As we get ready to close out 2024, it’s a great time to go through a year-end checklist to ensure you complete what’s necessary. Looking for year-end resources? Check out our ultimate guide to small business tax forms, schedules, and resources. When you’re done, be sure to read about all the latest QuickBooks updates.

Here’s what’s new in QuickBooks Online for December 2024

Table of contents

Table of contents

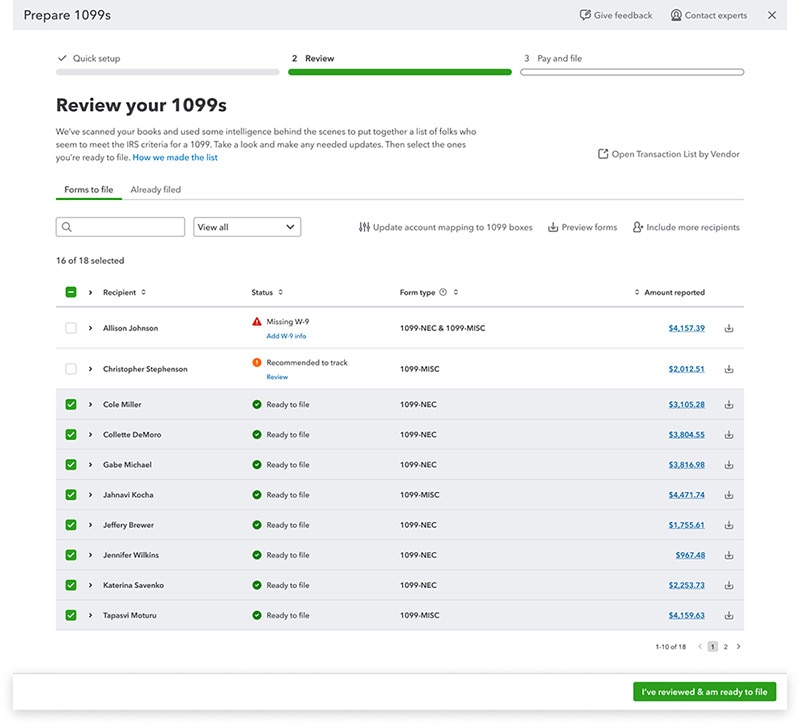

Combined Federal/State Filing and simplifying 1099s

In a nutshell: Recent updates simplify managing 1099s.

For the upcoming 1099 season, you might notice 2 key changes:

QuickBooks now supports Combined Federal/State Filing, which eliminates the need to file separate 1099s to participating states. With this update, you can handle more year-end compliance at once.

QuickBooks now has an Automated 1099 solution, in addition to the standard version. This automated option has a W-9 management module that uses QuickBooks transactions and vendor info to produce a list of contractors and/or vendors who may require a 1099 Form. QuickBooks Automated 1099 will also suggest which payments to include on the form and which box to map them to, auto-populating the 1099 forms for you. From here, all you have to do is review and edit them as needed before filing.

Introducing Intuit Assist for QuickBooks Online

In a nutshell: Intuit Assist helps automate bill and receipt entry, invoice and estimate creation, and knowing what to focus on next.

Right in QuickBooks Online, Intuit Assist gives you a new set of capabilities.

Save time entering bills and receipts

Intuit Assist will generate transactions from:

- A bill or receipt you upload in the form (upload file or take a picture, no mobile app required).

- A batch of bills or receipts you upload in the Bill or Sales receipt job centers.

- Bills and receipts sent to your personalized Intuit Assist expense email address (this email is open to any sender, including vendors and employees).

Simplify invoice and estimate creation

- Intuit Assist will generate invoices or estimates from your uploaded documents or typed notes in the form, as well as documents or conversations with customers that you email to your personalized Intuit Assist sales email address

- Invoice reminders created by Intuit Assist can help you get paid 5 days faster on average than with a standard template.1

Know what to do next

At any moment, you can find out what task your business should pay attention to. The Business Feed, powered by Intuit Assist, tells you which invoices to collect on, bills to review, and more. With Intuit Assist proactively bringing that information forward, you can skip the AR & AP aging reports and stay on top of your tasks

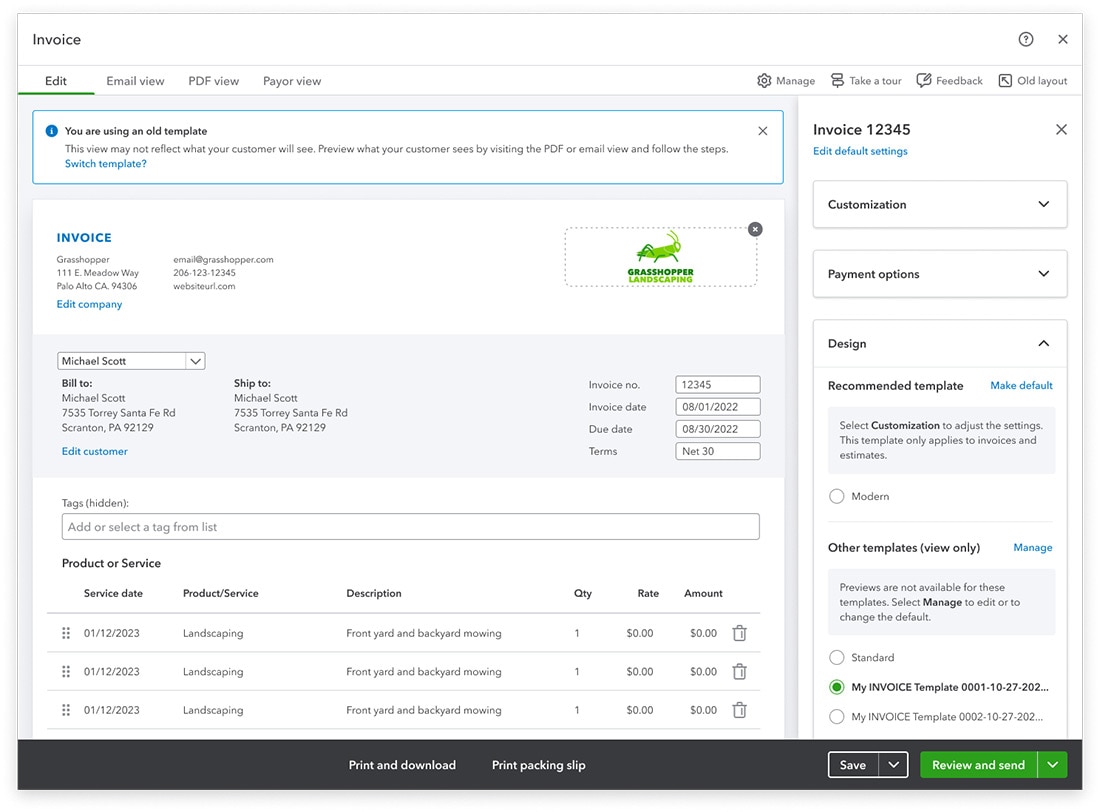

Invoice improvements you requested

In a nutshell: In response to customer feedback, QuickBooks Payments has recently launched 80+ new invoicing features.

You asked, we delivered. These new features provide an enhanced invoicing experience:

Better capabilities

- Adjust tax rates

- Add billable expenses grouped by time

- Use price rules

- Customize your invoice template while drafting an invoice

Convenient additions

- Access existing templates

- Show, hide, and rename columns

- Change color and font from the invoice

Quicker access

- Use keyboard shortcuts to access invoicing features faster

- Receive payments with one-click access

- Autosave your work in the QuickBooks Online mobile app