The QuickBooks Entrepreneurship in 2025 survey found that a majority of respondents plan to start a business this year. If this describes you, restructuring as an S-corp could help you save money during tax season.

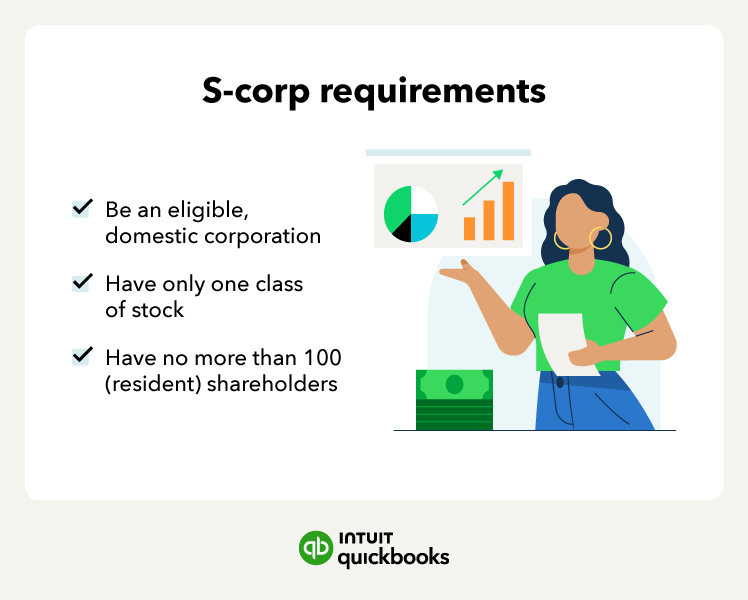

Structuring your business as an S-corp changes the way the IRS taxes your company. Unlike a C corporation, which faces "double taxation" on profit, an S-corp operates as a "pass-through" entity. This means its profits and losses pass directly to the owner (you), who then reports the income on their personal tax returns.

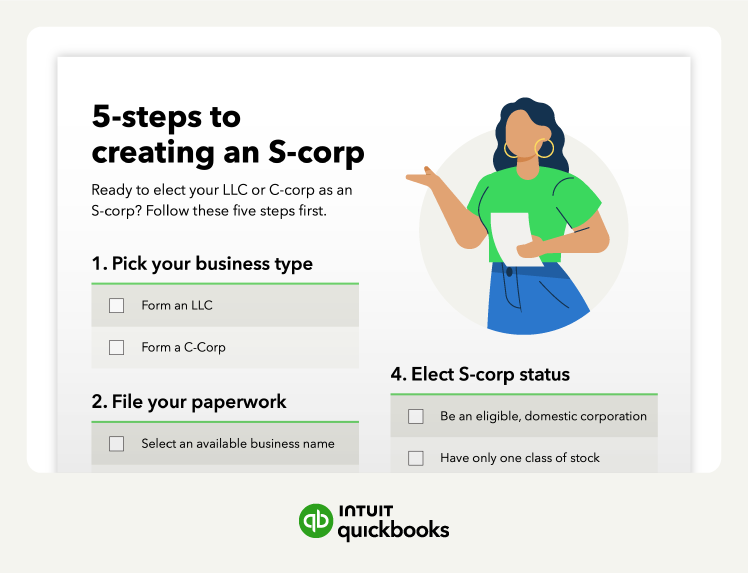

In this guide, we'll cover the five essential steps you need to take to start an S-corp and set your business up for success.

Jump to: