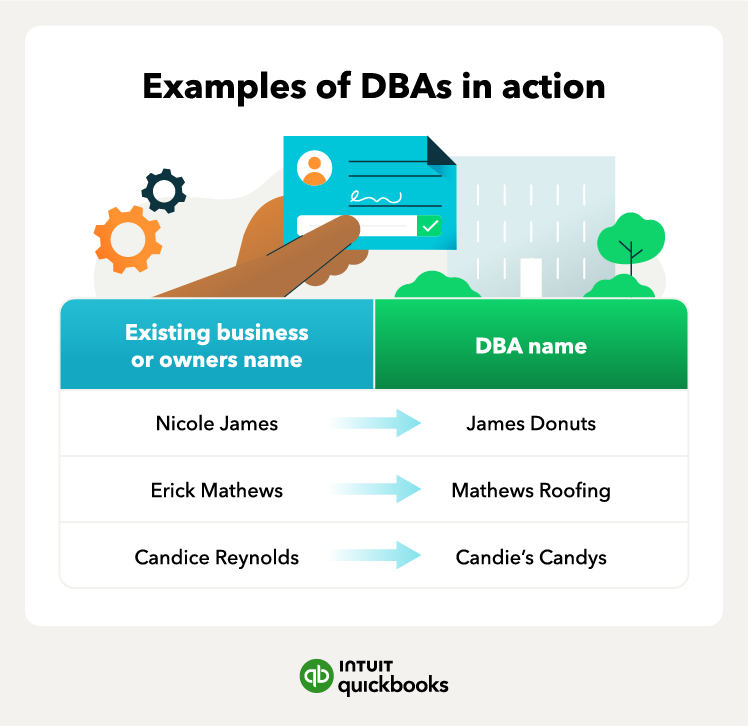

A DBA, otherwise known as “doing business as,” is the name under which you operate and market. Business owners can use DBAs if the name they operate with is different than their legal name on file with the state.

In this article, we’ll cover everything you need to know about DBAs, including how to get a DBA and the pros and cons of doing so.

- What is a DBA?

- DBA vs. LLC

- DBA name examples

- Benefits of a DBA

- Allows you to operate under a different name

- Lets you run multiple businesses or websites

- May boost your credibility

- Maintains the corporate veil

- Drawbacks of a DBA

- No legal right to a name

- Lack of legal protection

- Administrative hassle

- Do I need a DBA?

- Sole proprietorships and partnerships

- LLCs and corporations

- How to get a DBA

- FAQ