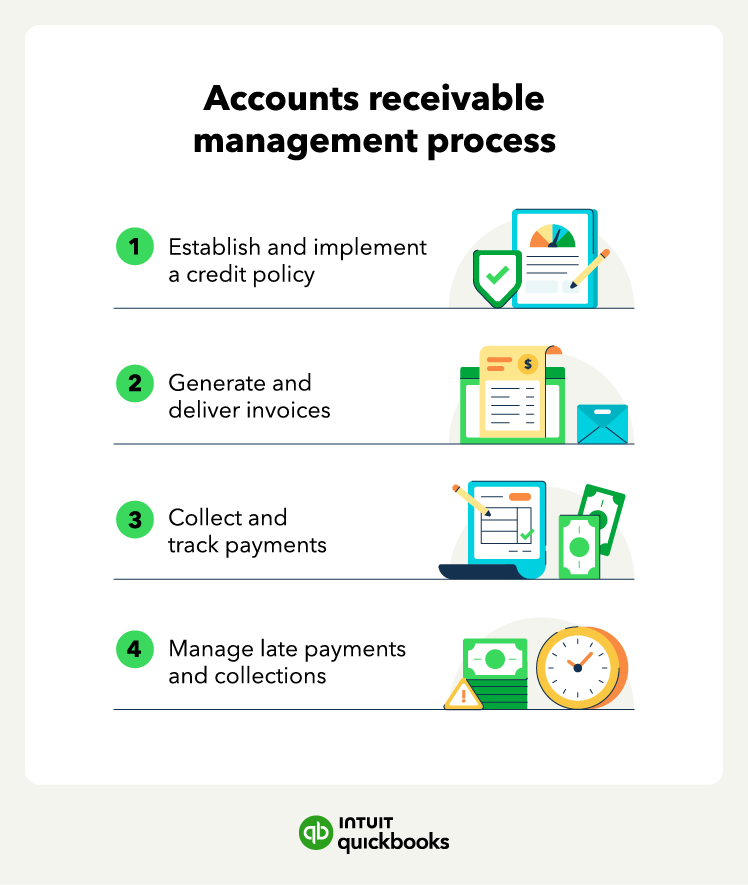

Accounts receivable (AR) management is the backbone of this process. It involves tracking every outstanding invoice and staying on top of collections to keep your cash flow steady.

When you manage your AR effectively, you spend less time chasing payments and more time growing your business. This guide explains how the process works, key metrics to watch, and how to modernize your approach for 2026.

Jump to: