Hiring 1099 workers: Pros vs. cons

When you’re weighing your options over whether to hire a contractor or not, there are a few important pros and cons to consider. Depending on the type of job that needs to be done, you may be required by your state to hire either a contractor or a full-time employee—if you’re not, though, these pros and cons can help you make a hiring decision.

Pro: Save money on taxes and benefits

When you hire independent contractors, you don’t need to provide them with access to benefits. In fact, doing so would mean they’re technically employees and not contractors. You’re also not required to pay employment-related taxes on their behalf, such as Social Security, Medicare, and unemployment.

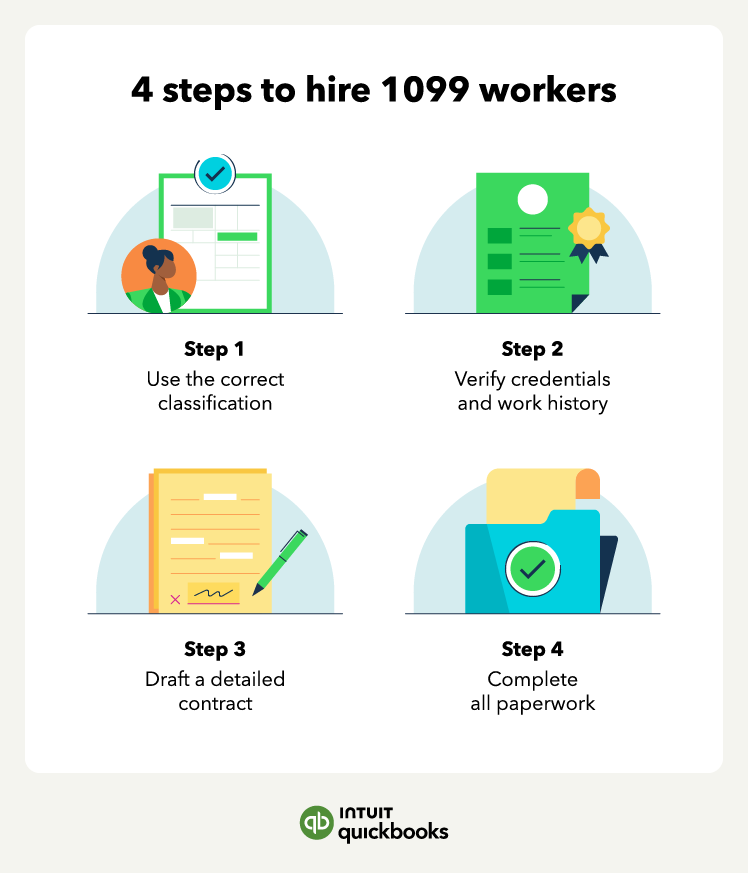

Pro: Avoid a lengthy hiring process

Hiring a W-2 employee can take weeks or even longer. With independent contractors, the hiring process is as simple as vetting their work history and agreeing on a scope of work. Once you both come to an agreement over the terms of their contract, the project can begin.

Con: Give up some control as the employer

Contract employees aren’t bound by all of the rules of your business when they begin a job. Unless it’s outlined in your contract with the worker, you can’t set their working hours, you can’t mandate their working conditions, and you aren’t able to control how the job gets done.

Con: Increase your risk of a government audit

Because W-2 employees generate tax revenue, the government has an interest in vetting the legal status of your business’s workers. Hiring contractors results in less tax revenue, and the IRS or another agency could audit your business if they suspect employees are misclassified.