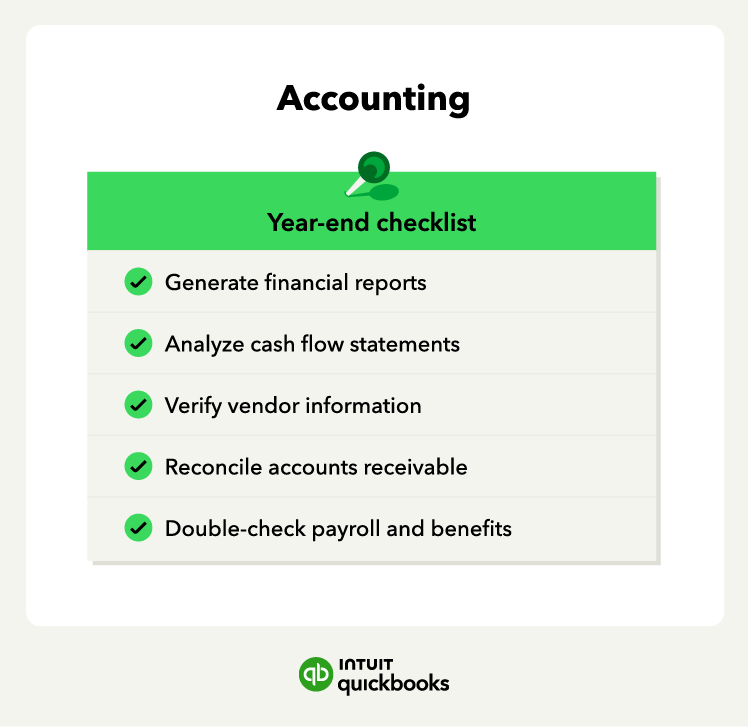

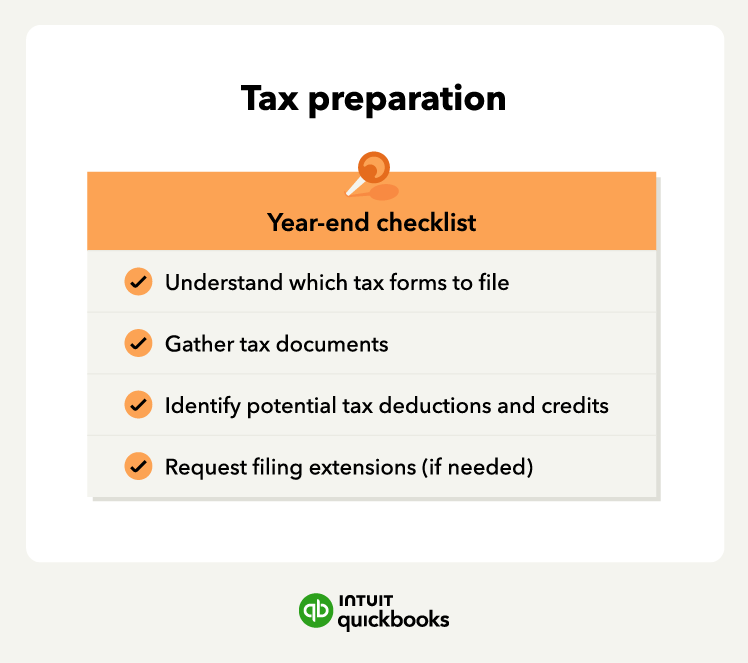

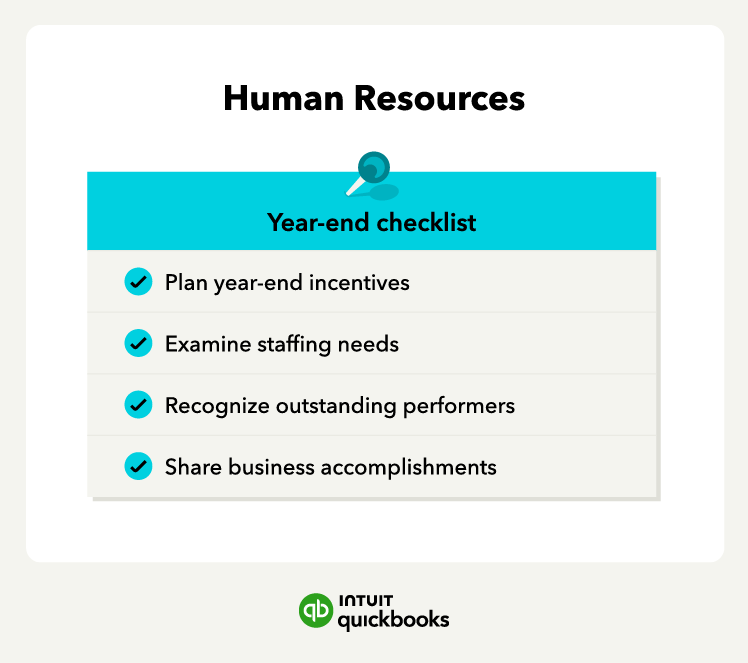

The end of the year is always busy: Prepping for the holidays, making time for family, and planning for the new year take both time and commitment. As a small business owner, you have an even longer list of things to think about at the end of the year, such as income statements, taxes, and employee incentives.

It can be tricky to balance work and life as December 31 approaches. Nevertheless, devoting some attention to your business not only helps you end the current year on a high note, but also sets you up for success in the new year.

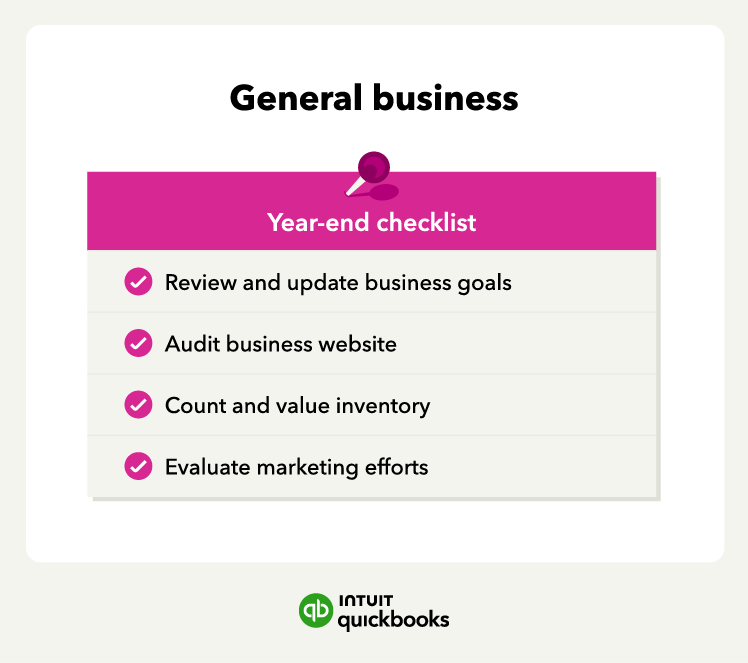

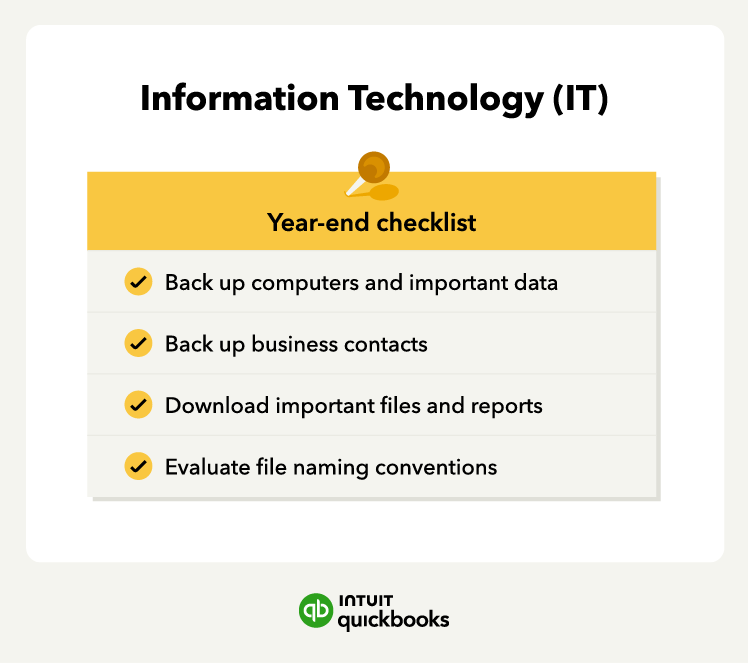

What actually needs to be done at year-end, and what’s more of a nice-to-have? Use this year-end checklist to ensure you take care of necessary business tasks before the end of the year. With these off your plate, you can focus on the things that matter most.